National Fuel Gas (NFG): Taking Stock of Valuation After a Strong Multi‑Year Shareholder Return Run

National Fuel Gas (NFG) has quietly outperformed many utility peers this year, and with shares hovering near 52 week highs, investors are asking whether the diversified gas player still offers room to run.

See our latest analysis for National Fuel Gas.

At around $81.58 a share, NFG has cooled off slightly in recent weeks, but its strong year to date share price return and impressive five year total shareholder return suggest momentum is still very much intact as investors reassess its long term growth profile and risk mix.

If NFG has you rethinking what steady compounders can look like in the utilities space, it might be worth scanning fast growing stocks with high insider ownership for other under the radar opportunities.

With valuation screens flagging a near 40 percent intrinsic discount and Wall Street targets sitting comfortably above today’s price, the key question now is whether NFG remains mispriced or whether markets are already discounting its next leg of growth.

Most Popular Narrative Narrative: 19.5% Undervalued

With the narrative fair value sitting at $101.33 against a last close of $81.58, the story leans toward meaningful upside if forecasts land.

Favorable regulatory mechanisms (modernization trackers, rate settlements) and a strong balance sheet enable reinvestment and capital return, while robust hedging and firm sales portfolios provide insulation from commodity volatility, helping to stabilize cash flow, support the dividend, and potentially rerate the stock's valuation.

Curious how steady pipes and shale barrels could justify a richer multiple than many utilities? The narrative leans on aggressive growth, expanding margins, and a bold earnings trajectory that reshapes what this business could earn a few years from now. Want to see exactly how those moving parts stack up into that fair value?

Result: Fair Value of $101.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on gas demand holding up. Faster electrification or tougher Northeast regulations are both capable of clipping volumes and depressing returns.

Find out about the key risks to this National Fuel Gas narrative.

Another View, What The Market Multiple Is Saying

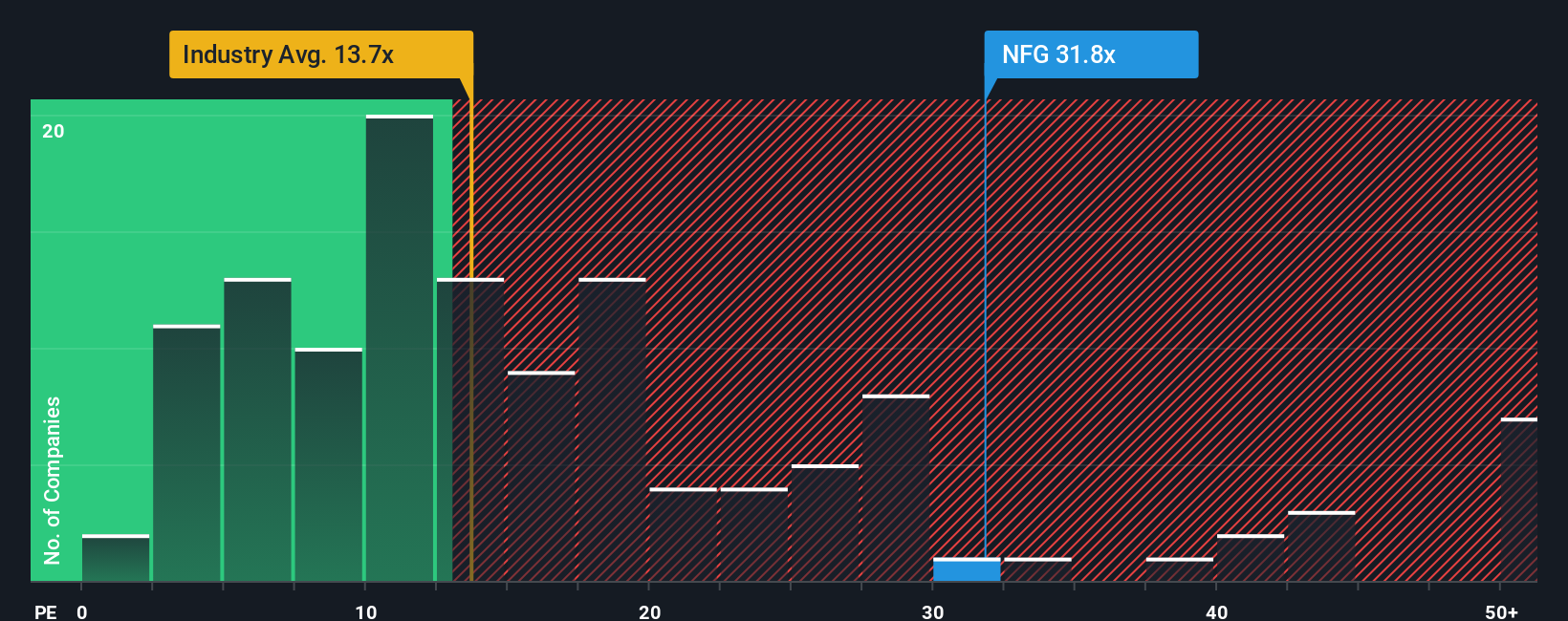

While the narrative fair value points to upside, today’s 14.3x earnings multiple is only slightly above the global gas utilities average of 13.9x and well below a 23.9x fair ratio our models suggest the market could move toward. This leaves open the question of whether investors are still underpricing NFG’s earnings power.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Fuel Gas Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your National Fuel Gas research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next step by scanning a few focused stock lists designed to highlight opportunities many investors may be overlooking.

- Explore underappreciated cash generators by reviewing these 902 undervalued stocks based on cash flows that trade at levels some investors may view as low relative to their potential future cash flows.

- Follow the development of intelligent automation by examining these 24 AI penny stocks involved in real world AI adoption.

- Assess ways to support an income-focused strategy by reviewing these 10 dividend stocks with yields > 3% that may help with long term, yield driven portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报