Has Alphabet’s 66% 2025 Rally Already Priced In Its AI and Cloud Ambitions?

- If you are wondering whether Alphabet at around $314 a share is still a smart buy after its massive run, you are not alone. That is exactly what this breakdown is here to tackle.

- The stock has climbed 5.9% over the last week but is roughly flat over the last month, while still showing longer term gains of 65.8% year to date and 60.8% over the past year that keep expectations high.

- Those moves sit against a backdrop of Alphabet investing heavily in AI infrastructure and cloud services, expanding its footprint in everything from search to productivity tools and digital advertising. At the same time, ongoing regulatory scrutiny and shifting ad budgets continue to fuel debate about how durable its growth and margins will be as the digital economy evolves.

- Right now Alphabet scores a 2 out of 6 on our valuation checks, suggesting the market might be pricing in a lot of optimism. We are going to unpack what different valuation methods say about that price tag and then finish with a more intuitive way to think about its worth than just a single number.

Alphabet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alphabet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

For Alphabet, the latest twelve month free cash flow is about $92.6 billion. Analysts and internal estimates expect this to rise steadily, with projections reaching around $254.8 billion in free cash flow by 2035. Simply Wall St uses a 2 Stage Free Cash Flow to Equity model. This combines analyst forecasts for the next few years with extrapolated growth assumptions further out to build a 10 year cash flow profile and a terminal value.

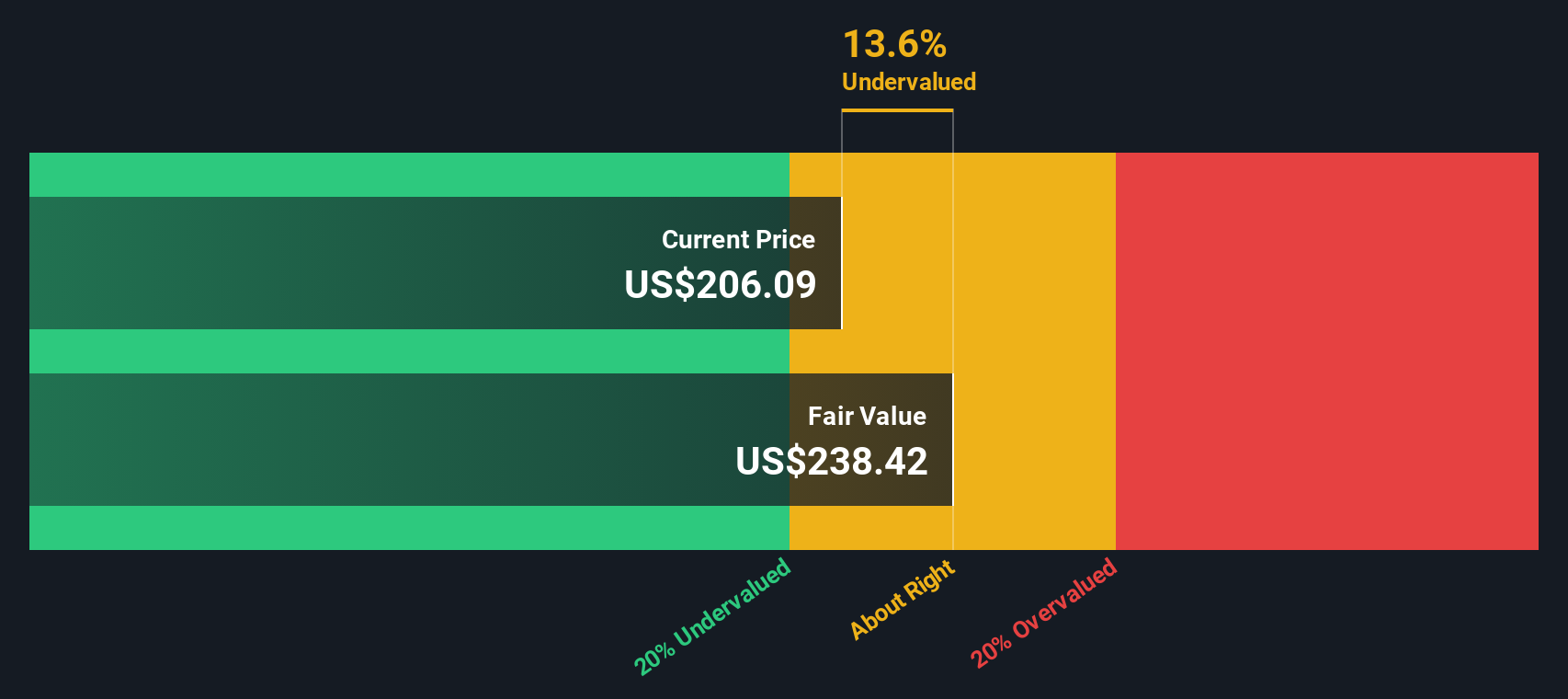

When those future $ cash flows are discounted back to the present, the model arrives at an intrinsic value of roughly $287.43 per share, compared with the current price of about $314. That implies the stock is around 9.3% overvalued on this DCF view, which is close enough to be within a reasonable margin of error rather than a glaring mispricing.

Result: ABOUT RIGHT

Alphabet is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Alphabet Price vs Earnings

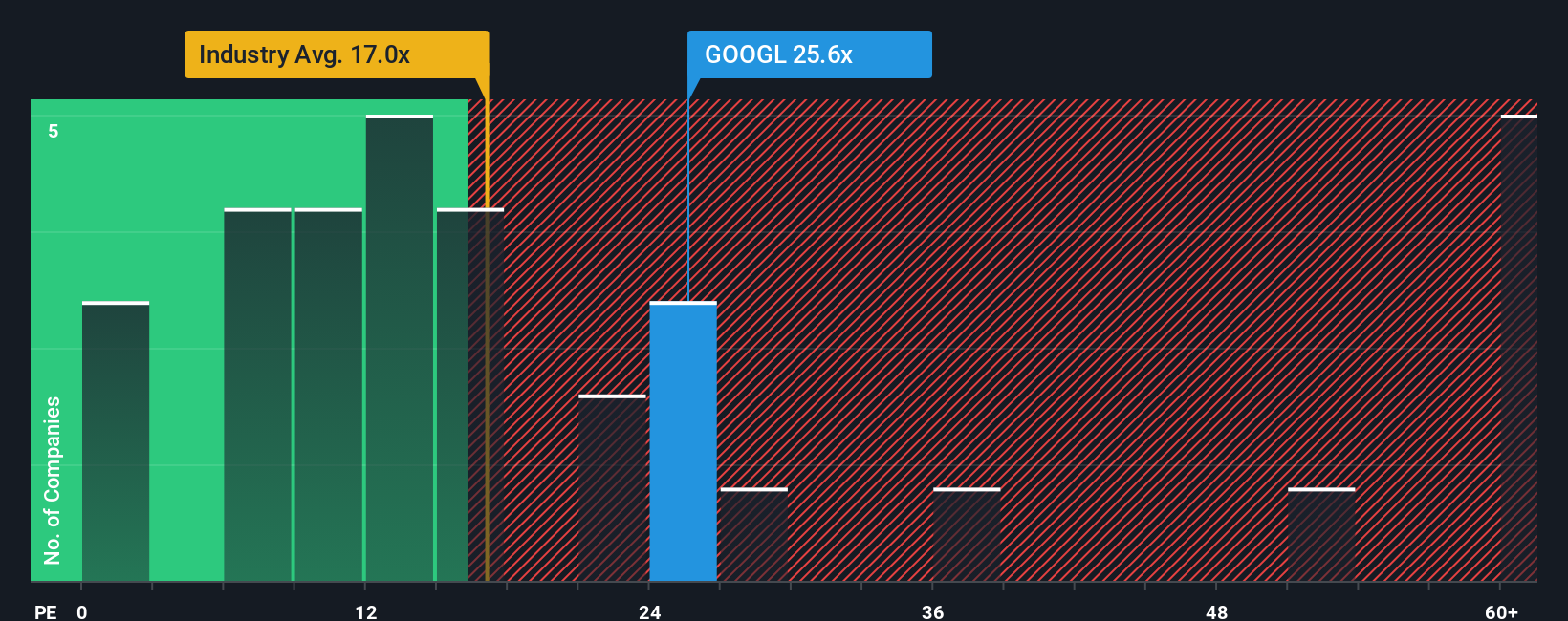

For profitable companies like Alphabet, the price to earnings ratio is a straightforward way to judge how much investors are willing to pay today for each dollar of current earnings. It naturally connects valuation to profitability, which is what ultimately supports long term returns.

What counts as a reasonable PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower risk generally justify a higher multiple, while slower or more volatile earnings usually deserve a discount. Alphabet currently trades on about 30.5x earnings, which is roughly double the Interactive Media and Services industry average of around 15.5x, but below the peer group average of about 48.9x.

Simply Wall St also calculates a Fair Ratio of 37.4x, a proprietary view of what Alphabet’s PE should be once its earnings growth, margins, industry, market cap and risk profile are all accounted for. This is more tailored than simple peer or industry comparisons, which can be skewed by very different business models or risk levels. With the market multiple of 30.5x sitting meaningfully below the 37.4x Fair Ratio, Alphabet appears modestly undervalued on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alphabet Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Alphabet’s story with concrete numbers like future revenue, earnings, margins and a fair value estimate. You can then compare that fair value to today’s price to decide whether to buy, hold or sell.

On Simply Wall St, Narratives live inside the Community page and give you an easy, accessible framework that ties a company’s qualitative story to a full financial forecast and valuation. This framework then keeps that view up to date as new information like earnings, AI product launches or regulatory news rolls in, so your decisions evolve with the business rather than being locked to a static model.

For Alphabet, for example, one Narrative might lean conservative, assuming slower AI monetisation, higher discount rates and more pressure on margins to arrive at a fair value near $171 per share. Another, more optimistic Narrative could factor in faster cloud growth, stronger AI adoption and higher long term profitability to support a fair value closer to $340, and those live side by side on the platform so you can choose, compare or blend the story that best fits your own view and risk tolerance.

For Alphabet however we will make it really easy for you with previews of two leading Alphabet Narratives:

Fair value: $340.00 per share

Implied undervaluation vs current price: 7.6%

Forecast revenue growth: 17.36%

- Frames Alphabet as a cash rich digital ad powerhouse with Google Search, YouTube and a broad ad tech stack driving durable, high margin cash flows.

- Highlights Google Cloud and AI leadership, including DeepMind, Gemini and AI infused products, as engines for long term growth and a higher future price to earnings multiple.

- Argues that Berkshire Hathaway’s stake strengthens the market perception of Alphabet as a quality compounder that deserves a valuation re rating over time.

Fair value: $212.34 per share

Implied overvaluation vs current price: 47.9%

Forecast revenue growth: 13.47%

- Sees Alphabet as fundamentally solid, but priced too richly relative to steady, not explosive, growth in digital ads, cloud and generative AI.

- Emphasises that generative AI is sustaining rather than disruptive, but costly to run, which could cap near term profitability and justify a lower multiple.

- Flags risks from heavy reliance on advertising, potential regulatory overhang and slower than hyped AI monetisation as reasons the market may be overpaying today.

Do you think there's more to the story for Alphabet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报