Exploring 3 Undervalued Small Caps In Global With Notable Insider Activity

In recent weeks, the global markets have experienced mixed performances, with the Russell 2000 Index declining by 0.86% amid ongoing concerns about tech valuations and economic indicators delivering mixed signals. As small-cap stocks navigate these turbulent waters, investors often look for companies that demonstrate resilience through strong fundamentals and notable insider activity as potential indicators of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paragon Care | 17.3x | 0.1x | 22.42% | ★★★★★☆ |

| Eurocell | 16.3x | 0.3x | 39.98% | ★★★★☆☆ |

| Clover | 19.4x | 1.6x | 32.94% | ★★★★☆☆ |

| Vita Life Sciences | 14.9x | 1.6x | 37.31% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 24.95% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.64% | ★★★★☆☆ |

| Tristel | 29.3x | 4.2x | 20.45% | ★★★☆☆☆ |

| Amaero | NA | 63.7x | 32.24% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 9.45% | ★★★☆☆☆ |

| CVS Group | 47.6x | 1.3x | 23.76% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

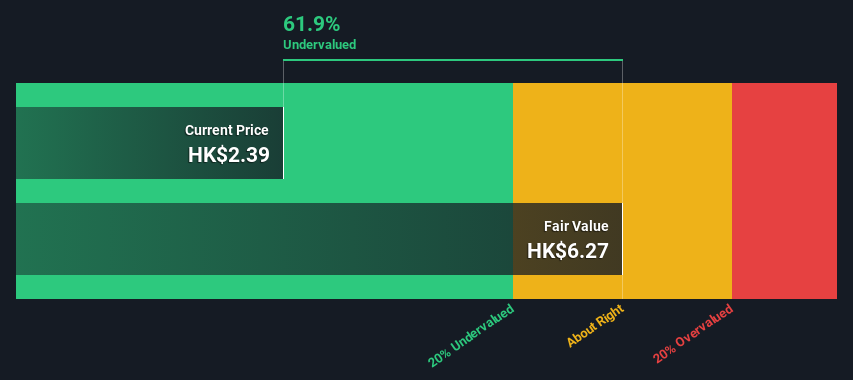

Shougang Fushan Resources Group (SEHK:639)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shougang Fushan Resources Group is engaged in coking coal mining operations and has a market capitalization of HK$14.62 billion.

Operations: The company's primary revenue stream is from coking coal mining, with the latest reported revenue at HK$4.63 billion. The gross profit margin has shown variability, recently noted at 38.84%. Operating expenses include significant allocations to general and administrative expenses and sales & marketing. Net income margin was last recorded at 22.93%, reflecting the impact of non-operating expenses on profitability.

PE: 14.3x

Shougang Fushan Resources Group, a small company in the resources sector, has caught attention for its potential value. Insider confidence is evident with Zhaoqiang Chen purchasing 640,000 shares for approximately HK$1.5 million, marking a significant 47% increase in their holdings. Despite relying solely on external borrowing for funding, which carries higher risk compared to customer deposits, earnings are projected to grow at 6.61% annually, suggesting promising prospects ahead.

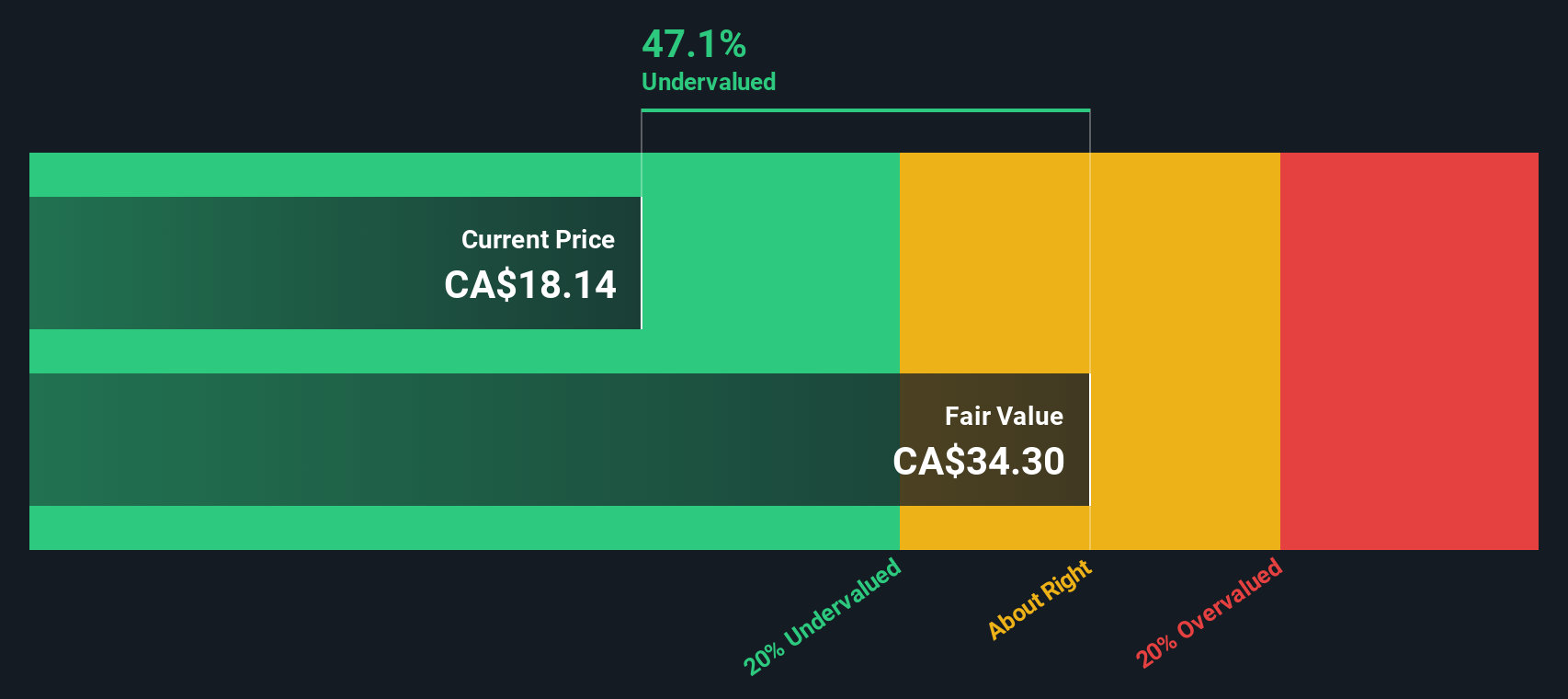

Neo Performance Materials (TSX:NEO)

Simply Wall St Value Rating: ★★★★★★

Overview: Neo Performance Materials is a company engaged in the production of advanced industrial materials, including magnetic powders, rare metals, and specialty chemicals, with a market cap of CAD 0.5 billion.

Operations: The revenue streams for the company are primarily derived from Magnequench, Rare Metals, and Chemicals & Oxides segments. The gross profit margin has shown fluctuations, with recent figures at 29.28% in Q3 2025. Operating expenses have consistently been a significant component of the cost structure, impacting net income margins over time.

PE: -75.1x

Neo Performance Materials, a smaller company in the materials sector, has shown promising signs of financial improvement. In Q3 2025, sales increased to US$122.21 million from US$111.28 million the previous year, with net income reaching US$1.36 million compared to a loss last year. Insider confidence is evident as they have been purchasing shares recently, indicating belief in future prospects despite reliance on external borrowing for funding. The company declared a CAD 0.10 dividend per share for December 2025 payment, reflecting steady shareholder returns amidst growth forecasts of 85% annually in earnings.

- Take a closer look at Neo Performance Materials' potential here in our valuation report.

Understand Neo Performance Materials' track record by examining our Past report.

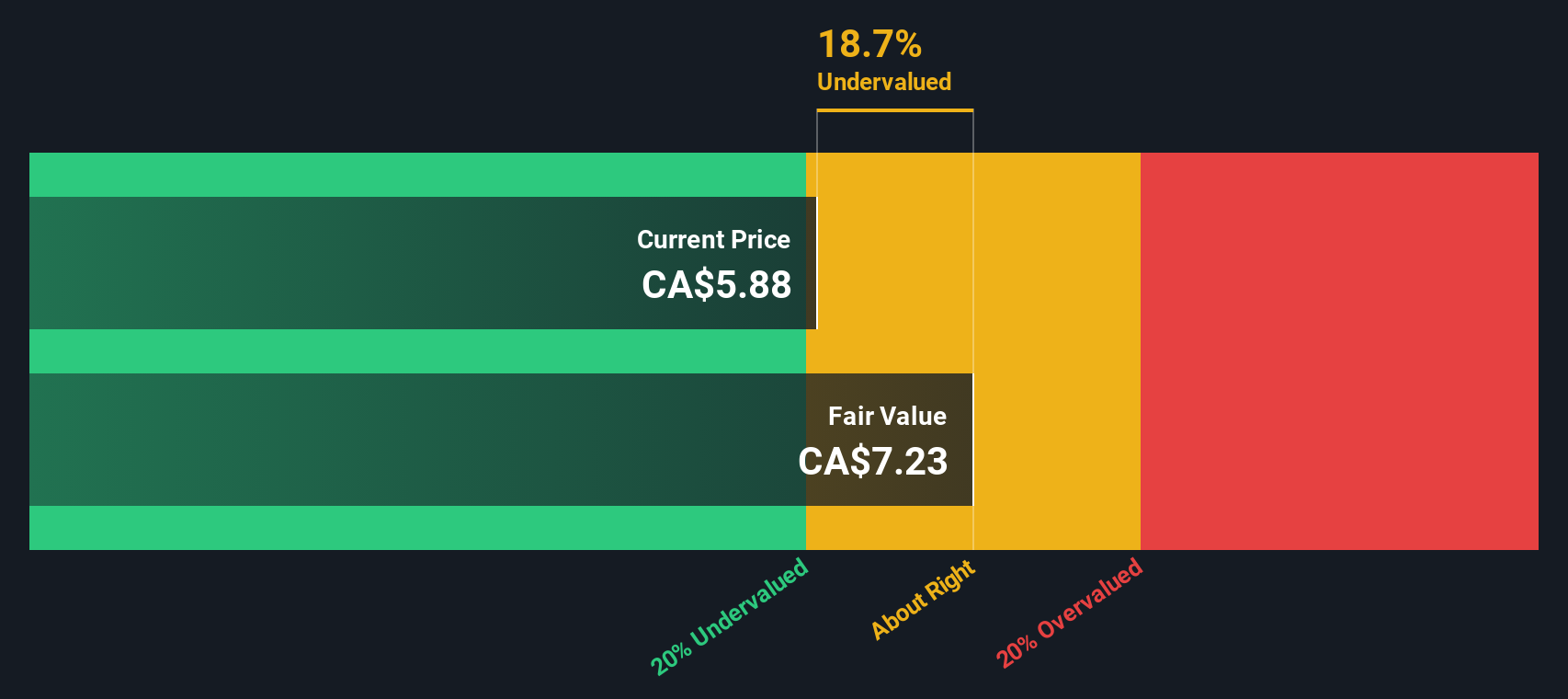

Pro Real Estate Investment Trust (TSX:PRV.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pro Real Estate Investment Trust is engaged in the ownership and management of a diversified portfolio of office and retail properties, with a market cap of CA$0.25 billion.

Operations: The primary revenue streams are derived from office and retail segments, with a notable segment adjustment contributing significantly to total revenue. The gross profit margin has shown variability, reaching 63.36% in Q3 2018 before decreasing to 58.00% by the end of 2023. Operating expenses have fluctuated over time, impacting net income margins which have ranged from as low as 0.35% in Q3 2024 to highs above 1.50% in earlier periods like Q3 and Q4 of 2022 due to significant non-operating income contributions during those times.

PE: 11.7x

Pro Real Estate Investment Trust, a smaller player in the real estate sector, recently expanded its portfolio by acquiring a Winnipeg industrial property for CAD 5.4 million. This acquisition strengthens their presence with 23 properties totaling 1.3 million square feet of leasable space. Despite relying entirely on external borrowing, Pro REIT maintains steady cash distributions of CAD 0.0375 monthly per unit and has shown insider confidence through recent stock purchases, indicating potential value recognition within the company’s strategy.

Make It Happen

- Navigate through the entire inventory of 150 Undervalued Global Small Caps With Insider Buying here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报