Global Stocks Estimated To Be Below Intrinsic Value In December 2025

As global markets navigate a period of mixed economic signals, with interest rate adjustments in major economies and fluctuating indices performance, investors are keenly observing opportunities that may arise from these developments. In this context, identifying stocks that appear undervalued relative to their intrinsic value can be particularly appealing, as they offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.38 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.31 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24535.74 | 50% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.81 | 49.9% |

| Kuraray (TSE:3405) | ¥1601.50 | ¥3167.15 | 49.4% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.44 | 49.5% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.34 | 49.9% |

Let's explore several standout options from the results in the screener.

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €15.14 billion.

Operations: The firm's revenue is derived from segments including Credit (€197.65 million), Secondaries (€124.38 million), and Private Equity (€951.11 million).

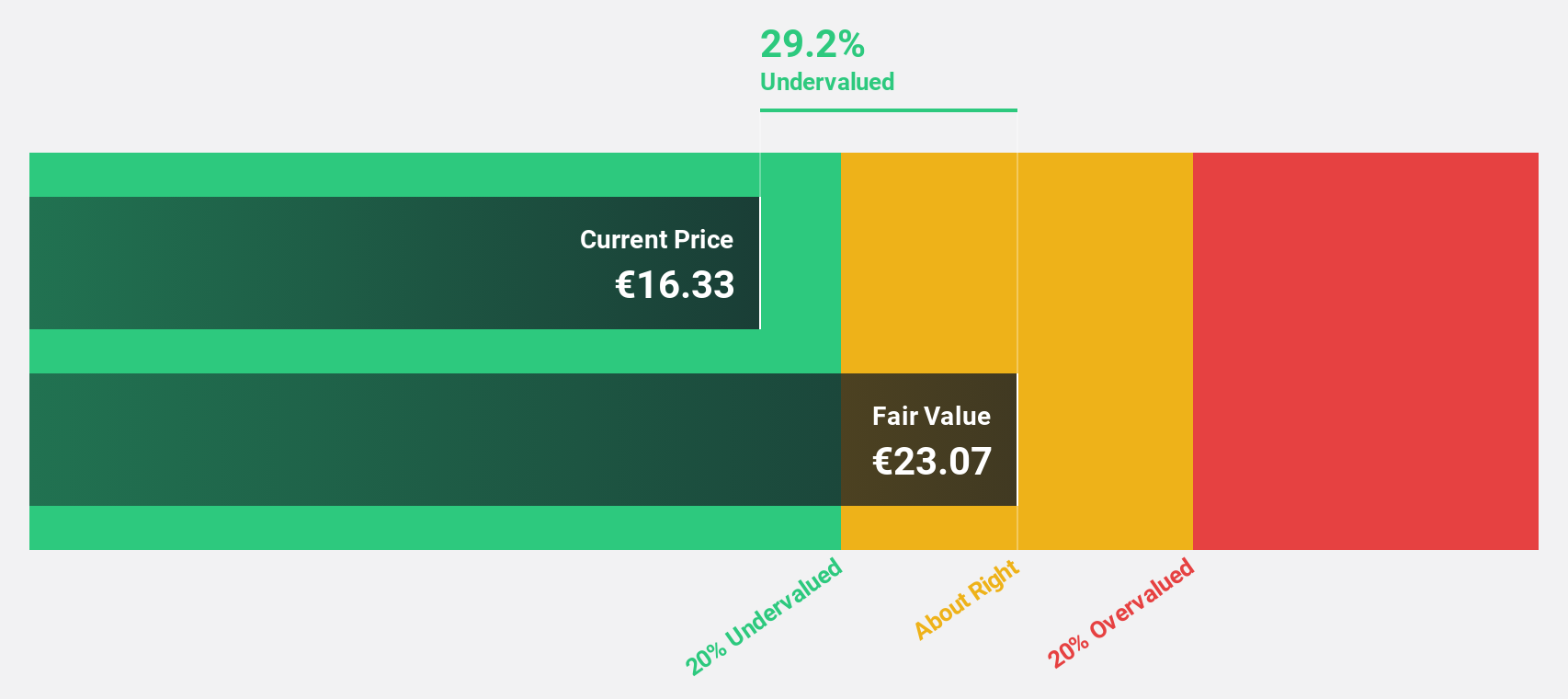

Estimated Discount To Fair Value: 31.5%

CVC Capital Partners is trading at €14.24, significantly below its estimated fair value of €20.8, suggesting it may be undervalued based on cash flows. Despite a high level of debt, CVC's earnings are projected to grow 16.77% annually, outpacing the Dutch market's 12.1% growth rate. Recent M&A discussions highlight strategic interest in enterprise tech sectors, while analysts agree the stock price could rise by 32.9%, reinforcing its potential as an undervalued opportunity.

- Upon reviewing our latest growth report, CVC Capital Partners' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of CVC Capital Partners.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market cap of CN¥12.97 billion.

Operations: Suzhou Hengmingda Electronic Technology Co., Ltd. generates its revenue from various segments within the electronic technology sector.

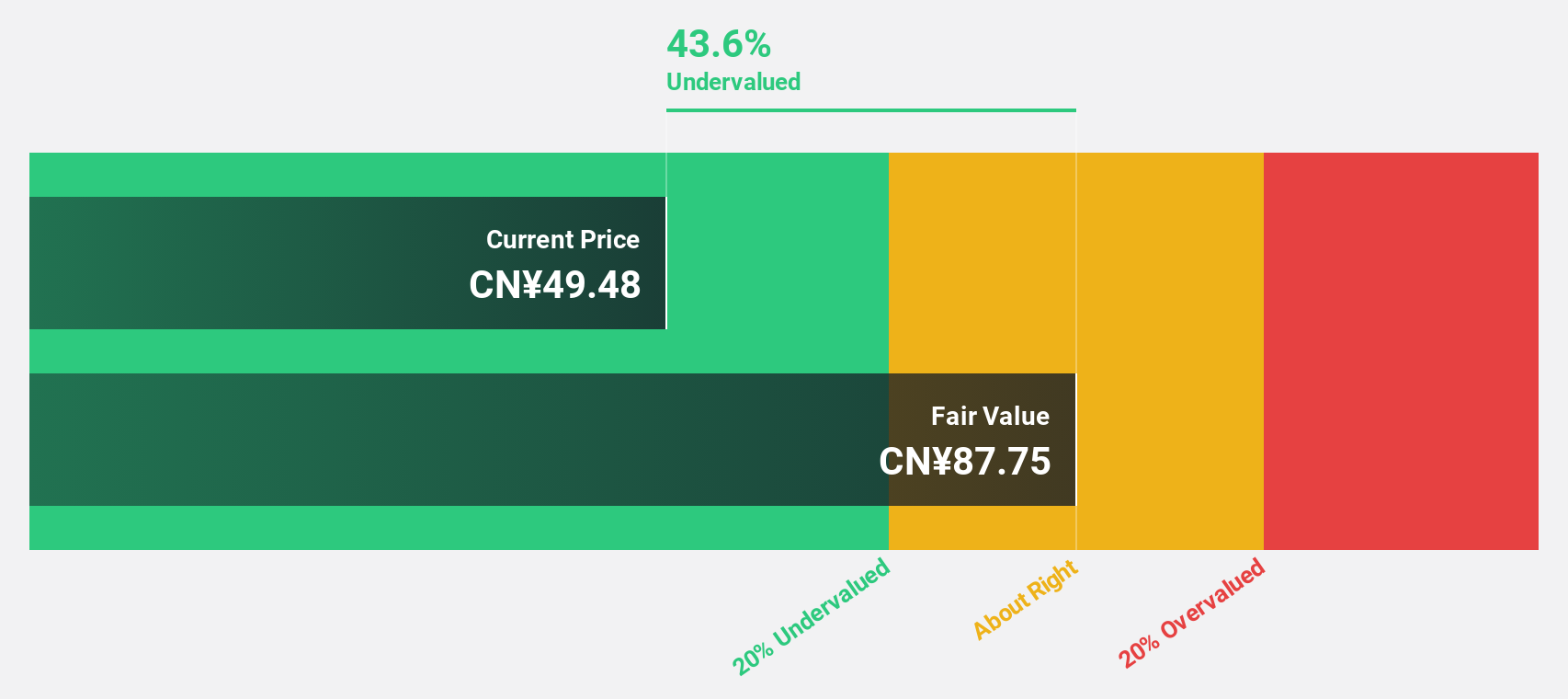

Estimated Discount To Fair Value: 47.7%

Suzhou Hengmingda Electronic Technology, trading at CN¥56.28, is valued below its estimated fair value of CN¥107.58, indicating potential undervaluation based on cash flows. Earnings are expected to grow significantly over the next three years despite a lower forecasted return on equity of 17.9%. The company recently announced a share repurchase program worth up to CN¥400 million to enhance investor confidence and stability, alongside amendments to its governance systems scheduled for discussion in December 2025.

- In light of our recent growth report, it seems possible that Suzhou Hengmingda Electronic Technology's financial performance will exceed current levels.

- Take a closer look at Suzhou Hengmingda Electronic Technology's balance sheet health here in our report.

Nayax (TASE:NYAX)

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants across various regions including the United States, Europe, the United Kingdom, Australia, and Israel with a market cap of ₪5.76 billion.

Operations: The company's revenue primarily comes from its Internet Software and Services segment, which generated $369.94 million.

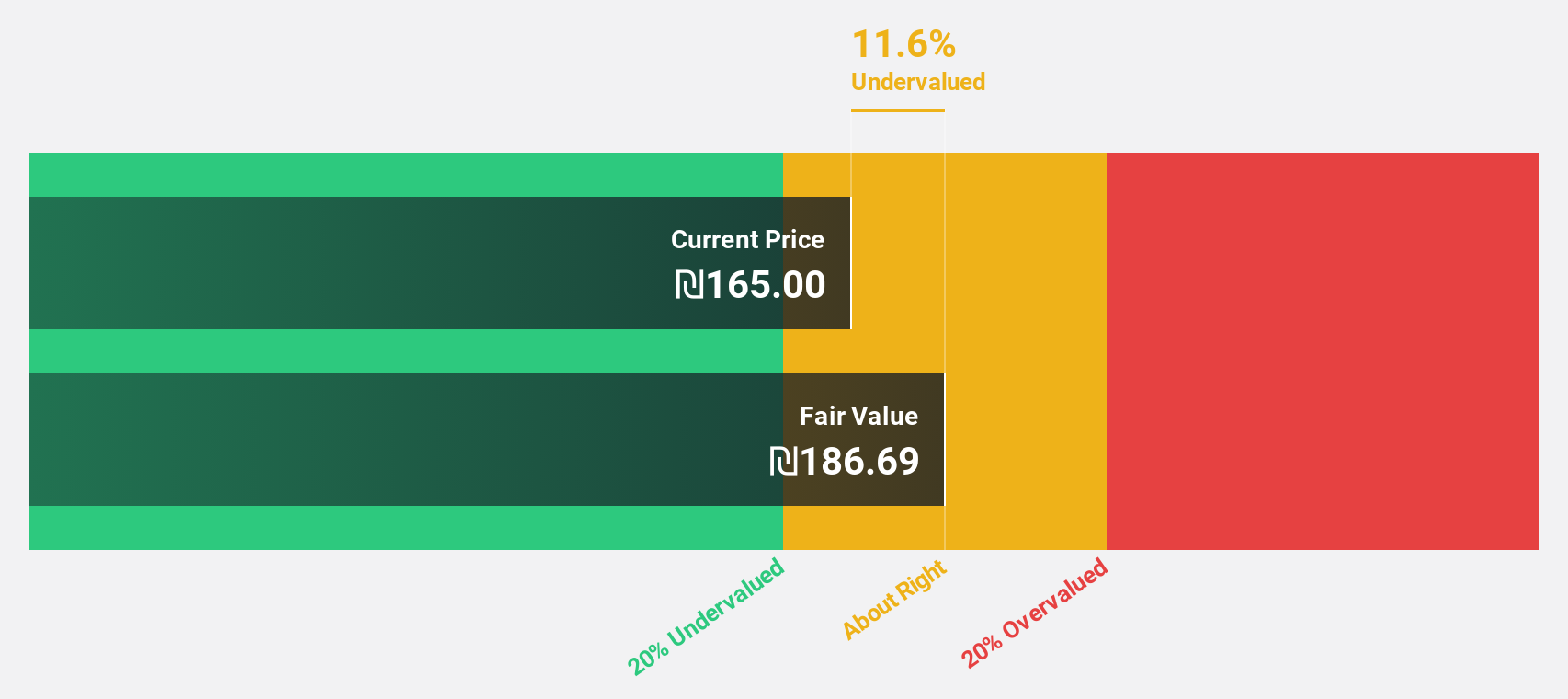

Estimated Discount To Fair Value: 17.7%

Nayax, trading at ₪156, is valued below its estimated fair value of ₪189.58, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 31.2% annually over the next three years, outpacing the IL market's growth rate. Despite a volatile share price recently and lower projected return on equity of 15.8%, strategic partnerships and M&A activities aim to bolster revenue streams and geographic expansion efforts in coming years.

- Our expertly prepared growth report on Nayax implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Nayax with our comprehensive financial health report here.

Where To Now?

- Click this link to deep-dive into the 488 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报