Top Global Dividend Stocks To Consider In December 2025

As global markets navigate a complex landscape marked by mixed economic signals and shifting monetary policies, investors are increasingly seeking stability through dividend stocks. In light of recent developments such as the Bank of Japan's rate hike and fluctuating U.S. employment data, identifying stocks with strong dividend yields can provide a reliable income stream amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.83% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| NCD (TSE:4783) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.29% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

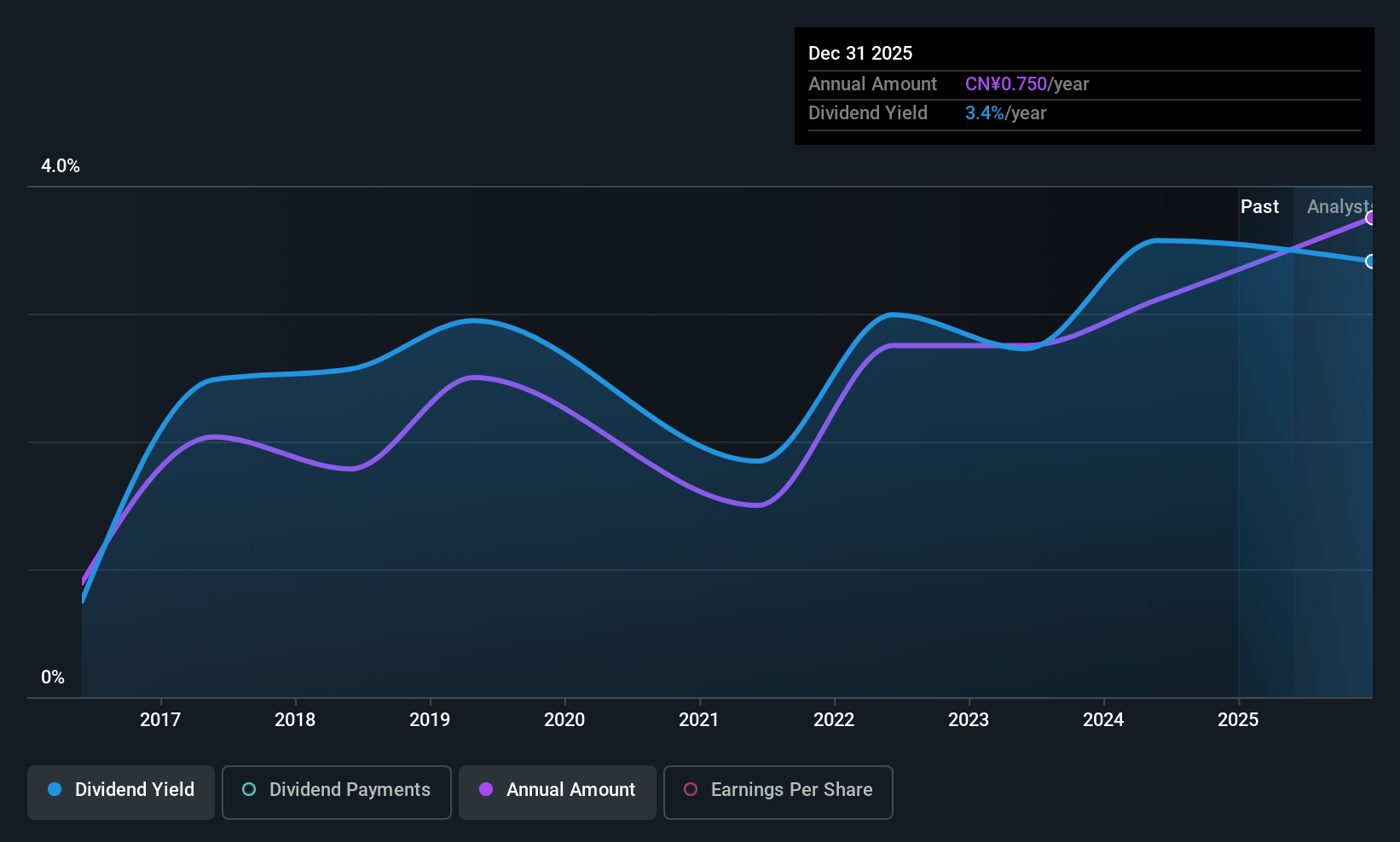

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both in China and internationally, with a market capitalization of CN¥6.16 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates revenue from its operations in intelligent manufacturing equipment and smart logistics systems across domestic and international markets.

Dividend Yield: 3.7%

Noblelift Intelligent Equipment Ltd. offers a dividend yield of 3.67%, ranking in the top 25% of CN market payers, but its dividends have been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 46.7% and 25.7%, respectively. Recent earnings show net income growth to CNY 396.31 million for nine months ending September 2025, supporting dividend sustainability despite revenue dips.

- Take a closer look at Noblelift Intelligent EquipmentLtd's potential here in our dividend report.

- The valuation report we've compiled suggests that Noblelift Intelligent EquipmentLtd's current price could be quite moderate.

Inner Mongolia Yitai CoalLtd (SHSE:900948)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inner Mongolia Yitai Coal Co., Ltd., along with its subsidiaries, is involved in the mining, production, transportation, and sale of coal in China and has a market capitalization of approximately $5.52 billion.

Operations: Inner Mongolia Yitai Coal Co., Ltd. generates its revenue primarily through the mining, production, transportation, and sale of coal within China.

Dividend Yield: 14.8%

Inner Mongolia Yitai Coal Ltd. offers a high dividend yield of 14.84%, placing it among the top 25% in the Chinese market, yet its dividends have been volatile over the past decade. Despite this instability, current payouts are covered by earnings and cash flows with payout ratios of 76.4% and 70.3%, respectively. Recent earnings show a decline in net income to CNY 3.77 billion for nine months ending September 2025, reflecting potential challenges in maintaining dividend stability amidst revenue declines.

- Dive into the specifics of Inner Mongolia Yitai CoalLtd here with our thorough dividend report.

- Our expertly prepared valuation report Inner Mongolia Yitai CoalLtd implies its share price may be lower than expected.

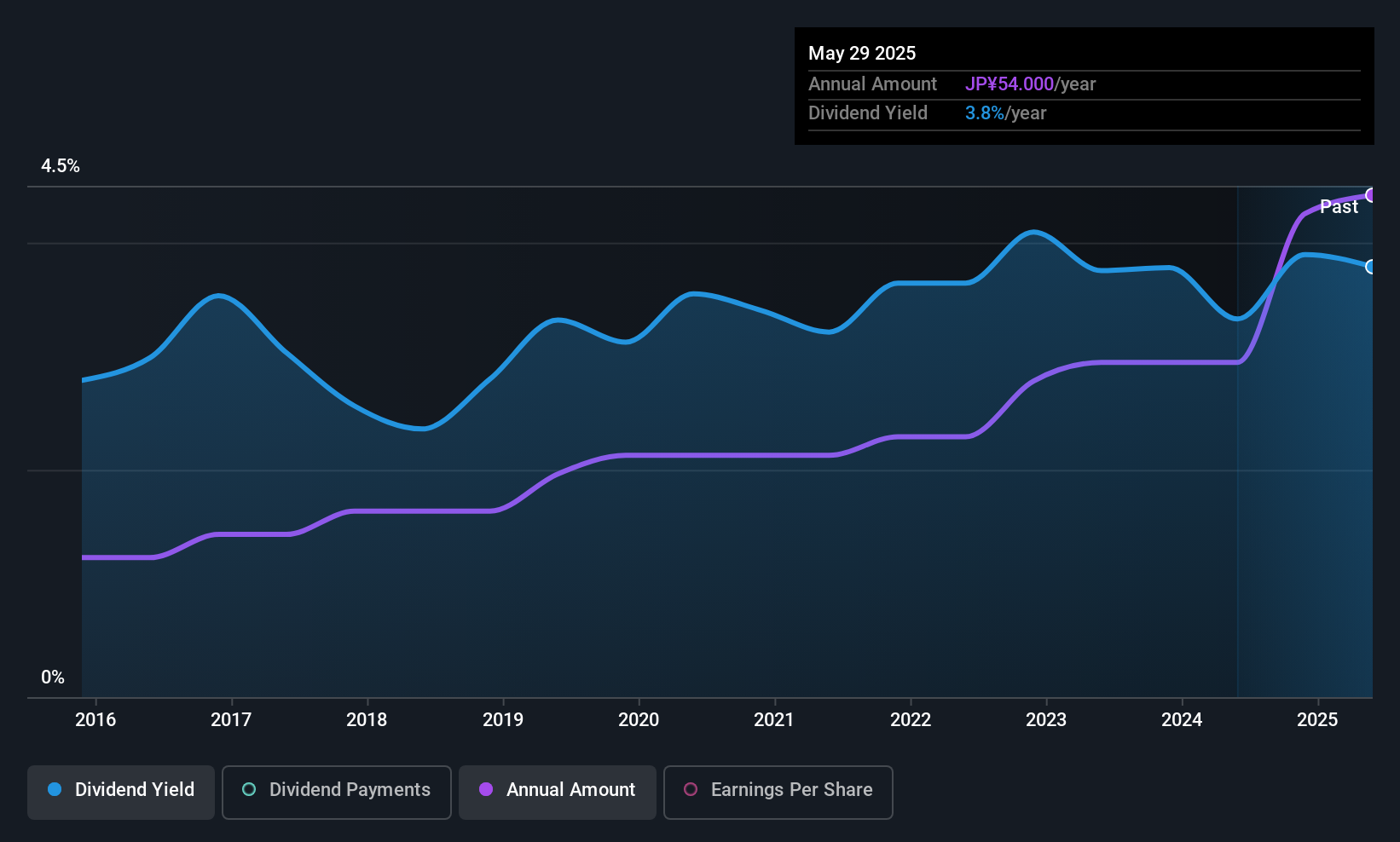

Japan Process Development (TSE:9651)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Process Development Co., Ltd. offers system integration and software development services in Japan, with a market cap of ¥17.98 billion.

Operations: Japan Process Development Co., Ltd.'s revenue segments include system integration and software development services in Japan.

Dividend Yield: 3.1%

Japan Process Development's dividend yield of 3.08% is below the top tier in Japan, and despite stable growth over the past decade, its dividends are not well covered by cash flows due to a high cash payout ratio of 118.4%. However, dividends are supported by earnings with a low payout ratio of 34.5%. Recent guidance projects net sales of ¥11.5 billion and operating profit of ¥1.26 billion for fiscal year ending May 2026, reflecting solid financial performance amidst large one-off items affecting results.

- Navigate through the intricacies of Japan Process Development with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Japan Process Development's current price could be inflated.

Next Steps

- Get an in-depth perspective on all 1292 Top Global Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报