Garmin (GRMN): Reassessing Valuation After Recent Share Price Recovery and Premium Earnings Multiple

Garmin (GRMN) has been quietly grinding higher, with the stock up about 7% over the past month even as its past 3 months performance stays negative. That gap has investors reassessing its trajectory.

See our latest analysis for Garmin.

Zooming out, Garmin’s 30 day share price return of 6.55% contrasts with a flat year to date move and a modestly negative 1 year total shareholder return of 1.28%. This suggests that near term momentum is rebuilding after a cooling phase.

If this kind of steady recovery has your attention, it might be a good moment to see what else is setting up well via fast growing stocks with high insider ownership.

With shares near all time highs, solid double digit three year returns and analysts still seeing upside, the key question now is whether Garmin is trading below its true value or if the market has already priced in its future growth?

Most Popular Narrative Narrative: 11.3% Undervalued

With Garmin last closing at $205 and the most followed narrative pointing to a fair value near $231, the story implies notable upside from here.

The launch of the Garmin Connect+ premium service, which offers AI based health and fitness insights, is likely to boost subscription based revenue growth and improve overall margins through higher margin services.

The new vívoactive 6 smartwatch release, with advanced features like an AMOLED display and enhanced sports apps, suggests potential revenue growth in the Fitness segment, supported by strong demand for advanced wearables.

Curious how steady subscription growth, richer device mix and ambitious profit assumptions combine into that upside case, and what earnings multiple it quietly bakes in?

Result: Fair Value of $231.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain, including softer Marine and Outdoor demand and rising operating expenses. These could pressure margins if revenue growth underwhelms.

Find out about the key risks to this Garmin narrative.

Another Lens On Valuation

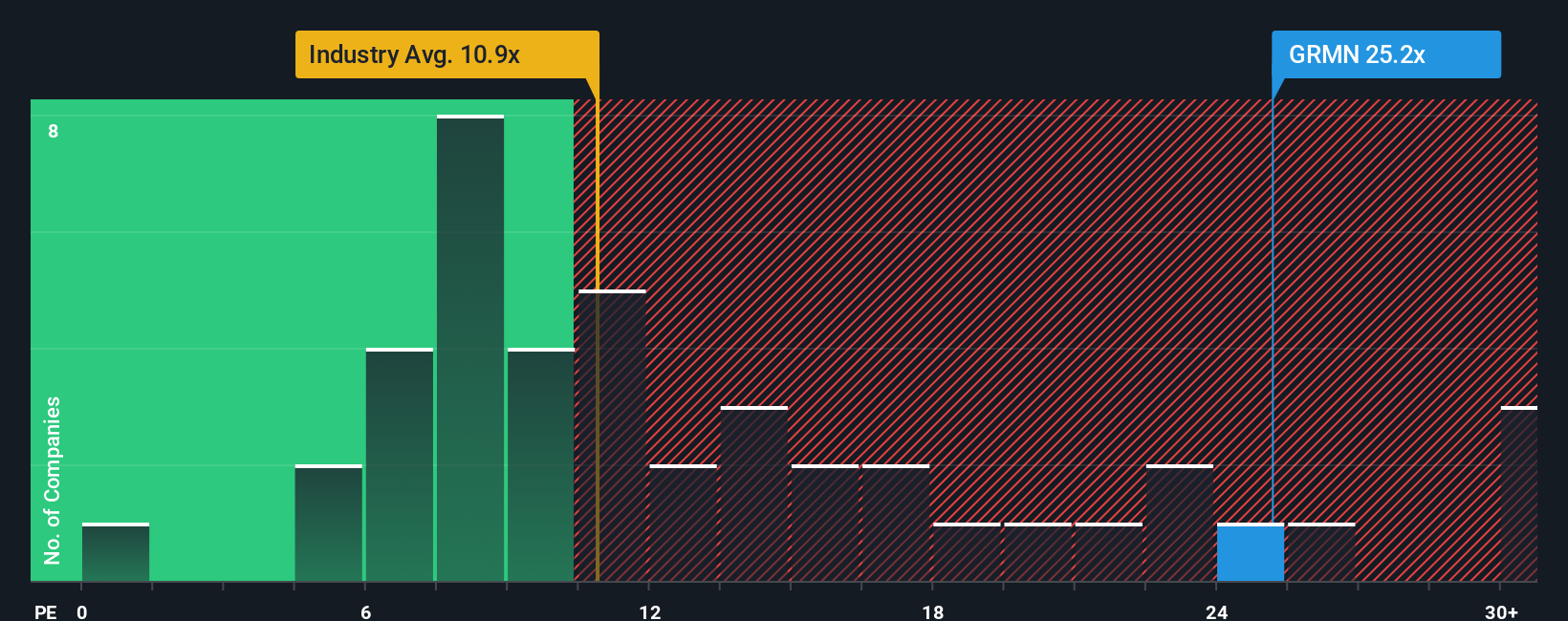

While our fair value work suggests Garmin is about 8.9% undervalued, its price to earnings ratio of 25.1 times screens as expensive versus both peers at 23.3 times and the broader US Consumer Durables industry at 9.8 times, and above a fair ratio of 20.8 times.

That gap means any stumble in growth or margins could trigger a sharp de rating. Investors therefore need to weigh the upside story against the risk that the multiple drifts back toward that lower fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Garmin Narrative

If this view does not quite match your own or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Garmin.

Ready for your next investing move?

Do not stop at Garmin. Put your research momentum to work by scanning fresh opportunities that match your style before the market prices them in.

- Capture potential mispricings by running through these 904 undervalued stocks based on cash flows that pair solid fundamentals with attractive valuation gaps.

- Ride powerful thematic trends by targeting these 24 AI penny stocks shaping automation, data intelligence and next generation software.

- Strengthen your income stream by checking out these 10 dividend stocks with yields > 3% that combine yield with balance sheet resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报