Ichigo (TSE:2337): Taking Stock of Valuation After Recent Share Price Strength

Ichigo (TSE:2337) has quietly outperformed the broader Japanese real estate space this year, and that strength is starting to get investor attention, especially given its mix of property and clean energy assets.

See our latest analysis for Ichigo.

With the share price now at ¥423, Ichigo has logged a solid year to date, with a 6.0 percent 1 month share price return and a 3 year total shareholder return of over 60 percent, suggesting momentum is gradually building.

If Ichigo’s mix of real estate and renewables has caught your eye, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

Yet with Ichigo now trading just above analyst targets and showing only modest earnings growth, investors must ask whether the recent run still leaves upside on the table, or whether the market already anticipates the next leg of growth.

Most Popular Narrative Narrative: 1% Overvalued

With Ichigo closing at ¥423 against a narrative fair value of ¥420, the valuation gap is slim, but the growth blueprint behind it is anything but simple.

The ongoing expansion and segmentation of their Asset Management and Sustainable Real Estate segments are expected to drive significant growth in AUM, positively affecting revenue and cash flow. Ichigo's strategic focus on hotel and hotel asset management, with significant RevPAR improvements and boutique hotel brand expansions, is enhancing profitability and is likely to contribute to higher net margins.

Want to see what kind of revenue climb and margin reset are built into this story, and how they shape Ichigo’s future earnings power and valuation?

Result: Fair Value of ¥420 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly higher interest costs or continued underperformance in clean energy could quickly challenge the earnings and valuation narrative that investors are leaning on.

Find out about the key risks to this Ichigo narrative.

Another Angle on Value

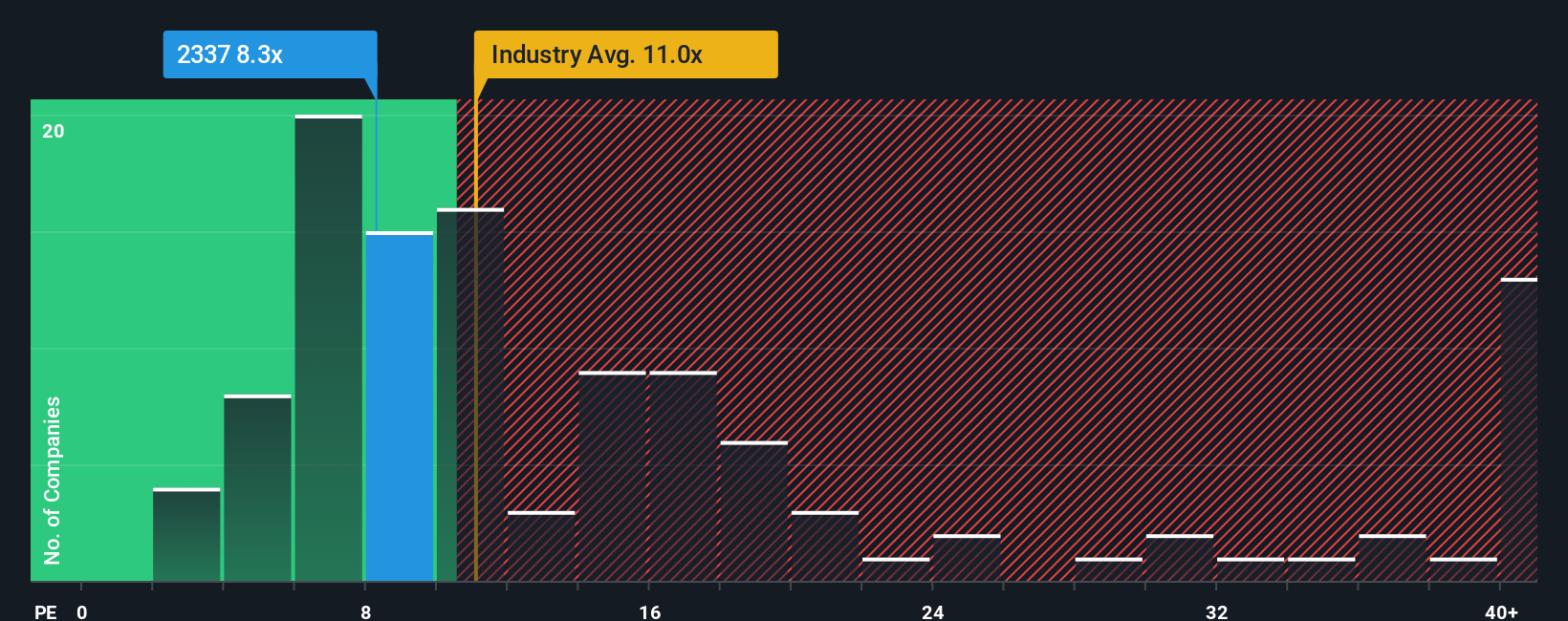

On earnings, Ichigo looks inexpensive at 9.5x versus 11.5x for the Japan real estate sector and a fair ratio of 12.6x, which hints at upside if sentiment normalizes. However, if the market stays cautious, that apparent discount could simply reflect lower growth and balance sheet risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ichigo Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Ichigo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few more smart possibilities by using the Simply Wall St Screener to uncover focused opportunities across different themes and strategies.

- Boost your income game by reviewing these 10 dividend stocks with yields > 3% that combine attractive yields with the potential for steadier returns.

- Capitalize on innovation by scanning these 24 AI penny stocks that are pushing the frontiers of artificial intelligence and automation.

- Strengthen your value hunting by checking these 904 undervalued stocks based on cash flows that currently trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报