3 European Dividend Stocks To Consider With Up To 10.2% Yield

As European markets show signs of steady economic growth and benefit from looser monetary policies, investors may find opportunities in dividend stocks that offer attractive yields. In the current environment, focusing on companies with strong fundamentals and consistent dividend payouts can be a prudent strategy for those seeking income amid market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.87% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.87% | ★★★★★☆ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BRD - Groupe Société Générale (BVB:BRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BRD - Groupe Société Générale S.A. offers a variety of banking and financial services to both corporate clients and individuals in Romania, with a market capitalization of RON17.77 billion.

Operations: BRD - Groupe Société Générale S.A.'s revenue is derived from three main segments: Retail at RON2.39 billion, Non-Retail at RON1.40 billion, and Corporate Center at RON310.33 million.

Dividend Yield: 4.1%

BRD - Groupe Société Générale offers a mixed outlook for dividend investors. Despite earnings growth of 4.3% over the past year and a low payout ratio of 46.5%, its dividend payments have been unreliable and volatile over the last decade, with a yield of 4.15% falling short of top-tier benchmarks in Romania (6.5%). The company also faces challenges with high non-performing loans at 2.7%. However, dividends are forecasted to remain covered by earnings in three years at a payout ratio of 65.5%.

- Dive into the specifics of BRD - Groupe Société Générale here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that BRD - Groupe Société Générale is trading beyond its estimated value.

Groupe CRIT (ENXTPA:CEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe CRIT SA offers temporary staffing and recruitment services both in France and internationally, with a market cap of €615.28 million.

Operations: Groupe CRIT SA's revenue primarily comes from its Temporary Work segment, generating €2.84 billion, and its Airport Assistance segment, contributing €437.18 million.

Dividend Yield: 10.3%

Groupe CRIT's dividend yield of 10.27% ranks among the top 25% in France, yet its sustainability is questionable due to a high payout ratio of 96.9%, indicating dividends are not well covered by earnings. While cash flow coverage is reasonable at 58%, dividend payments have been volatile and unreliable over the past decade despite growth. The stock trades significantly below estimated fair value, presenting potential relative value compared to peers and industry standards.

- Take a closer look at Groupe CRIT's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Groupe CRIT shares in the market.

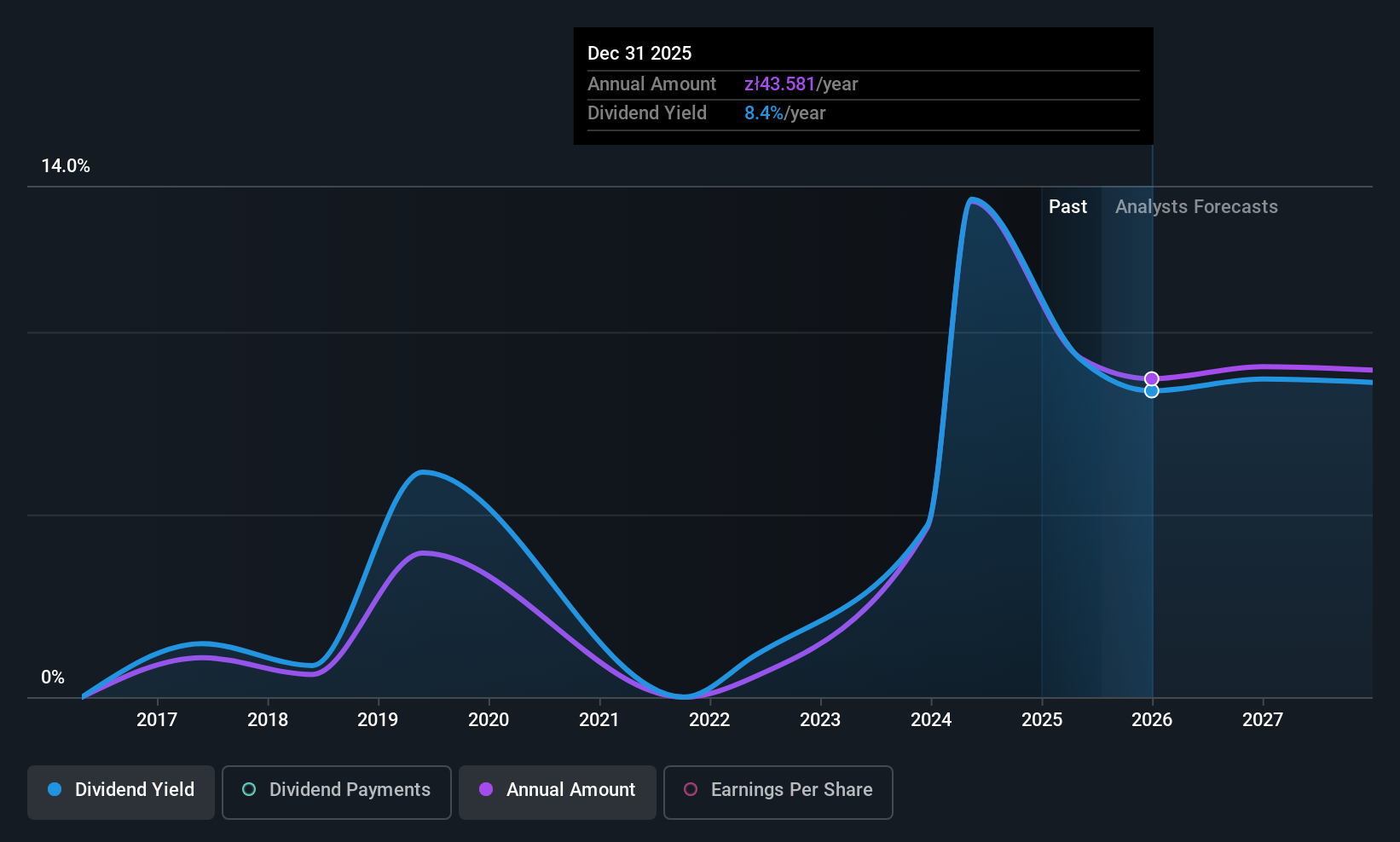

Santander Bank Polska (WSE:SPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Santander Bank Polska S.A. offers a range of banking products and services to individuals, SMEs, corporate clients, and public sector institutions with a market cap of PLN55.43 billion.

Operations: Santander Bank Polska S.A.'s revenue is primarily derived from Retail Banking (PLN10.18 billion), Business and Corporate Banking (PLN2.92 billion), and Corporate & Investment Banking (PLN1.53 billion).

Dividend Yield: 8.5%

Santander Bank Polska's dividend yield of 8.55% places it in the top 25% of Polish dividend payers, with current payouts covered by earnings at an 84.1% payout ratio, forecasted to improve to 75.2%. Despite a decade-long increase in dividends, their reliability is undermined by volatility and an unstable track record. The stock trades at a significant discount to its estimated fair value but faces challenges with high non-performing loans (4.1%) and large one-off items affecting earnings quality.

- Unlock comprehensive insights into our analysis of Santander Bank Polska stock in this dividend report.

- Our valuation report here indicates Santander Bank Polska may be undervalued.

Summing It All Up

- Take a closer look at our Top European Dividend Stocks list of 195 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报