Is Galaxy Digital (TSX:GLXY) Still Undervalued After Its Recent Share Price Volatility?

Galaxy Digital (GLXY) has had a choppy few months, with the stock up sharply year to date but giving back ground over the past 3 months, and that mix is exactly what makes it interesting now.

See our latest analysis for Galaxy Digital.

At today’s $24.43 share price, Galaxy’s strong year to date share price return contrasts with a weak 90 day stretch, while its multi year total shareholder returns still point to powerful long term momentum.

If Galaxy’s move has you thinking about where capital could work harder next, it is worth scanning fast growing stocks with high insider ownership for other high conviction, fast moving ideas.

With shares still trading at a steep discount to analyst targets despite a powerful multi year run, the puzzle now is simple: is Galaxy Digital still misunderstood value, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 48.9% Undervalued

With Galaxy Digital last closing at $24.43 against a narrative fair value near $47.82, the gap implies investors may be overlooking its long run earnings power.

The maturation of digital asset infrastructure, evidenced by large scale, long term data center developments and multi phase partnerships (e.g., CoreWeave), is described as being poised to generate significant, high margin cash flows beginning in 2026, enhance earnings visibility, and improve the company's overall capitalization efficiency as these business lines scale.

Curious how ambitious revenue ramps, rising margins, and a premium future earnings multiple can all coexist in one story? Unpack the full playbook behind this valuation.

Result: Fair Value of $47.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heavy reliance on CoreWeave for initial data center capacity and significant capital needs that could pressure returns if financing conditions tighten.

Find out about the key risks to this Galaxy Digital narrative.

Another Angle on Valuation

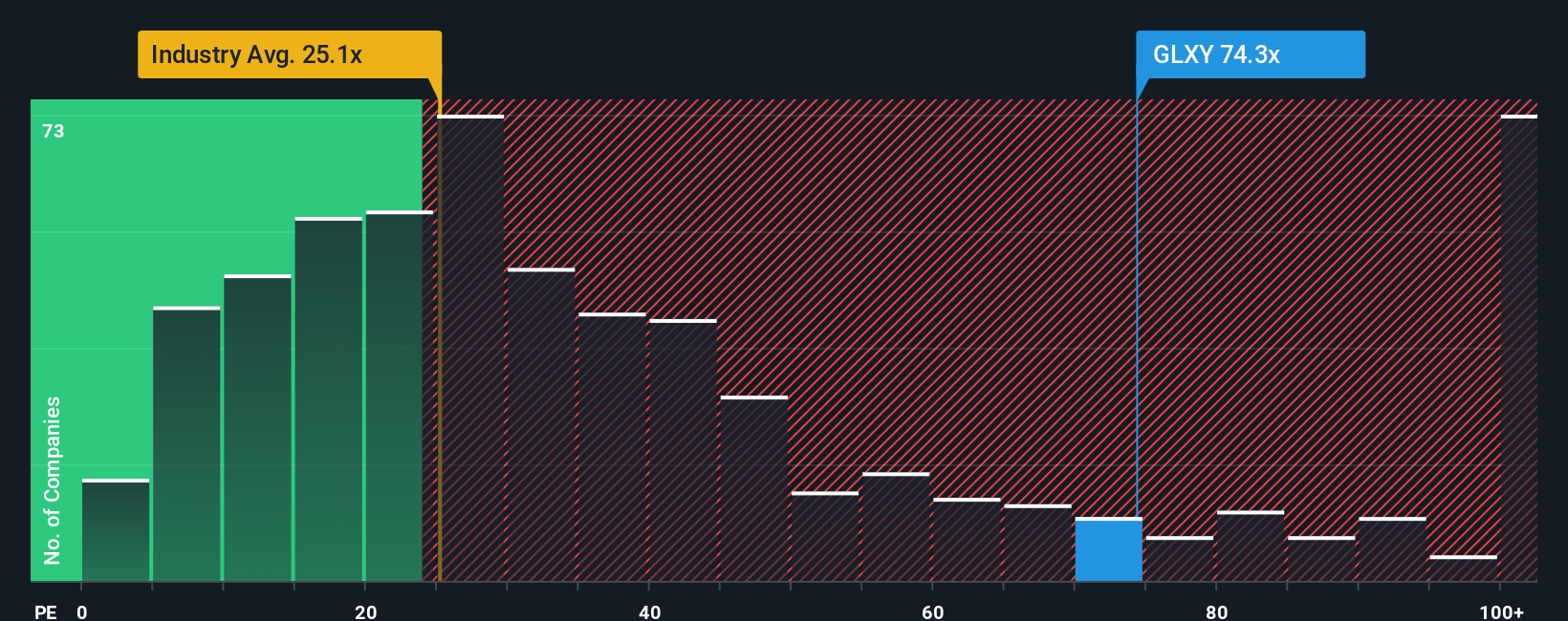

Galaxy looks cheap on narrative fair value, but its 39.4x price to earnings ratio stands well above both the US capital markets average of 25.6x and a fair ratio of 14.5x. This implies the market could re rate sharply if growth disappoints. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Looking for your next smart opportunity?

Before you move on, lock in your edge by scanning a few hand picked stock ideas on Simply Wall St’s powerful screener tools today.

- Scan these 3630 penny stocks with strong financials to find companies that combine tiny market caps with signs of financial resilience and potential for significant expansion.

- Explore these 29 healthcare AI stocks to focus on businesses where data, algorithms, and patient outcomes intersect to reshape medical economics.

- Filter for these 10 dividend stocks with yields > 3% to look for companies that balance attractive yields with balance sheet support and capacity for sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报