Toyota (TSE:7203) Valuation Check After Recent Share Price Outperformance

Toyota Motor (TSE:7203) has quietly extended its strong run, with the stock up about 8% over the past month and 13% in the past 3 months, outpacing Japan’s broader market.

See our latest analysis for Toyota Motor.

That recent 8 percent 1 month share price return builds on a solid year to date share price gain and a 1 year total shareholder return of about 17 percent, suggesting steady momentum as investors weigh Toyota’s gradual earnings growth and ongoing EV and hybrid push.

If Toyota’s climb has you rethinking the whole auto space, it is worth exploring other auto manufacturers that could benefit from the same demand and electrification tailwinds.

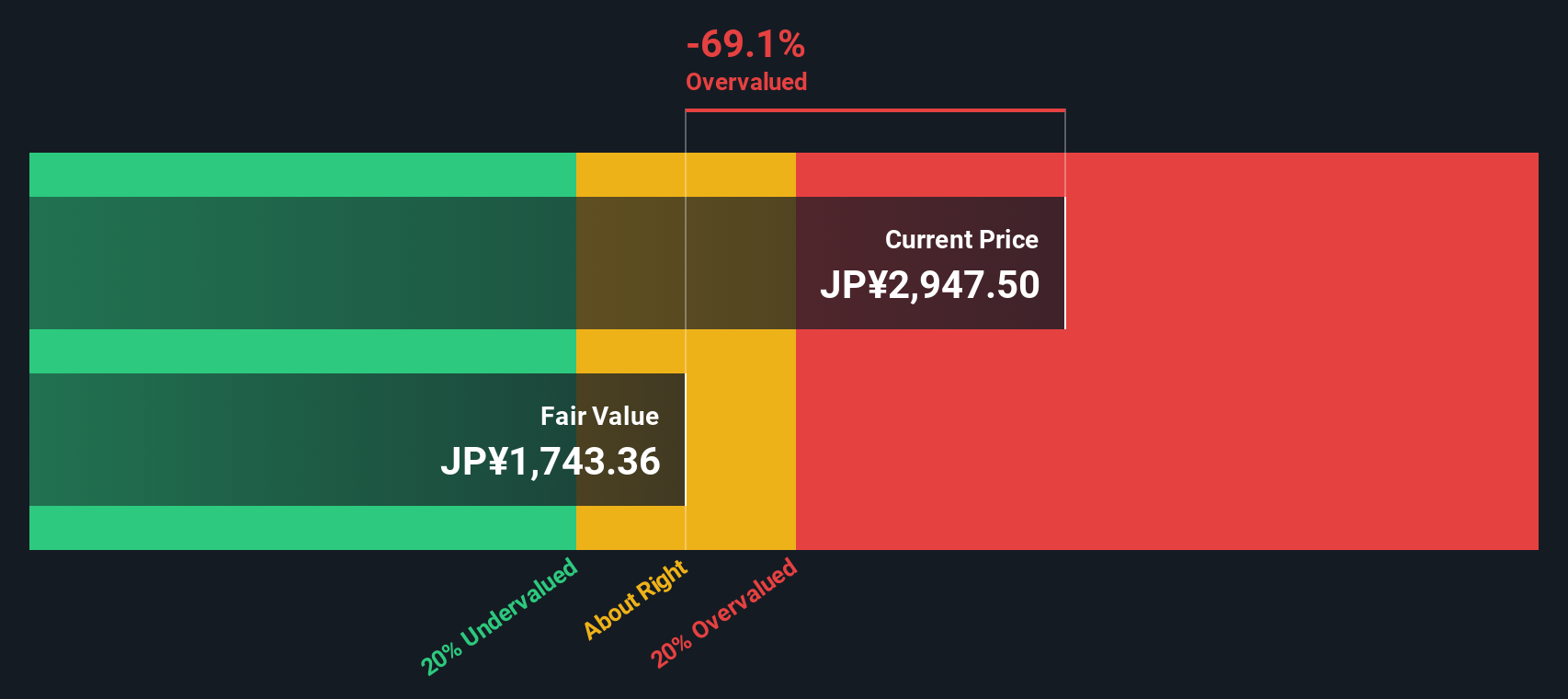

With shares trading just below analyst targets but screens flagging Toyota as richly valued on intrinsic metrics, investors now face a key question: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative Narrative: 5% Undervalued

With Toyota Motor last closing at ¥3,353 against a narrative fair value near ¥3,515, the story leans toward modest upside anchored in measured growth.

Toyota's investment in internal battery production, including various types of batteries for electric and hybrid vehicles, could bolster long term revenue and margins. By optimizing battery production and technology, Toyota positions itself competitively in the growing electrified vehicle market.

To see what kind of future profit engine could support that higher valuation, and how earnings, margins, and multiples are expected to evolve together, explore the full narrative.

Result: Fair Value of ¥3,515.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, production halts or renewed price competition in China could quickly pressure margins and undermine the modest upside implied by today’s fair value estimates.

Find out about the key risks to this Toyota Motor narrative.

Another Way Of Looking At Value

While the narrative fair value suggests Toyota is about 5 percent undervalued, our DCF model paints a tougher picture, with fair value closer to ¥1,955. This implies the shares are trading well above intrinsic worth. Is the market rightly pricing long term optionality, or leaning on optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Motor Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Toyota Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Toyota alone, you could miss other opportunities now building real momentum. Consider broadening your watchlist with a few targeted themes.

- Capture potential bargains early by scanning these 904 undervalued stocks based on cash flows that the market may be overlooking despite solid cash flow support.

- Ride structural tech trends by focusing on these 24 AI penny stocks positioned to benefit from the rapid adoption of intelligent automation.

- Harness income plus growth potential by targeting these 10 dividend stocks with yields > 3% that can reinforce returns through consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报