Has the Market Already Priced In Energy Transfer’s Post Rally Potential for 2025?

- If you have been wondering whether Energy Transfer is still a value play or if most of the easy money has already been made, you are not alone. This article is going to walk through that question step by step.

- Despite being down 16.8% year to date and about 10.0% over the last year, the stock is still sitting on gains of roughly 80.3% over 3 years and nearly 295.9% over 5 years. This suggests that the market has already reassessed this name more than once.

- Recent moves have been shaped by a steady stream of headlines around US midstream infrastructure, policies affecting fossil fuel transport, and Energy Transfer's continued push to expand its pipeline and export footprint. Together, these themes frame a tug of war between long term cash flow visibility and shifting regulatory and energy transition risks that investors are still pricing in.

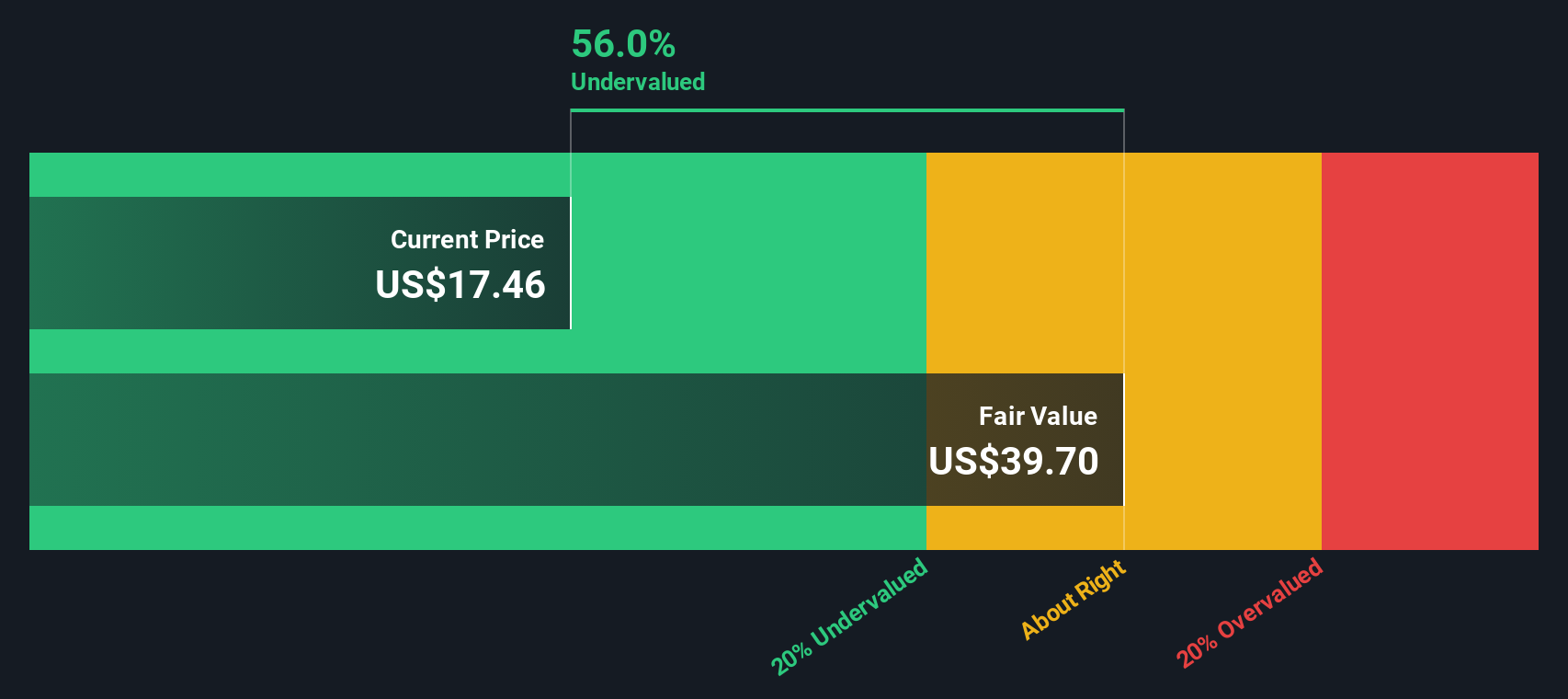

- Right now, Energy Transfer scores a 5/6 valuation check, suggesting it screens as undervalued on most of the metrics tracked. Next, this article will break down how DCFs, multiples, and asset-based views compare with an even more nuanced way to think about valuation that will be discussed at the end.

Find out why Energy Transfer's -10.0% return over the last year is lagging behind its peers.

Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

For Energy Transfer, the model used is a 2 Stage Free Cash Flow to Equity approach. The company generated about $6.7 billion in free cash flow over the last twelve months, and analyst estimates plus extrapolations see this rising to roughly $9.4 billion by 2035. Near term, forecasts call for free cash flow of about $5.0 billion in 2026, climbing through the $7.8 billion mark by 2029 as the asset base and export footprint expand.

When all of these projected cash flows are discounted back and summed, the DCF model produces an estimated intrinsic value of $43.54 per share. With the DCF implying that the stock is trading at roughly a 62.4% discount to this value, Energy Transfer screens as meaningfully undervalued on this cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Transfer is undervalued by 62.4%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

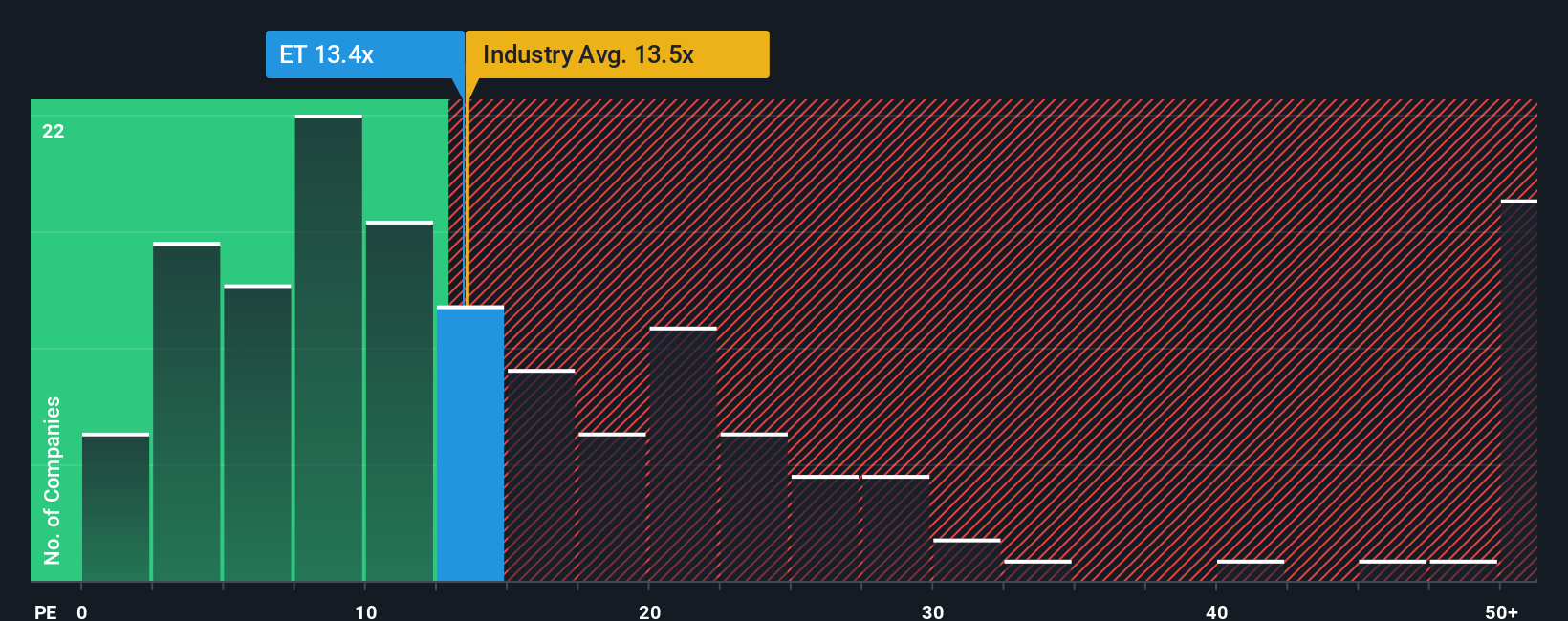

Approach 2: Energy Transfer Price vs Earnings

For a consistently profitable business like Energy Transfer, the price to earnings, or PE, ratio is a useful starting point because it directly links what investors pay today with the profits the company is generating right now. In general, companies with stronger growth prospects and lower perceived risk tend to justify higher PE multiples, while slower growing or riskier names usually trade at lower multiples.

Energy Transfer currently trades at about 13.0x earnings, which is roughly in line with the broader Oil and Gas industry average of around 12.9x, but meaningfully below the peer group average of about 19.1x. To go beyond these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE multiple would be reasonable given a company’s earnings growth outlook, margins, industry, size, and risk profile. For Energy Transfer, this Fair Ratio is 22.0x, materially higher than where the shares trade today. Because the Fair Ratio bakes in company specific drivers rather than just copying what peers trade at, it offers a more tailored view of value, and on this basis Energy Transfer still looks undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to turn your view of a company into a story that connects assumptions about future revenue, earnings and margins with a financial forecast and a Fair Value estimate. At its core, a Narrative is your explanation of what you think will actually happen to a business, translated into numbers that can be compared with today’s share price so you can decide whether to buy, hold, or sell. Narratives on Simply Wall St, available to millions of investors through the Community page, make this process accessible by guiding you to link the company’s story, like Energy Transfer’s pipeline growth or regulatory risks, to explicit forecasts that are updated dynamically as new earnings, news or price targets come in. For example, some investors may build a bullish Energy Transfer Narrative that assumes revenue growth near the top of analyst expectations, higher margins and a Fair Value closer to 25 dollars, while more cautious investors may lean toward slower growth, pressured margins and a Fair Value closer to 20 dollars, with both views automatically recalibrated when fresh information appears.

Do you think there's more to the story for Energy Transfer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报