Middle Eastern Penny Stocks To Watch In December 2025

Despite firmer oil prices, most Gulf markets have eased recently, reflecting a complex interplay of regional and global economic factors. In such a landscape, the appeal of penny stocks remains significant for investors seeking opportunities in smaller or newer companies. While the term 'penny stocks' might seem outdated, these investments can still offer a compelling mix of affordability and growth potential when supported by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.28 | SAR1.31B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.472 | ₪177.28M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.12B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.24 | AED670.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.85 | SAR972M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED375.38M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.69 | AED15.73B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.852 | AED518.23M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.535 | ₪198.99M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 82 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates with a market capitalization of AED5.96 billion.

Operations: The bank's revenue is primarily derived from Retail and Corporate Banking, which contributed AED423.61 million, and Treasury and Investments, which generated AED413.01 million.

Market Cap: AED5.96B

National Bank of Umm Al-Qaiwain (PSC) has demonstrated stable earnings growth, with a 20.7% annual increase over the past five years, although recent growth of 10.4% lags behind the industry average. The bank maintains a low Price-To-Earnings ratio of 10.4x, suggesting potential value relative to the market average. Despite its high-quality earnings and appropriate bad loan allowances, NBQ's return on equity remains low at 8.9%. Recent financial results show an increase in net income for Q3 and nine months ending September 2025 compared to last year, indicating resilience amidst market volatility and unstable dividend history.

- Jump into the full analysis health report here for a deeper understanding of National Bank of Umm Al-Qaiwain (PSC).

- Review our historical performance report to gain insights into National Bank of Umm Al-Qaiwain (PSC)'s track record.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment trust with a market cap of TRY700 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. does not report specific revenue segments.

Market Cap: TRY700M

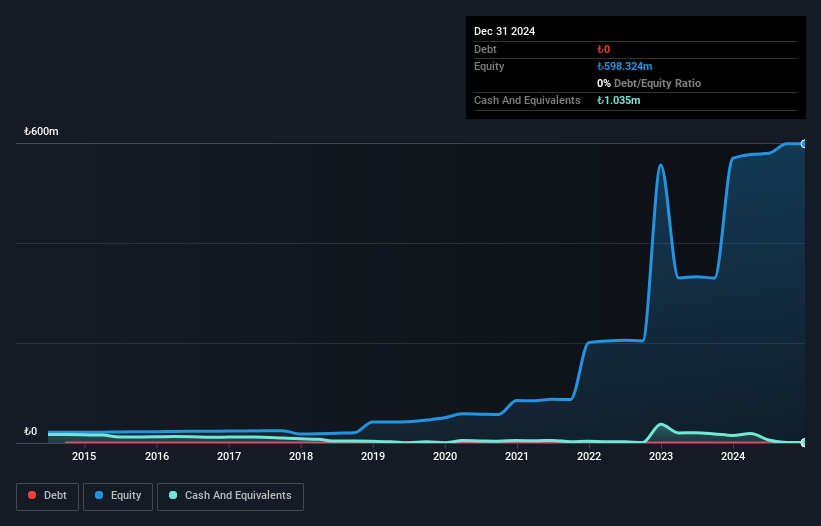

Hub Girisim Sermayesi Yatirim Ortakligi A.S. remains pre-revenue with sales under US$1m, indicating a focus on long-term growth rather than immediate profitability. Despite its unprofitable status, the company benefits from a strong cash position, ensuring more than three years of operational runway without debt concerns. However, its high volatility and increasing losses over the past five years highlight potential risks for investors. Recent financial results show increased net income in Q3 2025 compared to last year but also reveal significant net losses for the nine-month period, reflecting ongoing challenges in achieving sustainable profitability.

- Get an in-depth perspective on Hub Girisim Sermayesi Yatirim Ortakligi's performance by reading our balance sheet health report here.

- Understand Hub Girisim Sermayesi Yatirim Ortakligi's track record by examining our performance history report.

Neft Alsharq For Chemical Industry (SASE:9605)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neft Alsharq For Chemical Industry Company specializes in the manufacturing and sale of industrial motor oils, as well as lithium and calcium greases, with a market cap of SAR70.75 million.

Operations: The company's revenue is primarily derived from the Oil Sales Sector, amounting to SAR74.96 million.

Market Cap: SAR70.75M

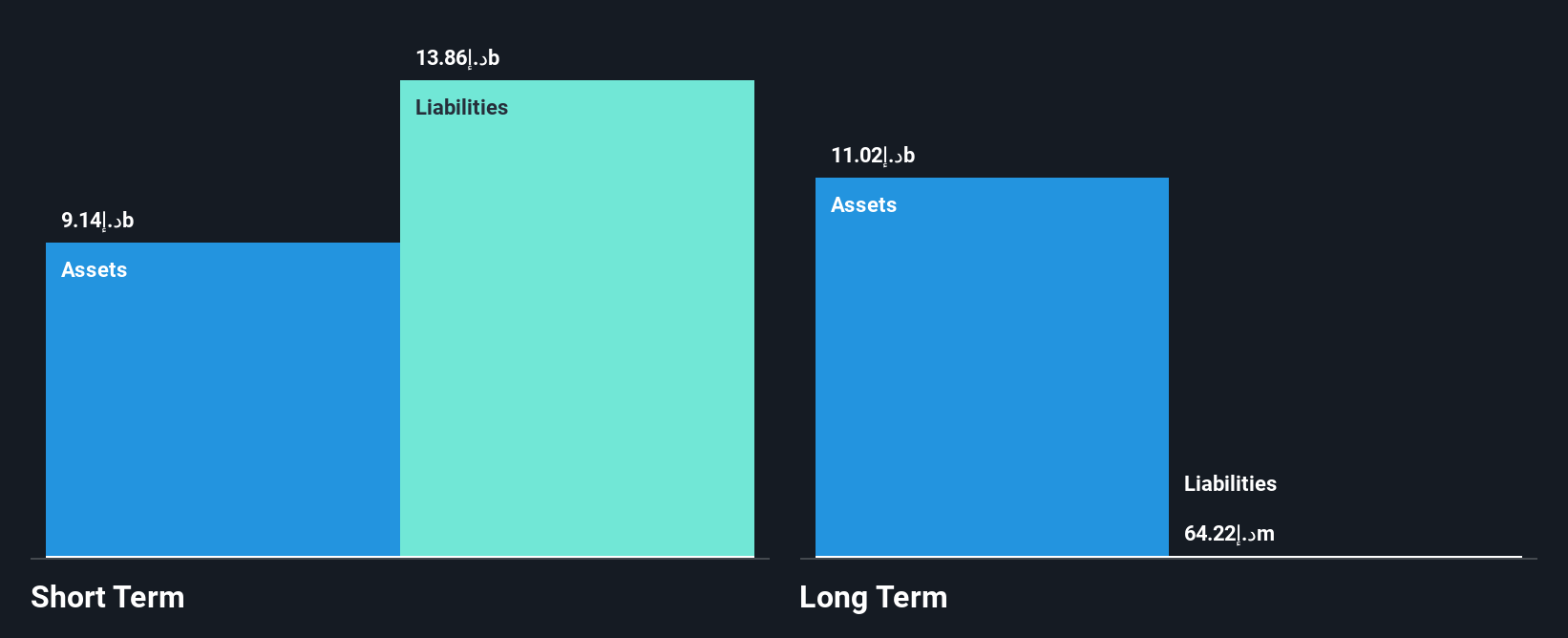

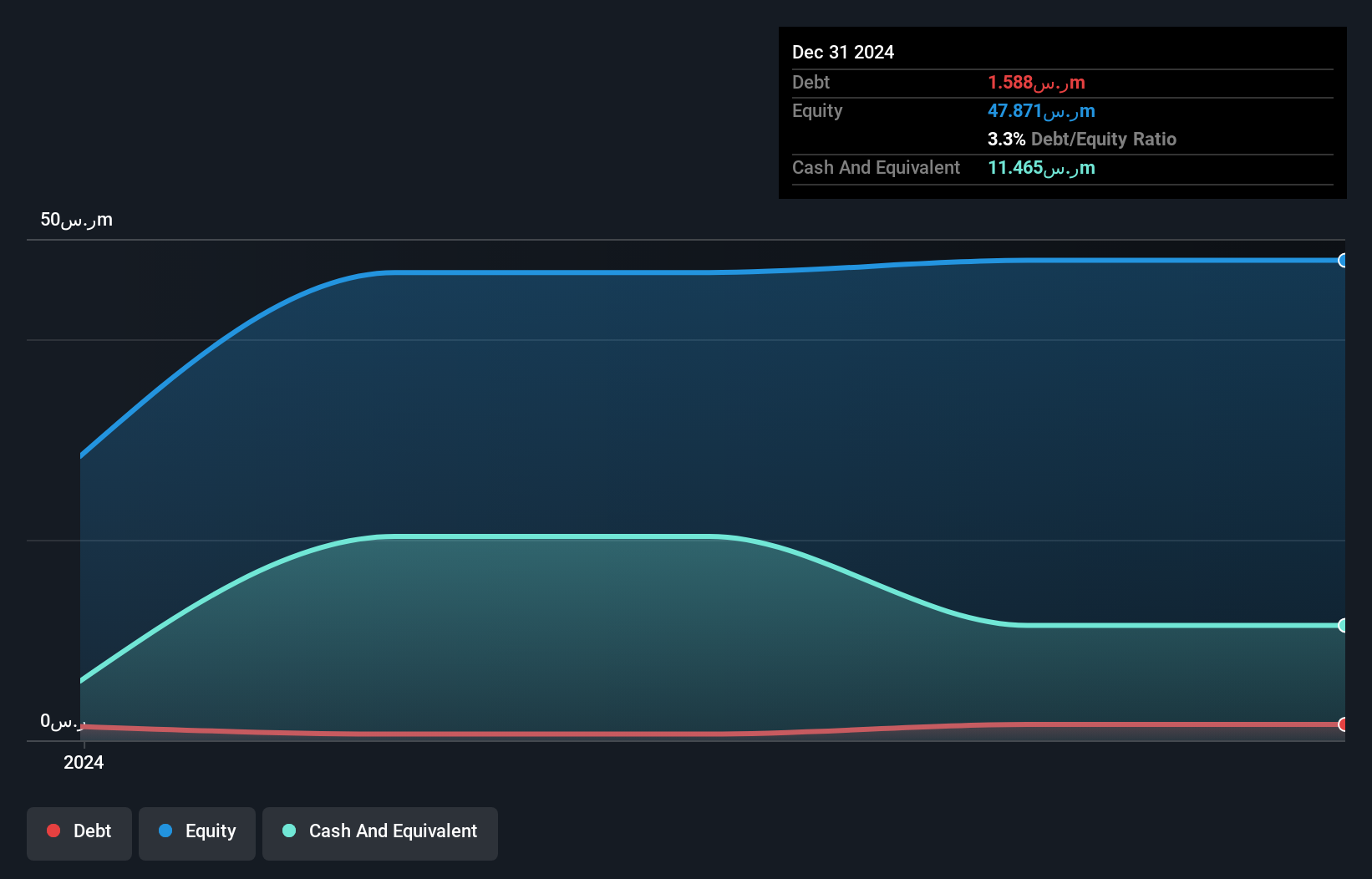

Neft Alsharq For Chemical Industry, with a market cap of SAR70.75 million, focuses on industrial motor oils and greases. It has demonstrated revenue growth of 45.1% over the past year, primarily from oil sales totaling SAR74.96 million. Despite this growth, the company faces challenges such as negative operating cash flow and declining profit margins from 2.5% to 0.5%. Its short-term assets comfortably cover both short- and long-term liabilities, but high volatility persists in its share price movements. The company's net debt to equity ratio is satisfactory at 4.4%, although earnings quality remains low due to significant non-cash components.

- Click to explore a detailed breakdown of our findings in Neft Alsharq For Chemical Industry's financial health report.

- Explore historical data to track Neft Alsharq For Chemical Industry's performance over time in our past results report.

Summing It All Up

- Discover the full array of 82 Middle Eastern Penny Stocks right here.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报