Lucid (LCID) Valuation Check After a Modest Share Price Rebound

Lucid Group (LCID) has quietly bounced about 6% over the past week even as the stock remains deep in the red for the year, a setup that has valuation-focused investors taking another look.

See our latest analysis for Lucid Group.

The recent 6.1% seven day share price return only slightly dents a much steeper year to date slide, signaling that buyers are testing the waters rather than confirming a sustained reversal in sentiment.

If Lucid's move has you rethinking the EV space, it could be a good moment to explore other auto manufacturers that might offer a more balanced mix of growth potential and risk.

With shares still down more than 60 percent this year, despite rapid revenue growth and a sizeable gap to analyst targets, are investors overlooking Lucid's long term potential or rightly assuming the market has already priced in future gains?

Most Popular Narrative Narrative: 35.9% Undervalued

With Lucid Group last closing at $11.81 against a narrative fair value near $18.43, the spread points to a market deeply skeptical of the growth blueprint embedded in that estimate.

The upcoming launch of Lucid's midsized EV platform in late 2026 targets a much broader customer base with lower cost, high volume vehicles, directly expanding Lucid's addressable market and providing operating leverage for stronger top line revenue growth and improved net margins as scale increases. Advancements in powertrain and battery technology, such as the in house Atlas Drive Unit and extended range battery packs, position Lucid as a technology leader, enhancing product differentiation and pricing power, which can drive higher gross margins and earnings through premium offerings.

Want to see how aggressive revenue expansion, margin rebuild, and a premium earnings multiple all fuse into that target price? The full narrative lays out a surprisingly bold financial path that the current share price does not seem to recognize.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative gross margins and Lucid's heavy reliance on fresh capital raise doubts over its ability to reach those ambitious long term targets.

Find out about the key risks to this Lucid Group narrative.

Another Take on Valuation

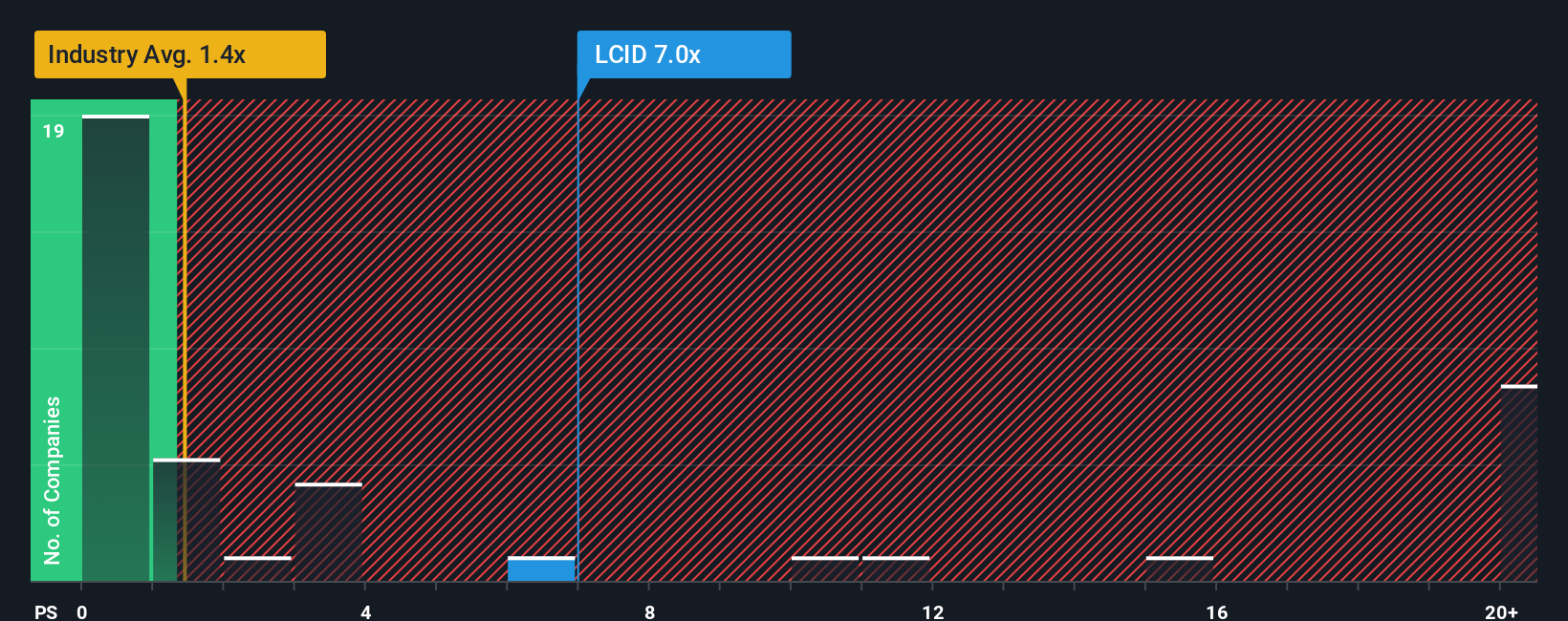

While the narrative fair value suggests Lucid is 35.9 percent undervalued, its 3.6 times price to sales ratio looks stretched against US Auto peers at 0.6 times and an estimated fair ratio near zero. This points to real downside risk if sentiment snaps back to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If you are not fully convinced by this interpretation or prefer to dive into the numbers yourself, you can easily build a custom view in just a few minutes, Do it your way

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next smart opportunity with hand picked stock ideas from Simply Wall Street's powerful screener so you are never caught flat footed again.

- Target steady income growth by reviewing these 10 dividend stocks with yields > 3% that aim to reward shareholders with reliable cash returns.

- Ride the next wave of innovation by backing these 24 AI penny stocks positioned at the forefront of intelligent automation and data driven products.

- Capitalize on potential mispricings by focusing on these 904 undervalued stocks based on cash flows where market expectations may not yet match underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报