Sterling Infrastructure (STRL): Reviewing Valuation After Buyback, Backlog Surge and AI-Fueled Growth Drivers

Sterling Infrastructure (STRL) has jumped back onto investors radar after being named a Zacks Bull of the Day, rolling out a $400 million buyback and reporting a 34% backlog surge tied to AI and reshoring demand.

See our latest analysis for Sterling Infrastructure.

Against that backdrop, Sterling Infrastructure’s share price has cooled a bit in the past month but still boasts an impressive year to date share price return above 80 percent and an extraordinary multi year total shareholder return. This suggests momentum remains firmly constructive as investors re rate its growth runway.

If AI fueled infrastructure demand has your attention, this could be a good moment to explore other names riding similar themes via Simply Wall St’s high growth tech and AI stocks.

With the shares up nearly 90 percent year to date and trading close to analyst targets, investors now face a pivotal question: Is Sterling Infrastructure still mispriced, or is the market already baking in its future growth?

Most Popular Narrative: 30.7% Undervalued

With Sterling Infrastructure last closing at $314 against a narrative fair value of about $453, the spread implies investors are still discounting its long term cash generation potential.

Record-high and growing backlog, particularly in E-Infrastructure Solutions (up 44% year-over-year to $1.2 billion), coupled with a robust pipeline of future phase work approaching $2 billion, provides strong multi-year revenue visibility and stability, mitigating downside risk to revenues and supporting sustained earnings growth.

Curious how a construction name earns a tech like valuation lens? The narrative leans on powerful revenue compounding, firm margins, and a bold future earnings multiple. Want to see which assumptions truly carry this fair value call?

Result: Fair Value of $453.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could crack if mega project awards or data center capital spending slow sharply, which would undermine backlog visibility and earnings momentum.

Find out about the key risks to this Sterling Infrastructure narrative.

Another Lens on Valuation

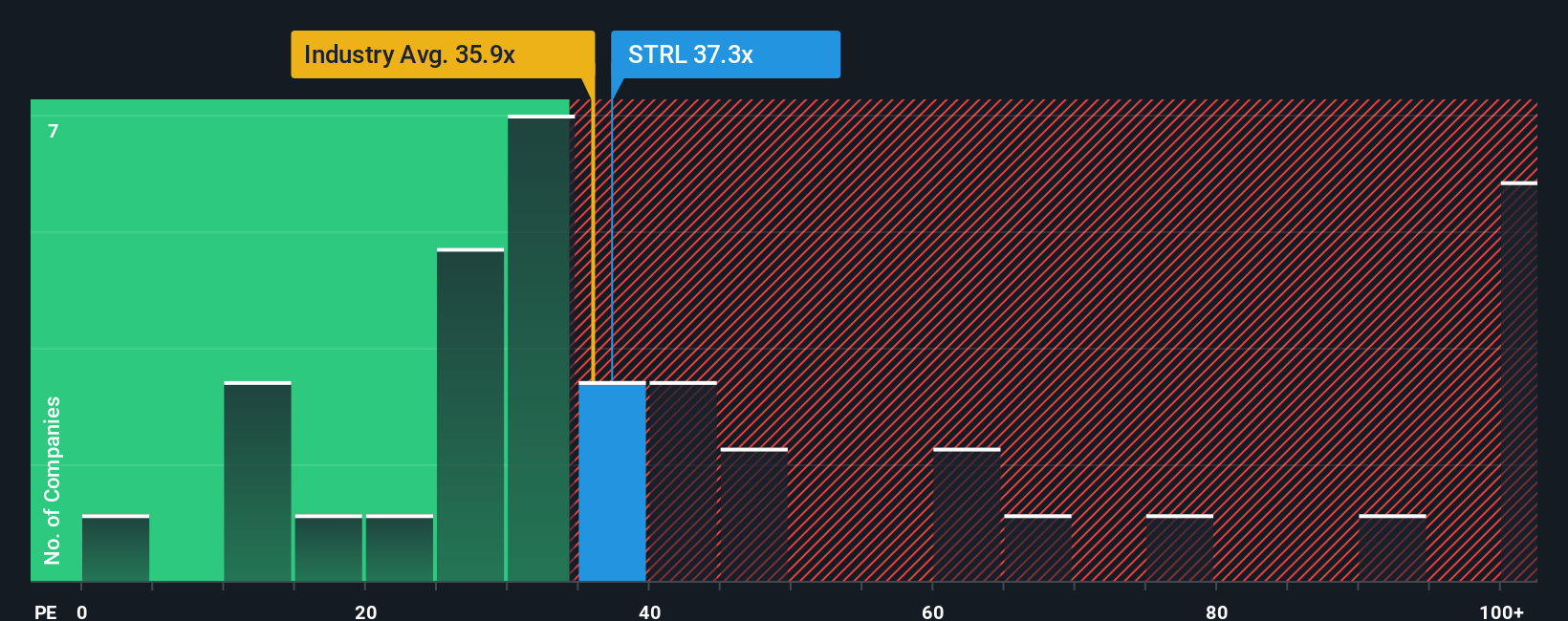

Step back from the narrative pricing and the picture looks less stretched. On earnings, Sterling trades at about 30.5 times, slightly below the US Construction average of 31.7 times and under our fair ratio of 34.8 times. This hints at some upside but also less margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sterling Infrastructure Narrative

If the conclusions here do not quite match your view, dive into the numbers yourself and build a custom story in minutes, Do it your way.

A great starting point for your Sterling Infrastructure research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

- Capture potential mispricings early by scanning these 904 undervalued stocks based on cash flows that may offer cash flow upside before the crowd catches on.

- Explore breakthroughs at the intersection of medicine and machine learning with these 29 healthcare AI stocks helping shape developments in patient outcomes and diagnostics.

- Strengthen your search for opportunities by targeting these 24 AI penny stocks focused on automation, data, and intelligent software.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报