Ipsen (ENXTPA:IPN): Rethinking Valuation After a Year of Steady Share Price Gains

Ipsen (ENXTPA:IPN) has been quietly grinding higher over the past year, and that steady climb is starting to draw more attention from long term investors watching European healthcare names.

See our latest analysis for Ipsen.

The stock has cooled a little in recent weeks, with a softer 1 month share price return, but its 90 day share price gain and double digit 1 year total shareholder return show momentum is still broadly constructive.

If Ipsen has you rethinking your healthcare exposure, this could be a good moment to explore other healthcare stocks that pair defensive earnings with interesting growth angles.

With earnings still growing faster than revenue and the shares trading below analyst targets and some intrinsic estimates, is Ipsen quietly offering a mispriced entry point, or are markets already baking in the next leg of growth?

Most Popular Narrative: 7.7% Undervalued

With Ipsen last closing at €120 and the most widely followed narrative pointing to value closer to €130, the gap hinges on how durable its growth engines really are.

Significant available cash and financial flexibility (€3B firepower, net cash balance) position the company to accelerate external innovation via targeted M&A or licensing, strengthening both pipeline depth and long-term earnings growth potential.

Curious how steady mid single digit growth, rising margins, and a leaner future earnings multiple can still point to upside from here? The full narrative unpacks the revenue mix, embeds detailed profit trajectories, and leans on a discounted cash flow view at a sub 7% discount rate to justify that higher fair value. Want to see which assumptions really do the heavy lifting in that calculation?

Result: Fair Value of €130.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case hinges on Ipsen navigating Somatuline competition and executing late stage pipeline launches without major regulatory or commercial setbacks.

Find out about the key risks to this Ipsen narrative.

Another View: Multiples Signal Less Room For Error

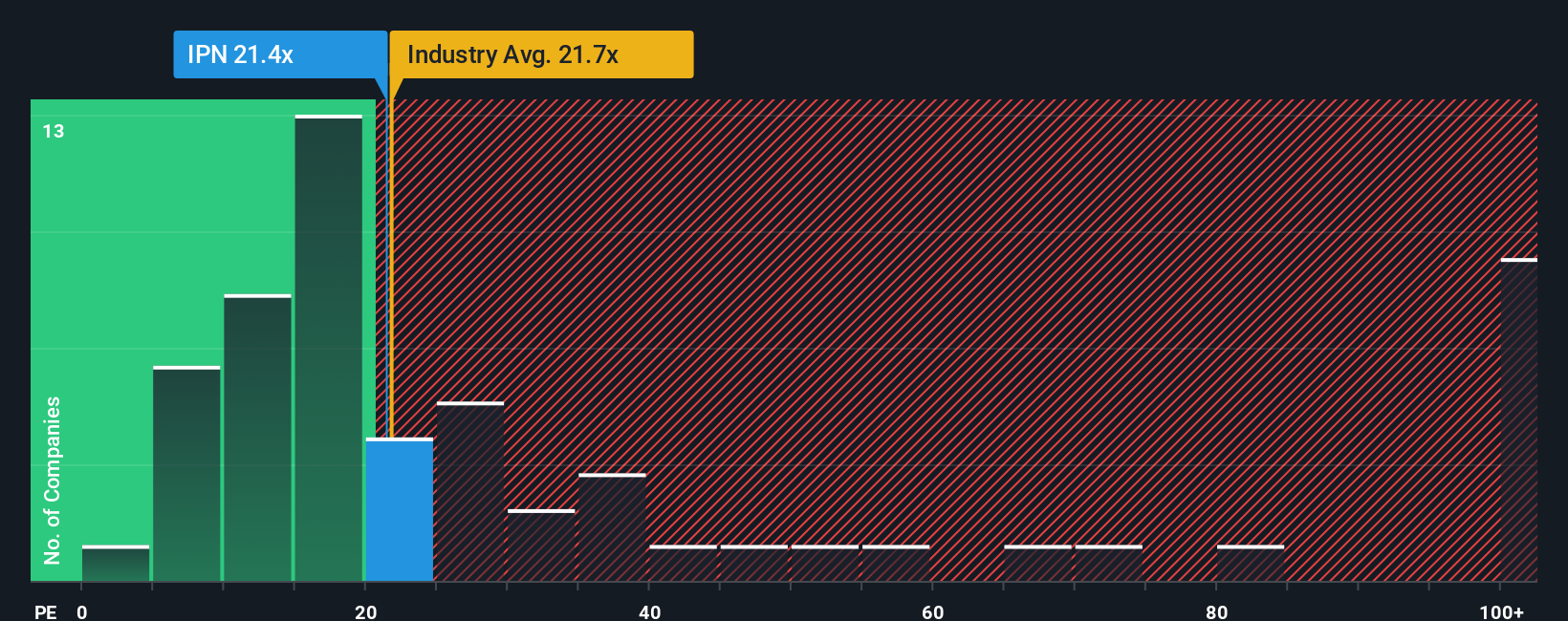

While the narrative and intrinsic work point to Ipsen as undervalued, the market is more cautious. At 22x earnings versus a 17.2x fair ratio and a 20.3x peer average, the current price already bakes in quality and leaves less obvious upside if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ipsen Narrative

If you are not fully convinced by these perspectives, or would rather dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A great starting point for your Ipsen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, put Simply Wall Street to work for you and uncover focused opportunities that could sharpen your portfolio and reveal tomorrow’s standout performers today.

- Capture potential mispricings by targeting companies that screen as compelling value on cash flows with these 904 undervalued stocks based on cash flows.

- Ride structural growth trends in automation and machine learning by zeroing in on companies at the heart of the AI surge through these 24 AI penny stocks.

- Strengthen your income stream while keeping quality in focus by filtering for reliable payers using these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报