CA$1.2 Billion in Industrial Wins Could Be A Game Changer For Bird Construction (TSX:BDT)

- In December 2025, Bird Construction Inc. announced it had secured approximately CA$1.20 billion in new projects and multi-year master service agreements across industrial, oil and gas, and major resource developments in Canada.

- The wins reinforce Bird’s expanding recurring revenue base and highlight how acquisitions and Indigenous partnerships are broadening its self-perform capabilities and sector reach.

- We’ll now examine how this CA$1.20 billion wave of industrial and recurring contracts could reshape Bird Construction’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Bird Construction Investment Narrative Recap

To own Bird Construction, you need to believe its record backlog, growing self perform capability, and rising share of recurring contracts can outweigh project timing swings and sector cyclicality. The new CA$1.20 billion in industrial work and multi year MSAs directly supports the near term catalyst of converting backlog into higher quality revenue, while partly easing the risk that delayed client decisions will drag on organic growth and margins.

The expanded role at Dow’s Path2Zero program ties this announcement back to one of Bird’s most important growth drivers: complex energy and transition related projects that can support margins as recurring industrial work ramps. Together, the new MSAs and capital project wins show how Bird’s acquisition led platform and Indigenous partnerships are helping it secure longer duration work that may soften the impact of project pushouts in more cyclical building segments.

Yet despite these contract wins, investors still need to watch closely how prolonged project deferrals could...

Read the full narrative on Bird Construction (it's free!)

Bird Construction's narrative projects CA$4.6 billion revenue and CA$257.8 million earnings by 2028. This requires 10.6% yearly revenue growth and about a CA$159 million earnings increase from CA$98.4 million today.

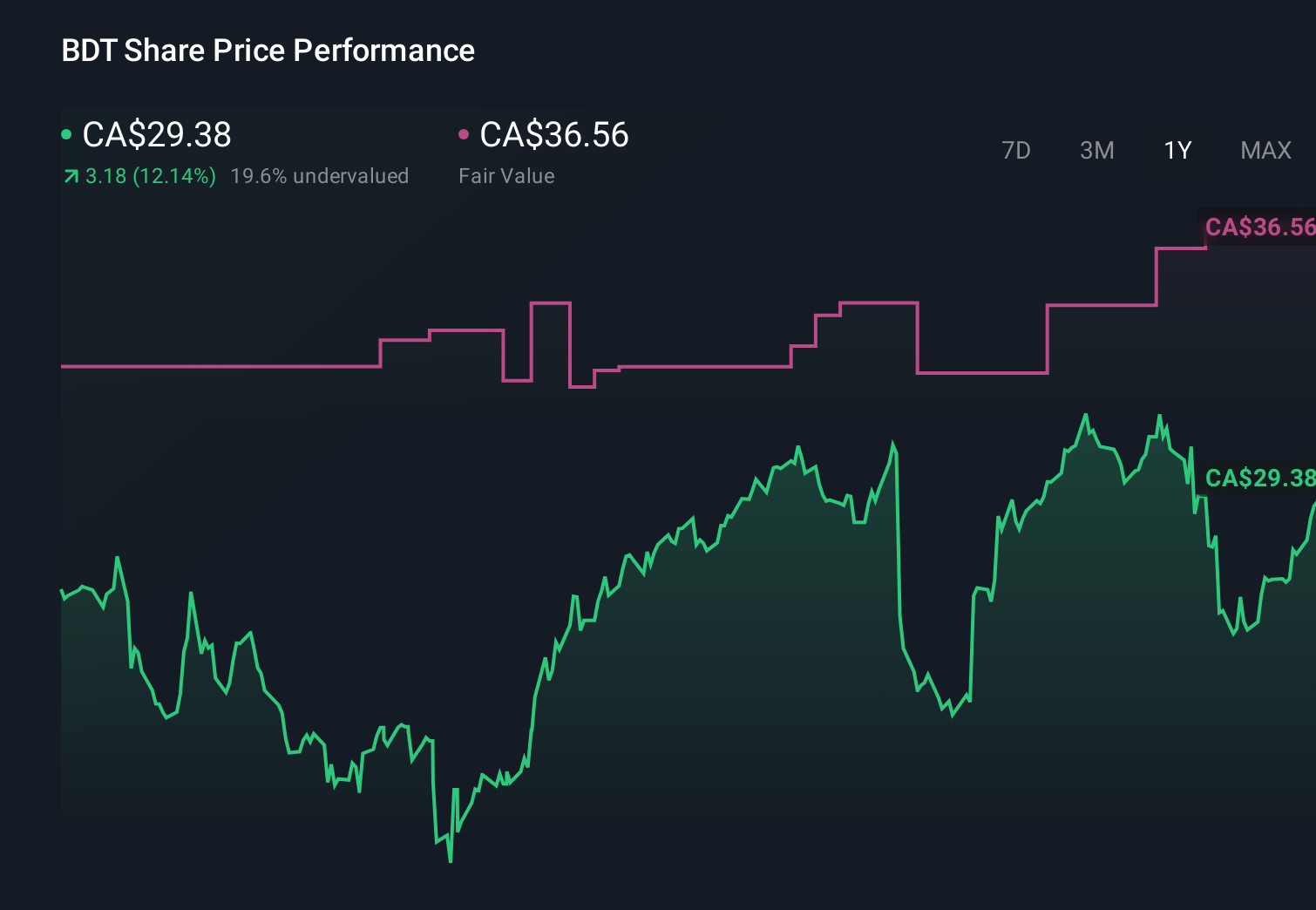

Uncover how Bird Construction's forecasts yield a CA$36.56 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community currently estimate Bird’s fair value between CA$28.60 and CA$91.38, reflecting a wide spread of expectations. Against this, the growing weight of multi year maintenance and facilities contracts in Bird’s backlog could matter a great deal for how reliably those expectations translate into future performance, so it is worth weighing several of these viewpoints side by side.

Explore 14 other fair value estimates on Bird Construction - why the stock might be worth just CA$28.60!

Build Your Own Bird Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bird Construction research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bird Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bird Construction's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报