Stewards (SWRD) Valuation Check After Governance Shake‑Up and Planned Nasdaq Uplisting

Stewards (OTCPK:SWRD) just gave investors a fresh governance catalyst by appointing veteran finance executive John Bode as board member and audit committee chair as the company gears up for a planned Nasdaq uplisting.

See our latest analysis for Stewards.

The governance upgrade is landing just as momentum in Stewards' shares has accelerated, with a 1 day share price return near 20 percent, a roughly 46 percent 1 month share price return, and a powerful year to date share price return above 2,300 percent. This sits alongside a roughly 1,200 percent 1 year total shareholder return that hints investors are rapidly repricing its growth story rather than writing it off as a one off trade.

If this kind of rerating has your attention, it could be worth seeing what else is breaking out. Now is a good time to discover fast growing stocks with high insider ownership.

Yet with Stewards still loss making but trading far above where it started the year, investors now face a tougher question: is this a genuine mispricing that leaves upside on the table, or is the market already baking in years of rapid growth?

Price to Book of 59.6x: Is it justified?

Stewards last closed at $6.88, and its valuation looks stretched when viewed through the lens of its sky high price to book multiple.

The price to book ratio compares a company’s market value to its net asset value, making it a common yardstick for financials like Stewards. At 59.6 times book value, investors are paying a substantial premium over both the US Diversified Financial industry average of 1.5 times and a peer average of around 1 time. This implies the market is pricing in very aggressive expectations for future growth and profitability that have yet to appear in the current numbers.

That gap is hard to ignore, especially given Stewards remains unprofitable, has a negative return on equity, and relies entirely on higher risk external borrowing rather than lower cost customer deposits. When a stock trades dozens of turns above both its sector and peer benchmarks, the multiple suggests the market is already discounting years of strong execution and margin expansion, which can leave limited room for missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 59.6x (OVERVALUED)

However, Stewards remains loss making with negative net income and no visible analyst support, so any growth wobble could quickly challenge the rich valuation.

Find out about the key risks to this Stewards narrative.

Another View Using Our DCF Model

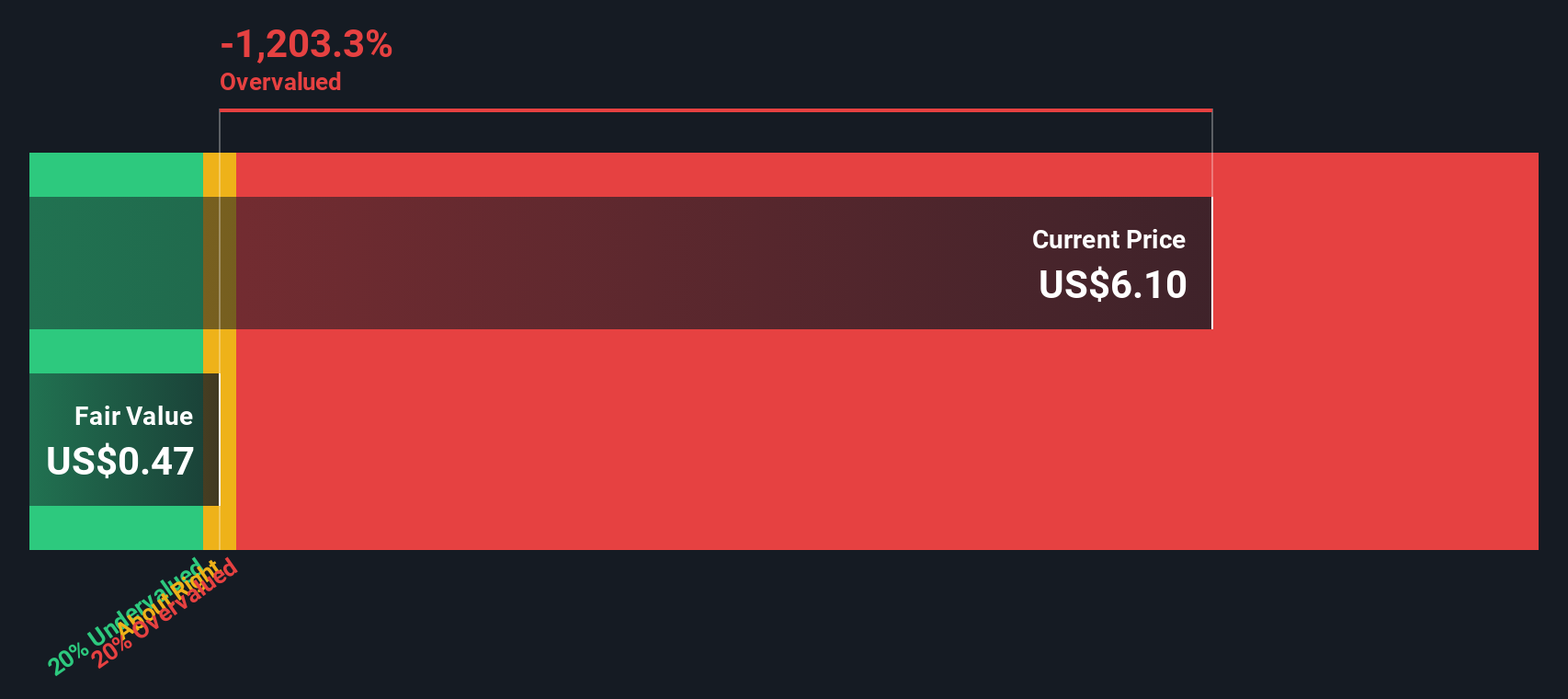

Our DCF model paints an even starker picture than the price to book ratio. It estimates Stewards' fair value at just $0.42 per share, meaning the current $6.88 price screens as sharply overvalued rather than merely punchy. Is the market right to look past the model, or is optimism running ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stewards for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stewards Narrative

If you would rather interrogate the numbers yourself and challenge these assumptions, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Stewards research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Stepping beyond a single stock can sharpen your edge, so use the Simply Wall St Screener now to spot opportunities others will only notice later.

- Capture potential multi baggers early by targeting these 3630 penny stocks with strong financials that already show real financial strength rather than just hype.

- Ride structural growth trends by focusing on these 29 healthcare AI stocks that blend defensiveness with cutting edge innovation in patient care.

- Strengthen your cash flow with these 10 dividend stocks with yields > 3% that offer attractive yields while aiming to keep payouts sustainable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报