Should Paychex’s Upgraded Outlook and AI Push Require Action From Paychex (PAYX) Investors?

- In the past week, Paychex reported fiscal second-quarter 2025 results showing revenue rising to US$1,557.6 million while net income and earnings per share eased modestly year-on-year, and it also completed a US$390.62 million buyback of 2,928,855 shares under its January 2024 authorization.

- Management raised its adjusted earnings outlook for fiscal 2026, pointing to stronger-than-expected contributions from the Paycor acquisition and early benefits from new AI-driven HR and compliance tools, even as some metrics such as revenue per client softened.

- We’ll now examine how Paychex’s upgraded earnings outlook and Paycor integration progress influence the company’s existing investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Paychex Investment Narrative Recap

To own Paychex, you need to believe it can turn the Paycor acquisition and its AI investments into steadier earnings despite softer revenue per client and smaller deal sizes. The upgraded fiscal 2026 EPS outlook supports that thesis near term, while the biggest risk remains execution on Paycor integration and whether underlying organic growth can keep up if small and mid-sized customers stay cautious on HR and benefits spending.

The latest earnings update is central here: Paychex’s fiscal second quarter showed revenue rising to US$1,557.6 million, helped by Paycor, even as net income and EPS declined year-on-year. Management’s decision to repurchase 2,928,855 shares for US$390.62 million under its existing authorization adds another layer for investors tracking how much of the improved earnings outlook is coming from operational progress versus financial engineering.

Yet while guidance is higher, investors should be aware that softer revenue per client and smaller deals could still pressure growth if...

Read the full narrative on Paychex (it's free!)

Paychex’s narrative projects $7.5 billion revenue and $2.3 billion earnings by 2028.

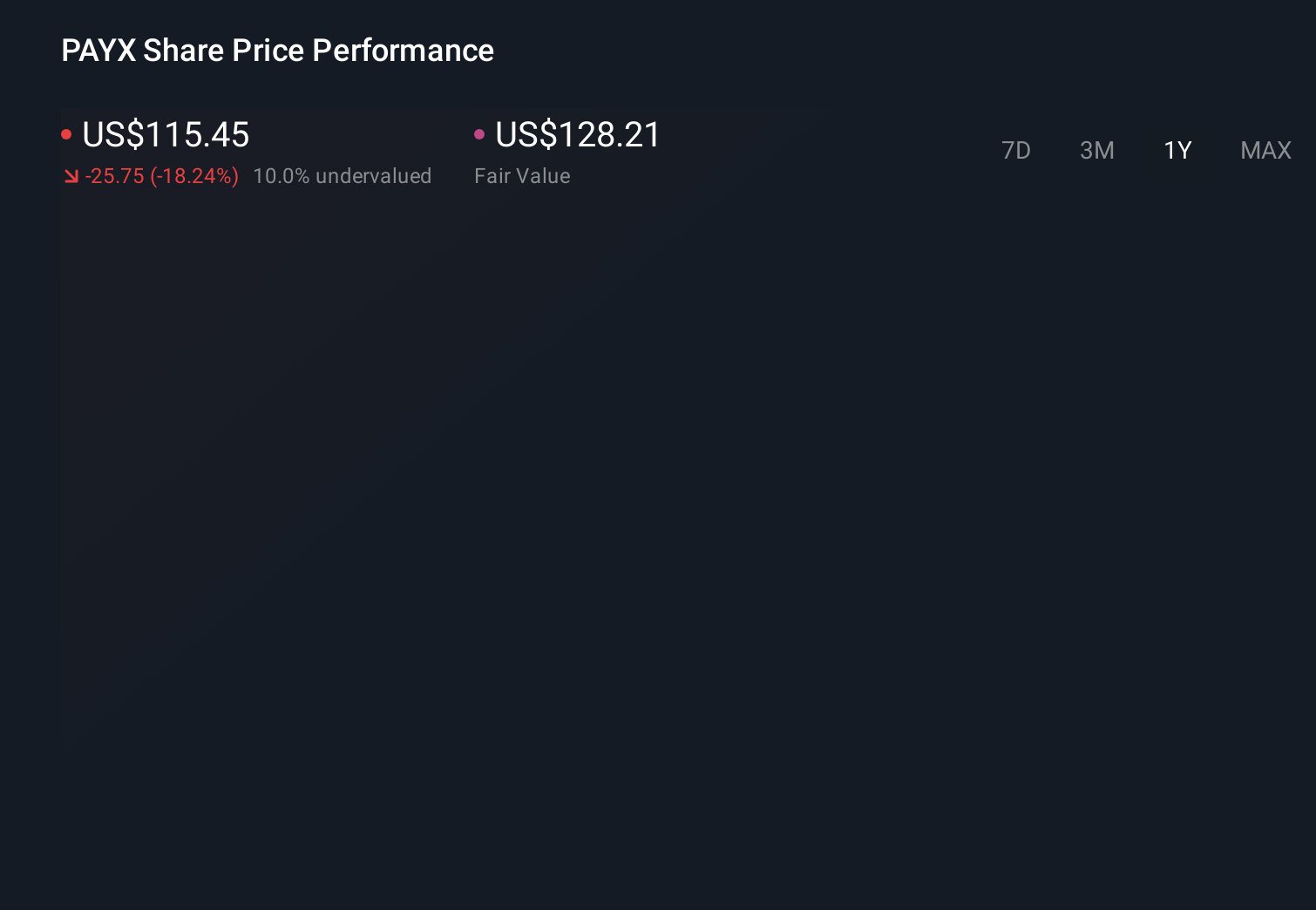

Uncover how Paychex's forecasts yield a $128.21 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members currently value Paychex between US$120 and about US$171 per share, showing a wide spread of expectations. You can weigh those views against the integration risk around Paycor and ask what that might mean for the company’s ability to sustain earnings growth if client spending remains cautious.

Explore 7 other fair value estimates on Paychex - why the stock might be worth as much as 49% more than the current price!

Build Your Own Paychex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paychex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Paychex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paychex's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报