Constellation Brands (STZ): Valuation Check as Wall Street Optimism Meets Softer Growth and Capital Allocation Concerns

Recent trading in Constellation Brands (STZ) has been driven by a clash between optimism and caution, as investors digest upbeat Wall Street expectations alongside softer organic growth and an outlook for declining sales in a tougher demand backdrop.

See our latest analysis for Constellation Brands.

Those crosscurrents help explain why, even with a roughly 6 percent 1 month share price return and recent rebound toward 140.49 dollars, Constellation Brands still shows a deeply negative 1 year total shareholder return, signaling sentiment repair rather than fresh momentum so far.

If this reassessment of Constellation has you rethinking your watchlist, it might be a good time to explore fast growing stocks with high insider ownership as potential next wave candidates.

With the share price lagging its history but still sitting about 22 percent below analyst targets, investors face a tougher question: is Constellation genuinely undervalued here, or is the market already discounting its future growth?

Most Popular Narrative: 17.9% Undervalued

Against a last close of 140.49 dollars, the most followed narrative implies a notably higher fair value, hinging on a powerful medium term earnings reset.

The company plans to generate approximately 9 billion dollars in operating cash flow and 6 billion dollars in free cash flow from fiscal 26 to fiscal 28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.

Curious how modest top line assumptions can still justify a richer future earnings multiple than today? The secret mix: cash generation and margin rebuild. Want the full recipe behind that valuation jump?

Result: Fair Value of $171.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish setup could unravel if beer demand stays soft longer than expected, or if new tariffs and inflation further erode margins.

Find out about the key risks to this Constellation Brands narrative.

Another Angle On Value

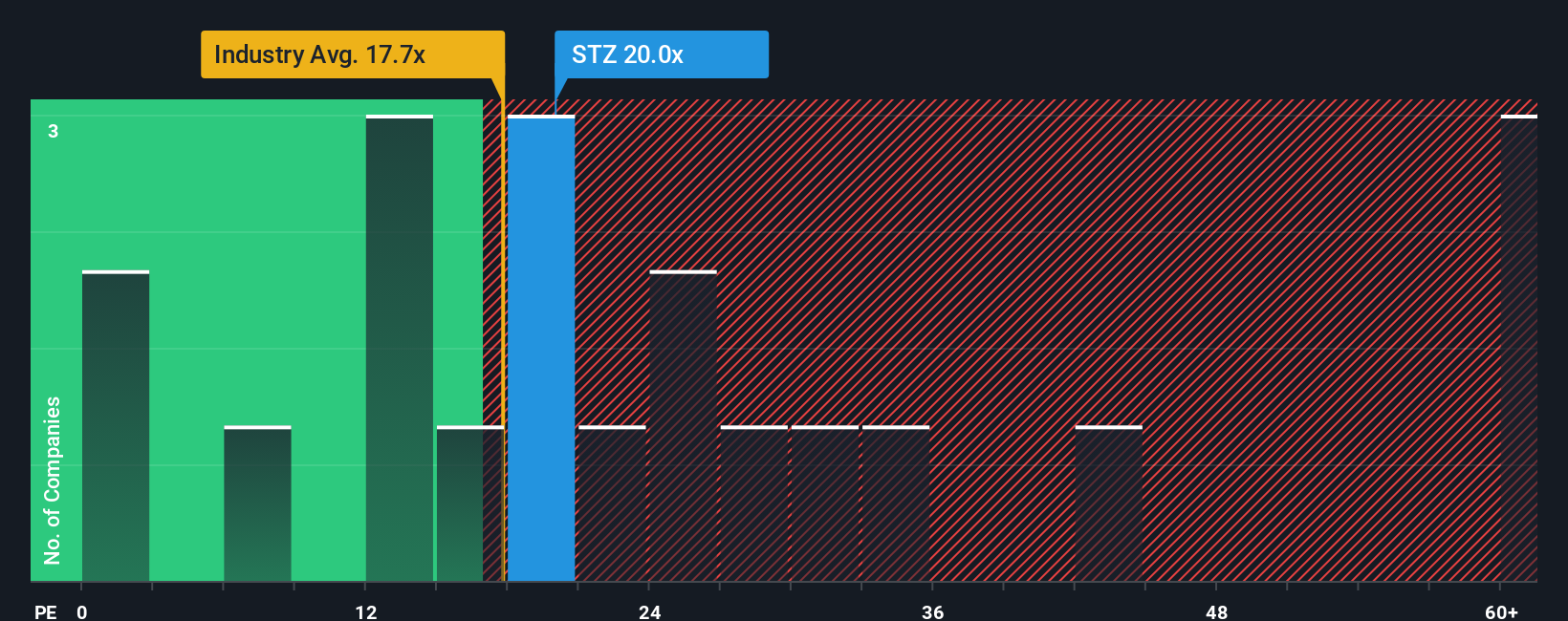

Relative to peers, Constellation trades on a 20 times price to earnings ratio, richer than the global beverage average of 17.6 times and its peer group at 19.3 times, even though our fair ratio suggests 21.8 times. Does paying a premium today really leave enough margin of safety?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Brands Narrative

If you see the story differently or want to stress test every assumption yourself, you can build a full narrative in minutes: Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Constellation Brands when the market offers so many angles. Use the Simply Wall Street Screener to explore additional opportunities.

- Consider growth potential early by reviewing these 3628 penny stocks with strong financials that already show financial strength rather than relying solely on speculative hype.

- Position your portfolio for the future by looking at these 24 AI penny stocks involved in automation, data analytics, and intelligent software.

- Evaluate value opportunities with these 904 undervalued stocks based on cash flows that trade below their cash flow metrics before they attract broader market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报