Archer Aviation (ACHR) Valuation Check After Recent Share Price Recovery

Archer Aviation (ACHR) has been trading sideways after a choppy few months, but the stock’s recent bounce is pulling fresh attention to its long term bet on electric vertical takeoff and landing aircraft.

See our latest analysis for Archer Aviation.

At around $8.13, Archer’s recent share price recovery comes after a volatile stretch where shorter term share price returns have softened even as the three year total shareholder return remains strongly positive. This suggests that optimism is cooling but not broken.

If Archer’s story has you looking at the broader future of flight, it could be worth exploring other aerospace and defense stocks that might benefit from similar long term themes.

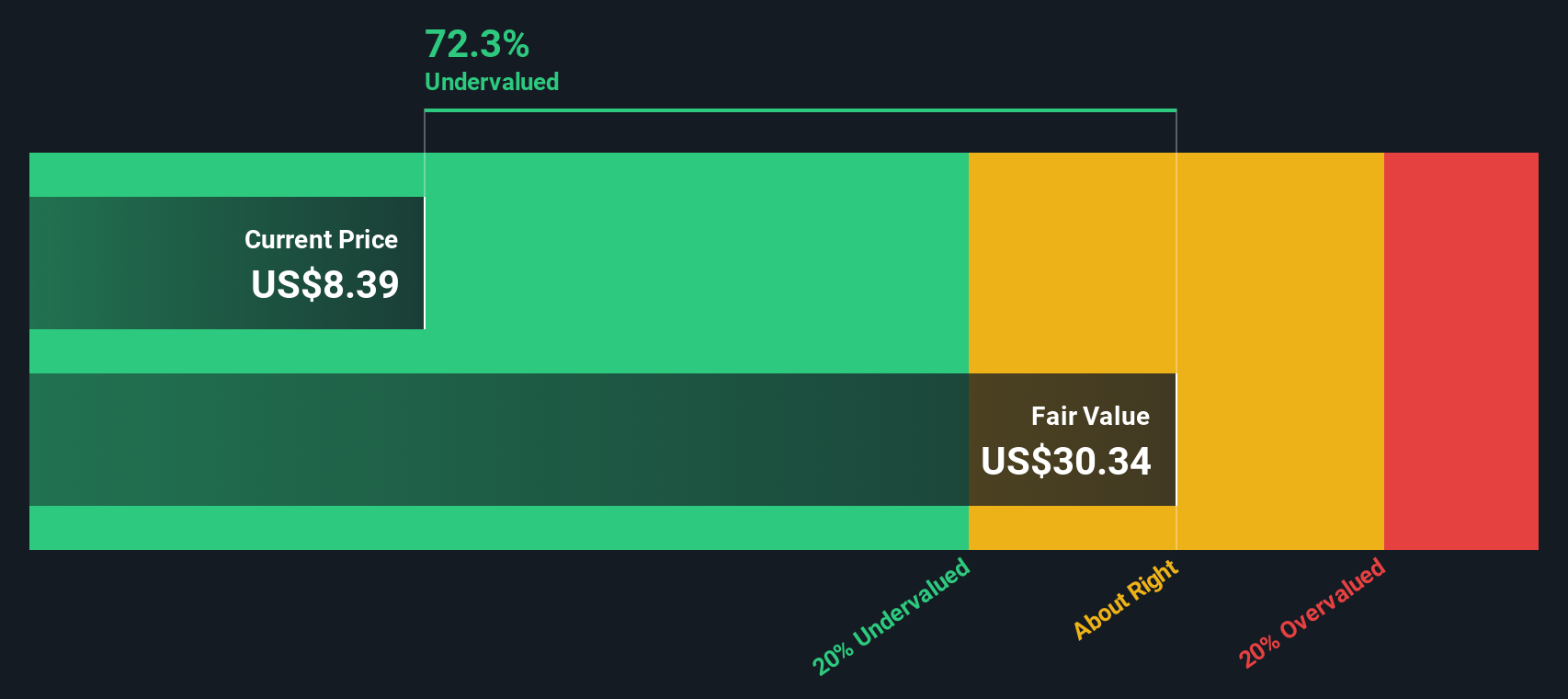

With shares still trading at a steep discount to analyst targets but following a sizable multiyear run, investors now face a key question: Is Archer undervalued at current levels or already pricing in much of its future growth?

Price to Book of 3.6x, Is it Justified?

Archer Aviation trades on a price to book ratio of 3.6 times, a level that screens as modestly cheap versus peers despite the recent share price rebound.

The price to book multiple compares the market value of the company to the accounting value of its net assets. This can be particularly relevant for early stage, asset heavy aerospace businesses where profits are still in the future.

With Archer still unprofitable and generating less than 1 million dollars of revenue, a below peer price to book ratio suggests investors are not paying a premium for its balance sheet or long dated growth story, even though the company is expected to deliver very rapid top line expansion.

Compared to the immediate peer set at 4.1 times and the broader United States Aerospace and Defense industry at 3.8 times, Archer’s 3.6 times multiple implies a small valuation discount that stands out given forecasts for much faster revenue growth than the wider market.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 3.6x (UNDERVALUED)

However, the narrative could unravel if Archer struggles to commercialize eVTOL services, or if regulatory, funding, or technology setbacks delay its growth trajectory.

Find out about the key risks to this Archer Aviation narrative.

Another View, Cash Flows Point to Deeper Value

While the price to book ratio hints at a mild discount, our DCF model paints a far starker picture, suggesting fair value around 21.84 dollars versus the current 8.13 dollars. If both are right, is the market overlooking Archer’s long runway or simply pricing in the execution risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Archer Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Archer Aviation Narrative

If you see the numbers differently and want to stress test your own assumptions, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your Archer Aviation research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with Archer, use the Simply Wall St Screener now to pinpoint fresh opportunities that match your strategy before the market wakes up.

- Capture potential mispricings by targeting companies trading below their intrinsic worth through these 905 undervalued stocks based on cash flows that spotlight strong cash flow cases.

- Ride powerful secular trends by scanning these 24 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence across industries.

- Tap into high risk, high reward territory with these 3628 penny stocks with strong financials that already show solid financial underpinnings instead of pure speculation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报