Roblox (RBLX): Reassessing Valuation After Child-Safety Lawsuits, Regulatory Scrutiny and Rising Platform Investment Costs

Roblox (RBLX) is under the microscope right now, with fresh child safety lawsuits and regulatory scrutiny colliding with heavy spending on AI safety, infrastructure, and creator payouts. That mix is driving the latest slide in the stock.

See our latest analysis for Roblox.

Those headline grabbing lawsuits and the Russia related restrictions are landing just as Roblox leans into new partnerships like its Universal Music Group deal, and the tension is showing up in the numbers. A roughly 38% 3 month share price return drop contrasts sharply with a still strong 3 year total shareholder return of about 213%, suggesting long term believers have been rewarded even as near term momentum fades.

If Roblox's volatility has you rethinking concentration risk, it might be a good moment to explore other high growth tech and AI names via high growth tech and AI stocks.

With Roblox still growing bookings and trading at roughly a 30% plus discount to some analyst targets, investors now face a tougher question: is this a mispriced platform leader, or is the market already discounting future growth?

Most Popular Narrative: 43.8% Undervalued

At a last close of $81.88 against a most popular narrative fair value near $145.63, Roblox is framed as a deeply discounted growth story built on aggressive expansion and future monetization.

The evolving digital economy on Roblox, including expanded monetization opportunities like digital goods, Rewarded Video ads, and a systematized IP licensing marketplace, is expected to unlock new high margin revenue streams and enhance net margins as adoption matures.

Want to see how rapid revenue expansion, a sharp margin swing, and a towering future earnings multiple combine into that fair value? The narrative lays out a bold, numbers driven path that links user growth, new ad formats, and scaling creator payouts into one ambitious valuation roadmap. Curious which specific financial levers have to fire in sync to justify that gap?

Result: Fair Value of $145.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting infrastructure and safety costs alongside heavy creator payouts could squeeze margins if viral hits fade, challenging the high-growth, high-multiple narrative.

Find out about the key risks to this Roblox narrative.

Another Angle on Valuation

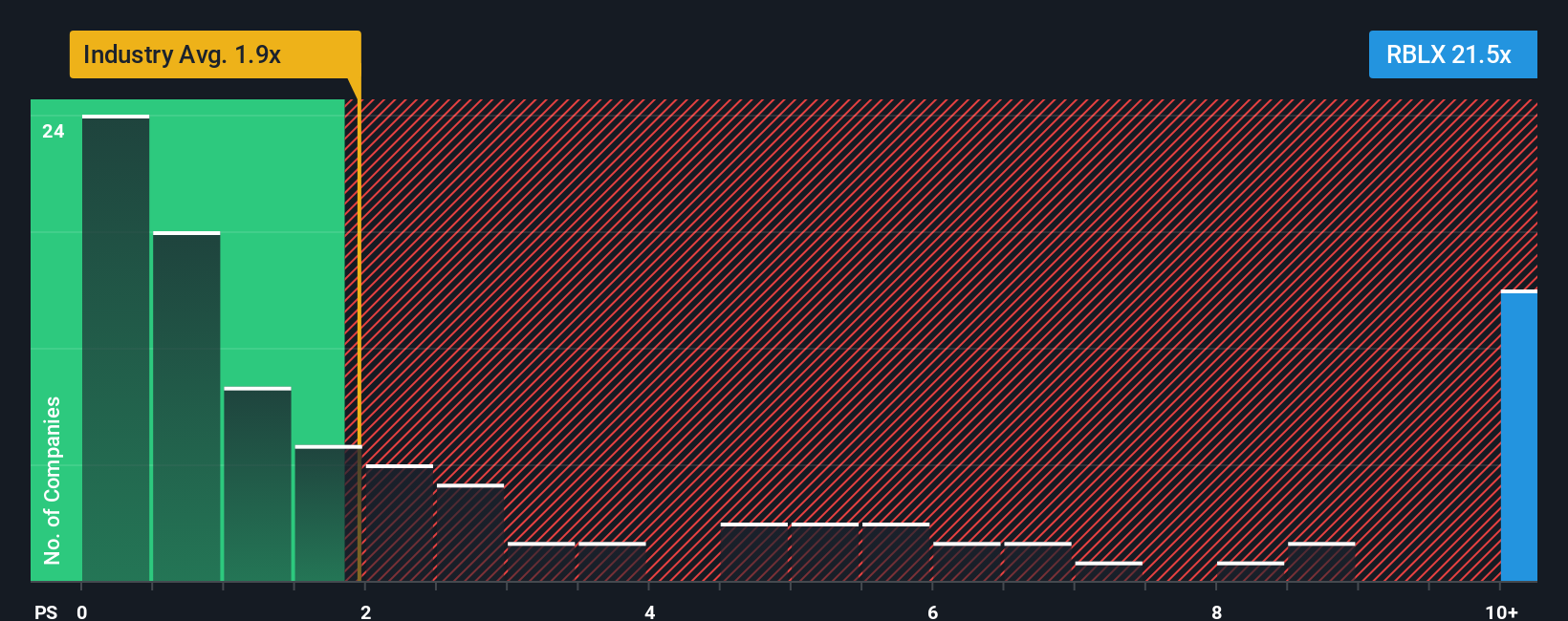

Roblox may look undervalued against its narrative fair value, but its 12.9x price to sales ratio is steep versus the US Entertainment industry at 1.3x and an estimated fair ratio of 4.9x. That premium signals real execution risk, so are investors paying too far ahead of the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roblox Narrative

If this view does not quite fit your thesis, or you would rather dig into the numbers yourself, you can build a full narrative in just a few minutes: Do it your way.

A great starting point for your Roblox research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a shortlist of fresh opportunities using the Simply Wall Street Screener, so you are not relying on Roblox alone.

- Capture potential mispricings by reviewing these 905 undervalued stocks based on cash flows that may offer stronger upside based on discounted cash flow and fundamentals.

- Supercharge your growth watchlist by scanning these 24 AI penny stocks positioned at the intersection of innovation, automation, and scalable software economics.

- Strengthen your income strategy by targeting these 10 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报