Is It Too Late To Consider Expeditors After Its Strong Multi Year Share Price Rally?

- If you are wondering whether Expeditors International of Washington is still worth considering after its big run, or if the easy money has already been made, this breakdown is designed to help you decide with less guesswork.

- The stock has climbed 1.2% over the last week, 5.1% over the past month, and is now up 37.8% year to date and 38.0% over the last year, building on gains of 50.8% over 3 years and 69.7% over 5 years.

- Recent attention around global trade routes, freight demand stability, and ongoing efforts by logistics players to optimize supply chains has kept Expeditors in the conversation, especially as investors reassess which companies can sustain margins if shipping volumes normalize. At the same time, sector wide debates over how much of the pandemic era strength was structural rather than temporary have added nuance to how the market prices logistics stocks like Expeditors.

- Despite that track record, Expeditors currently scores just 0/6 on our valuation checks. Next, we will unpack what different valuation approaches say about the stock today, and then look at a more holistic way to think about its worth beyond the headline multiples.

Expeditors International of Washington scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Expeditors International of Washington Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting those back to the present. For Expeditors International of Washington, the model uses a 2 stage Free Cash Flow to Equity framework based on cash flow projections in $.

The company generated trailing twelve month free cash flow of about $924 million, providing a solid base for the analysis. Analysts supply detailed forecasts only for the next few years, so cash flows out to 2035, which range from roughly $778 million in 2026 to about $1.14 billion by 2035, are extrapolated by Simply Wall St using modest growth assumptions.

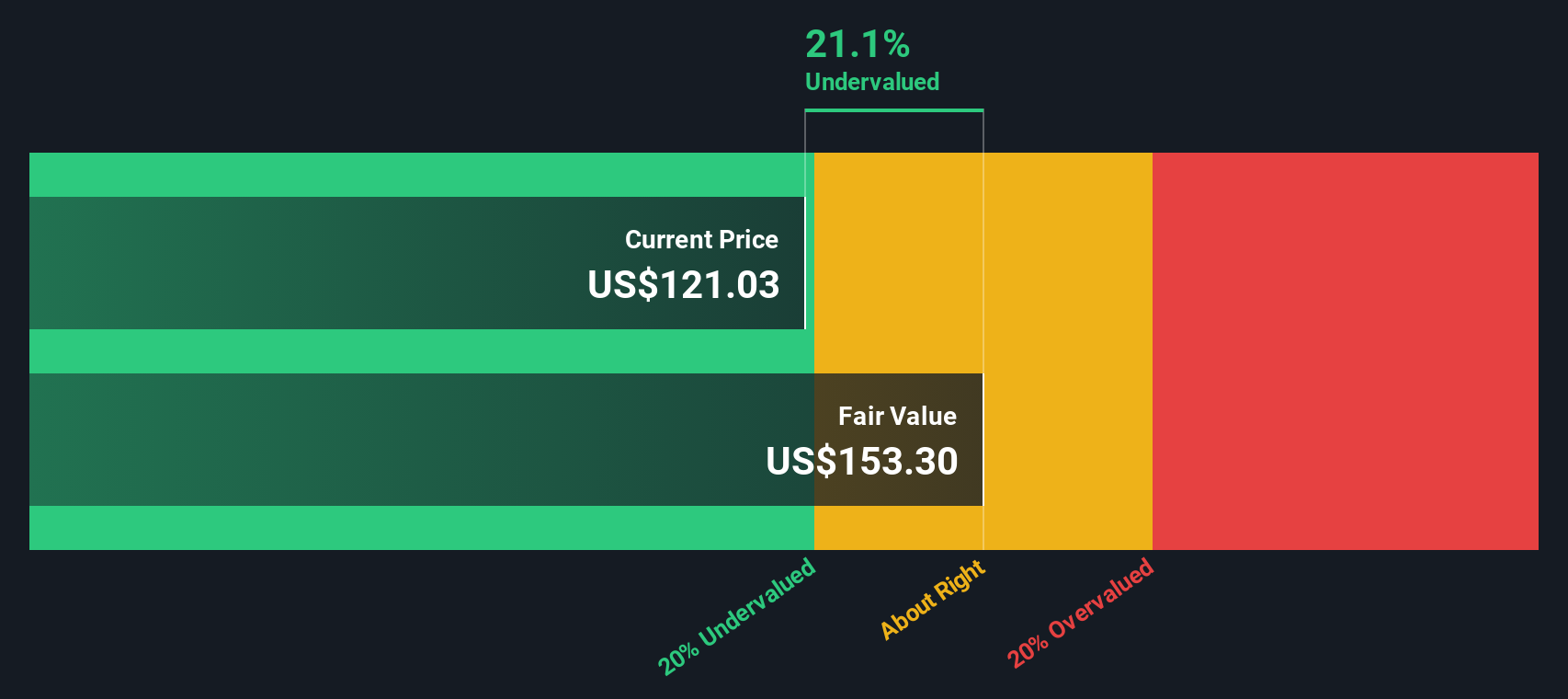

When these future cash flows are discounted back to today, the model arrives at an intrinsic value estimate of $144.27 per share. Compared with the current share price, this implies the stock is roughly 5.0% overvalued, which sits within a reasonable margin of error for valuation models.

Result: ABOUT RIGHT

Expeditors International of Washington is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Expeditors International of Washington Price vs Earnings

For profitable, mature businesses like Expeditors, the Price to Earnings ratio is a practical way to assess value because it directly links what investors pay for each share to the profits the company is generating today.

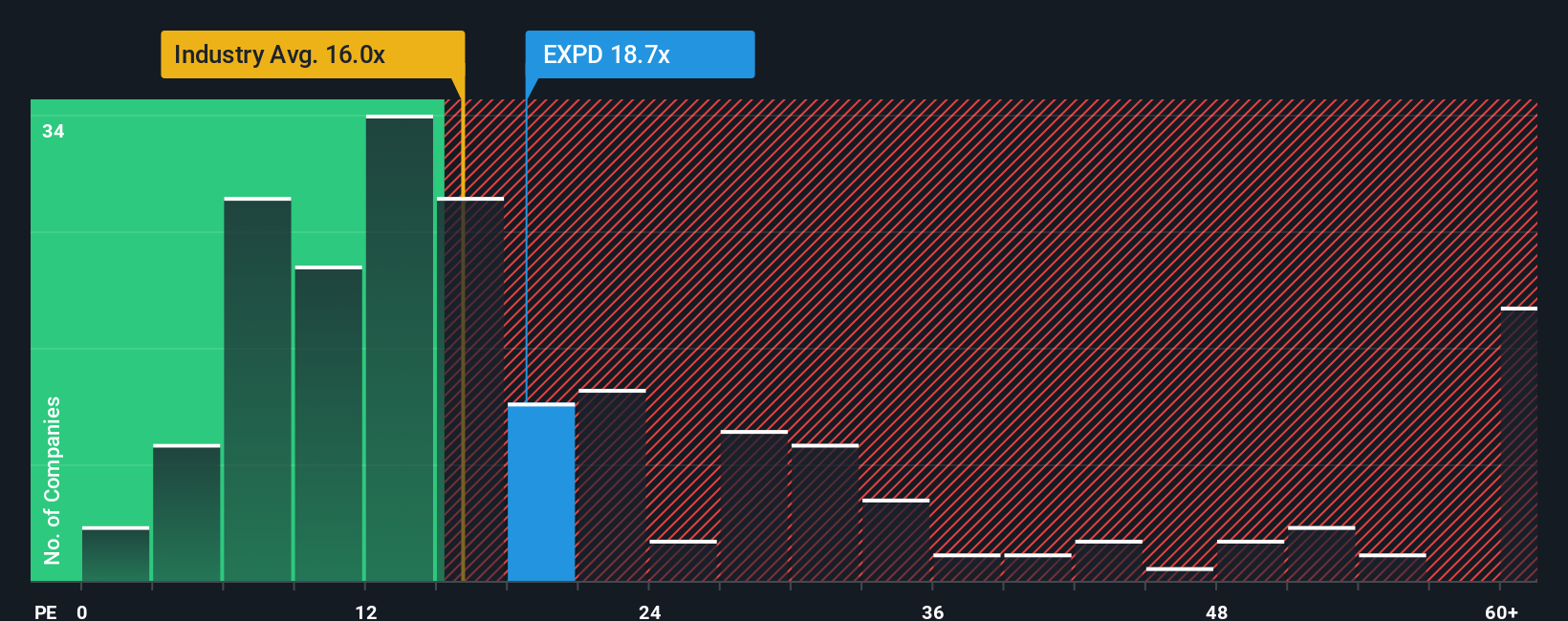

In general, faster earnings growth and lower risk justify a higher PE ratio, while slower growth or greater uncertainty point to a lower, more conservative multiple. Expeditors currently trades at about 24.0x earnings, a premium to both the Logistics industry average of roughly 15.9x and the broader peer group average of around 19.3x, which implies that the market is already assigning it a quality and growth premium.

Simply Wall St’s Fair Ratio framework refines this further. It estimates what PE multiple a company should trade on, given its growth profile, profitability, risk factors, industry and market cap. For Expeditors, that Fair Ratio comes out at about 13.9x, noticeably below the current 24.0x. Because the Fair Ratio adjusts for fundamentals rather than relying only on blunt peer or industry comparisons, it offers a more tailored view of value. On that basis the shares look meaningfully expensive.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Expeditors International of Washington Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers by combining your view of a company with assumptions about its future revenue, earnings and margins to arrive at your own fair value. A Narrative links what you believe about Expeditors International of Washington, such as how trade routes, pricing power or cost control evolve, to a financial forecast, and then to a fair value that you can easily compare with today’s share price to decide whether it looks like a buy, a hold or a sell. Narratives are available on Simply Wall St’s Community page, where millions of investors create and share their views, and each Narrative automatically updates as new information like earnings reports or major news is released. For example, one Expeditors Narrative might assume conservative growth and lower margins while another expects stronger trade volumes and improving profitability, leading to very different fair values and therefore very different conclusions about what to do with the stock today.

Do you think there's more to the story for Expeditors International of Washington? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报