Assessing Nasdaq’s (NDAQ) Valuation After Its Recent Share Price Strength

Recent Performance Puts Nasdaq in Focus

Nasdaq (NDAQ) has been quietly climbing, with the stock up about 12% over the past month and 27% year to date, drawing fresh attention to how its evolving, tech-driven model is being valued.

See our latest analysis for Nasdaq.

With the share price now around $98.64, supported by a strong year to date share price return and robust multi year total shareholder returns, momentum looks to be building as investors increasingly back Nasdaq’s tech heavy, recurring revenue story.

If Nasdaq’s run has you rethinking where growth and innovation might come from next, it could be worth scanning high growth tech and AI stocks for other tech driven opportunities.

With shares near record highs, a modest premium to analyst targets, and rich multi year returns already banked, the key question now is simple: is Nasdaq still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 4.4% Undervalued

With Nasdaq closing at $98.64 against a narrative fair value near $103.13, the story suggests modest upside still exists at today’s levels.

The enhanced partnership with AWS is expected to modernize Nasdaq's market infrastructure across its financial services clientele, driving operational efficiencies, improving scalability, and potentially increasing market share, positively impacting net margins and future revenue growth.

Curious how a shrinking top line, rising margins, and an above industry earnings multiple can still add up to upside potential? The narrative connects those moving parts in a way that might surprise you. Want to see which assumptions do the heavy lifting in that fair value math? Read on.

Result: Fair Value of $103.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing deal decisions in Financial Technology and challenges integrating acquisitions like Adenza could derail the margin expansion and earnings trajectory on which this narrative relies.

Find out about the key risks to this Nasdaq narrative.

Another Angle on Valuation

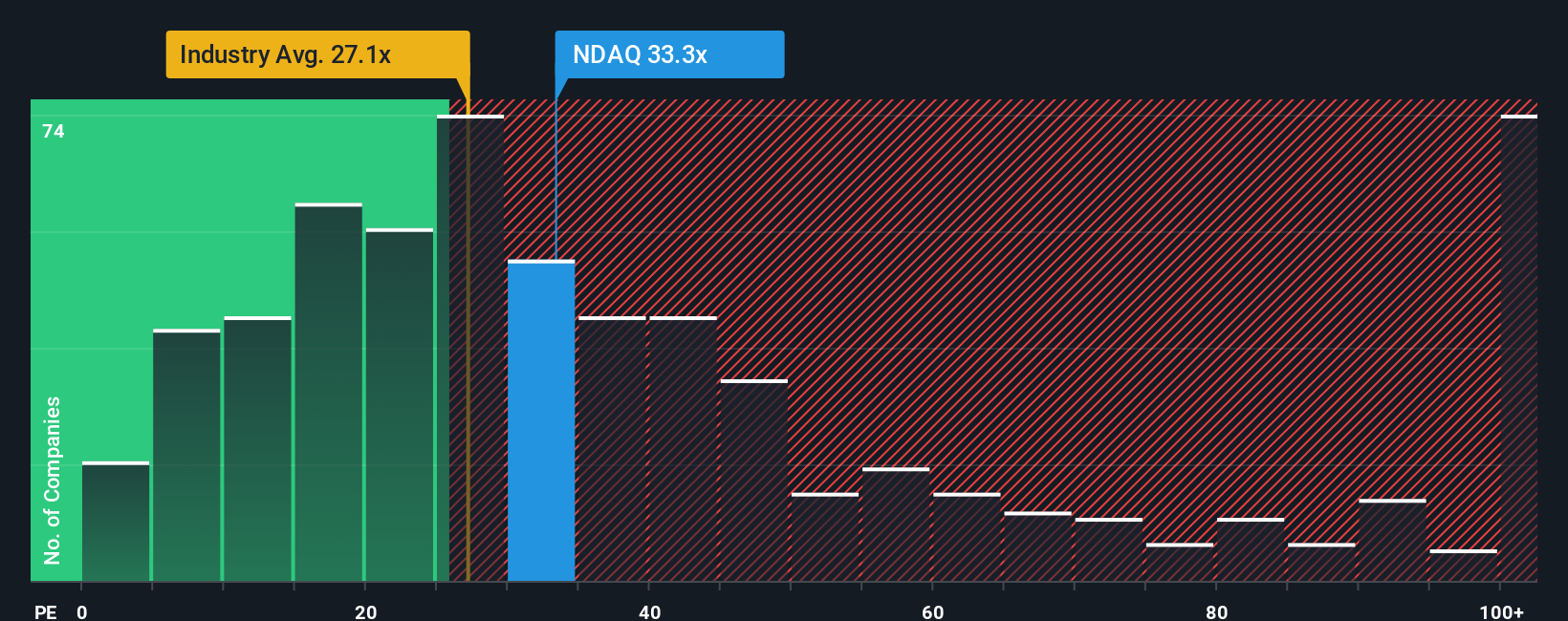

Step back from the narrative fair value, and Nasdaq looks pricey on earnings. It trades at about 34.7 times profits, versus 25.6 times for the US Capital Markets industry, 33.3 times for peers, and a fair ratio of just 16.1 times. Is investors’ optimism getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nasdaq Narrative

If this perspective does not quite match your own, or you prefer hands on work with the numbers, you can craft a fresh view in just a few minutes, Do it your way.

A great starting point for your Nasdaq research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Nasdaq might not be the only opportunity on your radar, and if you stop here you could easily miss stocks with even stronger upside potential.

- Capture potential mispricings by scanning these 905 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations before the wider market catches on.

- Ride the next wave of innovation by targeting these 24 AI penny stocks positioned at the intersection of software, automation, and intelligent data.

- Strengthen your income stream by evaluating these 10 dividend stocks with yields > 3% that offer reliable payouts alongside sustainable business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报