Is Tesla’s Valuation Still Justified After Its Recent AI and Autonomy Driven Rally?

- If you are wondering whether Tesla is still a buy at today’s price, you are not alone. This article is going to walk through what the numbers say about its current valuation.

- Over the last month the stock has climbed 16.2%, adding to a 28.0% gain year to date and a 330.7% return over three years. This naturally raises questions about how much upside is really left.

- Recent headlines have focused on Tesla’s push to deepen its AI and autonomous driving capabilities, regulatory approvals for Full Self Driving in new regions, and continued expansion of its global manufacturing footprint. All of these factors shape how investors think about its long term growth runway. At the same time, ongoing debates around EV demand, competition from Chinese automakers, and policy uncertainty in key markets have injected more volatility into how the market prices that growth.

- Despite all of this, Tesla currently scores just 0/6 on our valuation checks, suggesting that by our standard metrics it does not screen as undervalued right now. In the sections that follow we will unpack the main valuation approaches that investors typically use, and then finish with a more holistic way to think about what the stock might really be worth.

Tesla scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Tesla Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it could generate in the future and then discounting those cash flows back to today in dollar terms.

For Tesla, the model uses a 2 Stage Free Cash Flow to Equity approach. The company generated roughly $6.4 billion in free cash flow over the last twelve months, and analysts, plus Simply Wall St extrapolations, see this rising sharply over time. By 2029, projected free cash flow reaches about $20.9 billion, with longer term estimates climbing above $50 billion by 2035 as the business scales.

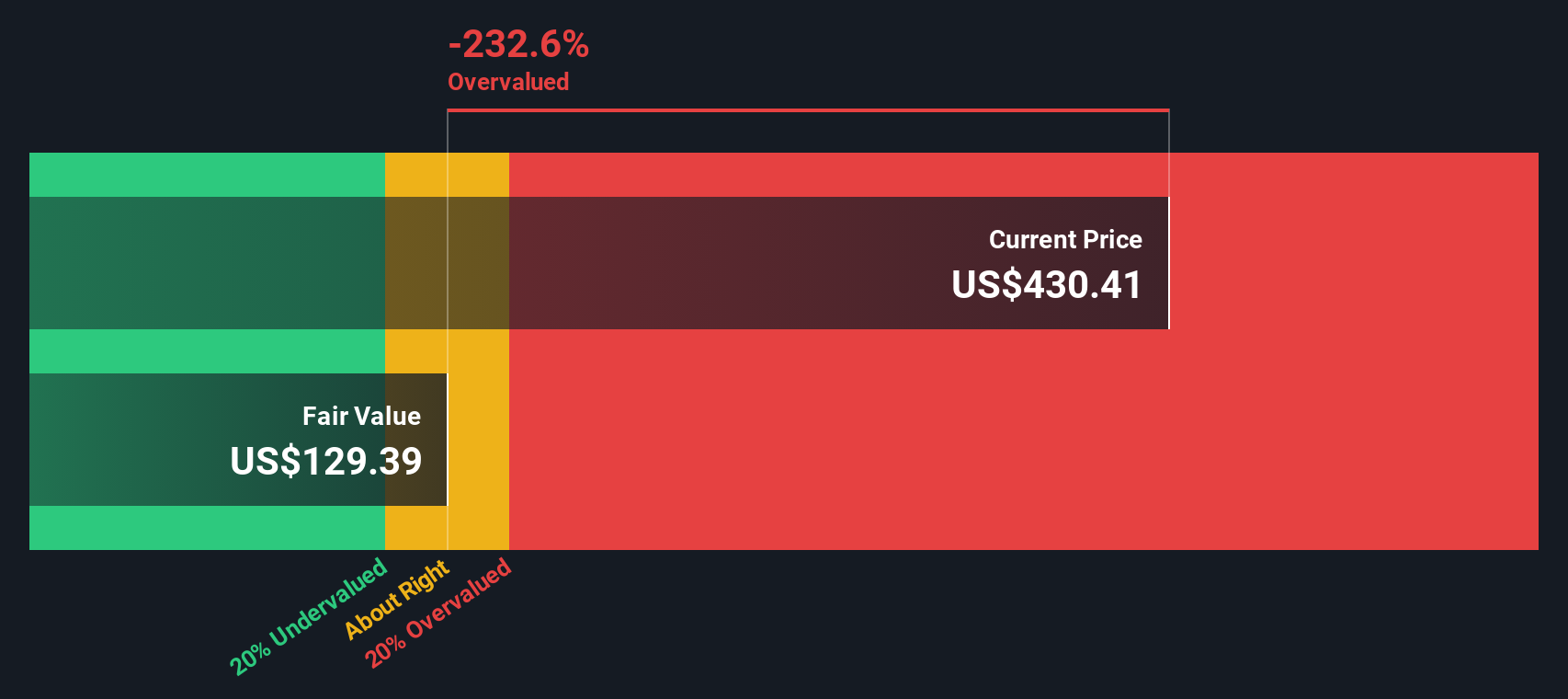

When all those forecast cash flows are discounted back to today, the model arrives at an intrinsic value of about $137.49 per share. Compared with the current market price, this implies the stock is about 253.1% above its DCF based fair value, suggesting Tesla screens as significantly overvalued on this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Tesla may be overvalued by 253.1%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

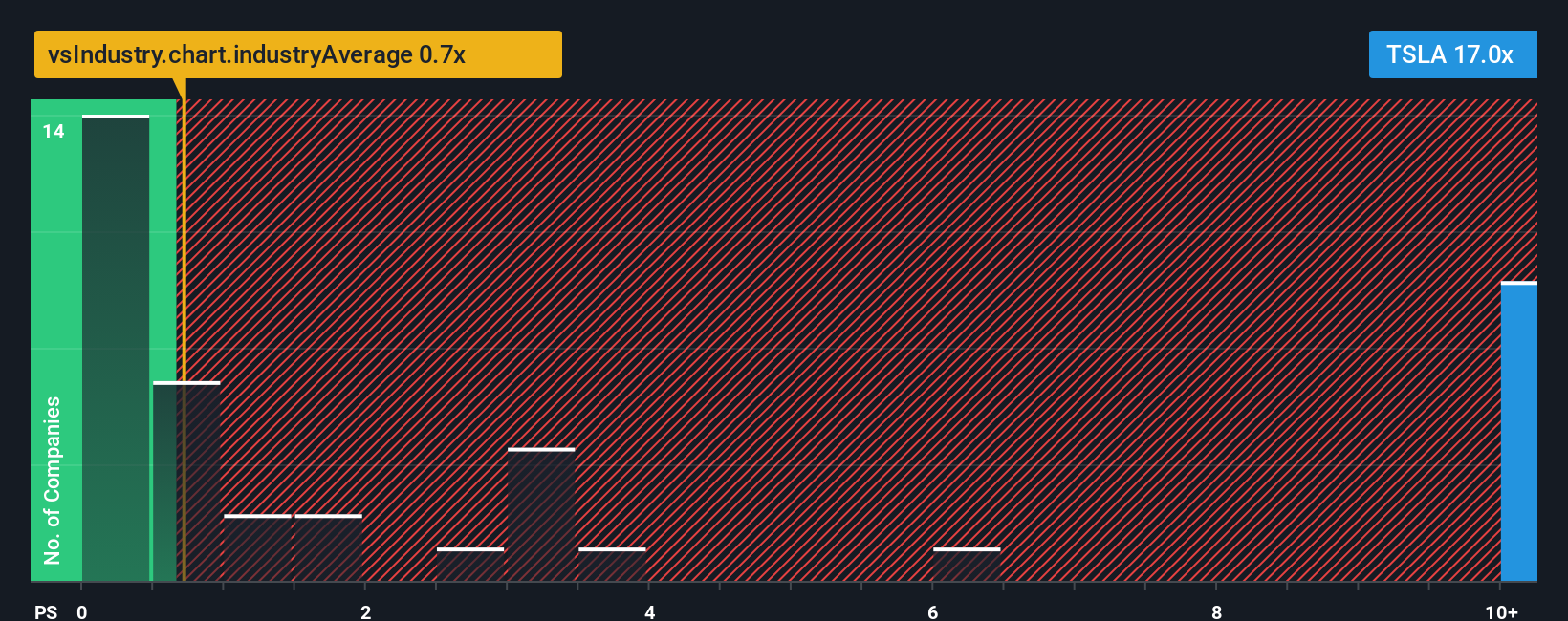

Approach 2: Tesla Price vs Sales

For profitable and growing companies like Tesla, price to sales is a useful cross check on valuation because it focuses on how much investors are paying for each dollar of revenue the business generates. Higher growth and higher perceived quality usually justify a higher multiple, while more cyclical or slower growing companies tend to trade on lower ratios.

Tesla currently trades on a price to sales multiple of 16.88x. That is dramatically above the broader Auto industry average of around 0.60x, and also well ahead of the peer group average of about 1.61x. At first glance this gap suggests the market is assigning Tesla a very large growth and quality premium compared with traditional automakers and even higher growth peers.

To refine this comparison, Simply Wall St uses a Fair Ratio, which is the price to sales multiple we would expect for Tesla after factoring in its growth outlook, profitability, risks, industry and market cap. For Tesla, this Fair Ratio is 2.85x, well below the current 16.88x. Because this framework adjusts for growth and risk rather than relying on blunt peer averages, it offers a more tailored view of value, and it indicates Tesla’s shares are trading materially above what our fundamentals based model would support.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Tesla Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect the story you believe about a company with concrete forecasts for its future revenue, earnings, margins and fair value. Narratives then continuously compare that fair value to the current share price so you can see how it aligns with your view, all while staying dynamically updated as new news and earnings arrive.

In practice, that means one Tesla Narrative might say it is “just a car company” facing mounting Chinese competition and limited autonomy upside. That view could lead to a fair value near $70 per share and a more cautious stance. Another Narrative might see Tesla as a multi trillion dollar AI, energy and robotics platform with robotaxis and Optimus driving significant profits, supporting a fair value above $2,700 per share. Other Narratives will land in between those extremes, around $330 to $425, depending on how optimistic they are about growth, margins and execution.

For Tesla however we will make it really easy for you with previews of two leading Tesla Narratives:

Fair value: $2,707.91 per share

Implied undervaluation vs last close: approximately 82.1%

Forecast revenue growth: 77%

- Breaks Tesla into five engines: Optimus robots, batteries and storage, FSD and software, automotive, and energy solutions, then scales each to a 2030 view.

- Projects 2030 revenue near $1.94 trillion with about $534 billion of net profit, implying a tech like, high margin platform spanning AI, energy and robotics.

- Discounts multiple 2030 P/E scenarios back to today, landing on a fair value in the $2,120 to $4,240 range and arguing the current price massively underestimates long term optionality.

Fair value: $332.71 per share

Implied overvaluation vs last close: approximately 45.9%

Forecast revenue growth: 30%

- Credits Tesla with meaningful growth from new products, including Cybertruck, a lower cost Model 2, Semi, Optimus and FSD, but frames these as ambitious, execution heavy catalysts.

- Builds a 5 to 10 year path with revenue in the $120 to $150 billion range and profit margins around 18 to 22%, while highlighting intensifying competition, regulation and supply chain risk.

- Applies more moderate future earnings multiples of roughly 20x to 25x, concluding that even with solid growth the current share price embeds too much optimism relative to the narrative fair value.

Do you think there's more to the story for Tesla? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报