3 Asian Stocks Estimated To Be Trading Below Intrinsic Value By At Least 24.4%

As Asian markets navigate a complex landscape marked by Japan's interest rate hike to its highest level in 30 years and China's mixed economic signals, investors are keenly observing opportunities that may arise from these developments. In such an environment, identifying stocks trading below their intrinsic value can provide potential entry points for those looking to capitalize on undervaluation amidst broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.52 | CN¥162.07 | 48.5% |

| Takara Bio (TSE:4974) | ¥797.00 | ¥1575.68 | 49.4% |

| Shuangdeng Group (SEHK:6960) | HK$14.97 | HK$29.65 | 49.5% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24535.74 | 50% |

| Kuraray (TSE:3405) | ¥1606.00 | ¥3168.85 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5680.00 | ¥11002.86 | 48.4% |

| H.U. Group Holdings (TSE:4544) | ¥3376.00 | ¥6592.59 | 48.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3340.00 | ¥6544.37 | 49% |

| CURVES HOLDINGS (TSE:7085) | ¥798.00 | ¥1577.17 | 49.4% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.44 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

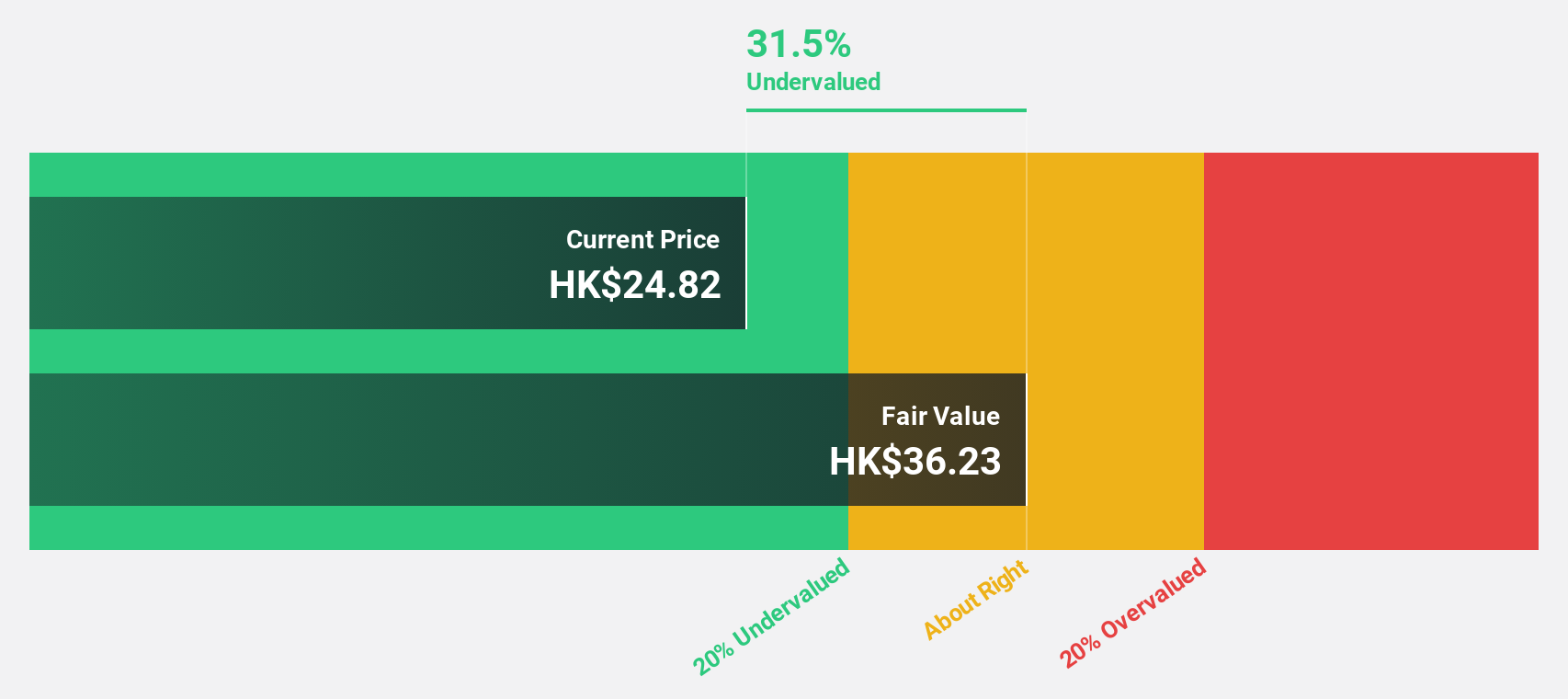

Lygend Resources & Technology (SEHK:2245)

Overview: Lygend Resources & Technology Co., Ltd. operates in the production, smelting, and trading of nickel products both in Mainland China and internationally, with a market cap of HK$34.85 billion.

Operations: The company's revenue segment in Metals & Mining - Miscellaneous amounts to CN¥36.50 billion.

Estimated Discount To Fair Value: 47.3%

Lygend Resources & Technology is trading at HK$22.4, significantly below its estimated fair value of HK$42.49, indicating it may be undervalued based on cash flows. Despite its high debt levels and recent insider selling, the company shows strong earnings growth potential with forecasts predicting a 28.87% annual increase over the next three years, outpacing the Hong Kong market's growth rate. However, its share price has been highly volatile recently.

- According our earnings growth report, there's an indication that Lygend Resources & Technology might be ready to expand.

- Dive into the specifics of Lygend Resources & Technology here with our thorough financial health report.

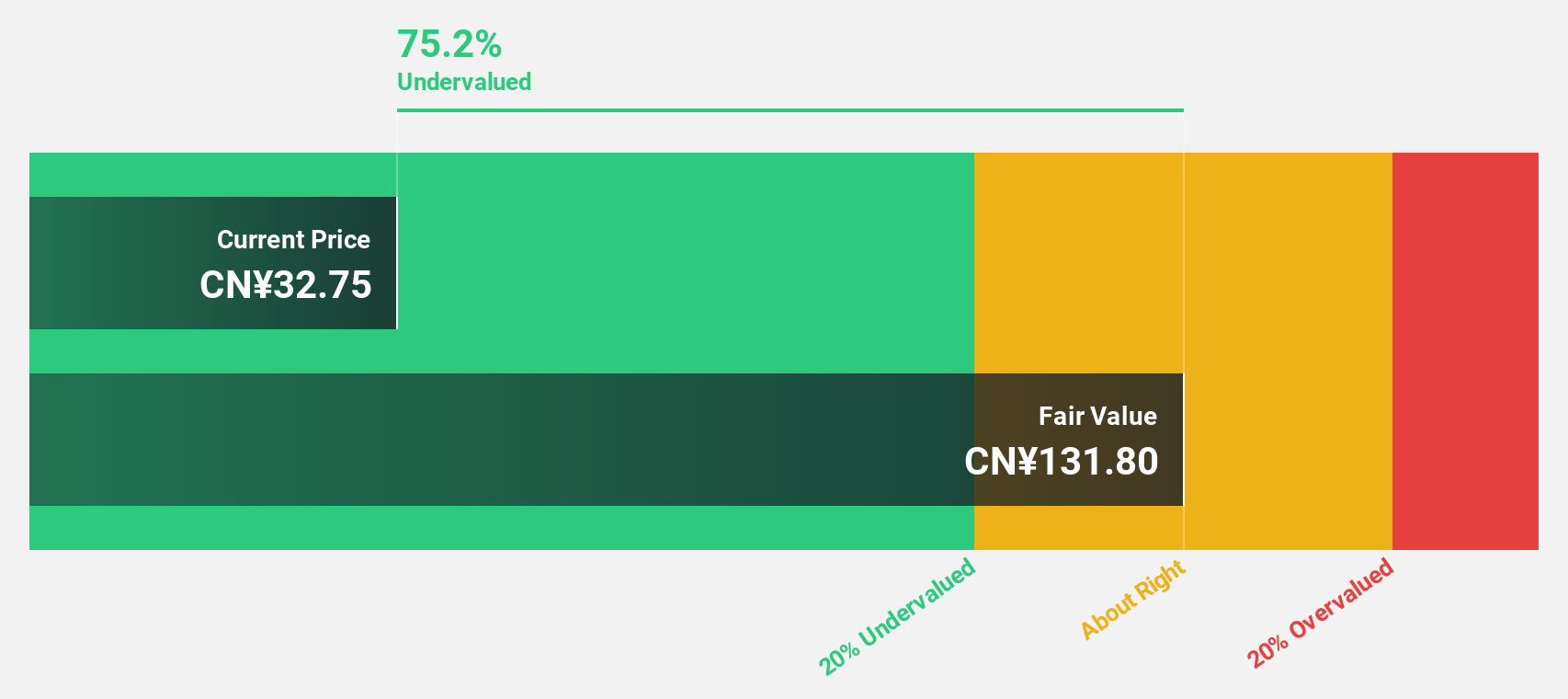

Sinomine Resource Group (SZSE:002738)

Overview: Sinomine Resource Group Co., Ltd. is involved in the development and utilization of lithium battery new energy raw materials, rare light metals, and solid minerals both in China and internationally, with a market cap of CN¥54.39 billion.

Operations: The company's revenue segments include the development and utilization of lithium battery new energy raw materials, rare light metals, and solid minerals across both domestic and international markets.

Estimated Discount To Fair Value: 47.4%

Sinomine Resource Group is trading at CN¥75.38, significantly below its estimated fair value of CN¥143.35, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 14.9% to 6.3%, the company exhibits strong growth prospects with earnings and revenue forecasted to grow substantially above the Chinese market averages. However, its dividend yield of 0.66% lacks coverage by free cash flows, and recent earnings have shown decreased net income year-over-year despite higher sales figures.

- Our comprehensive growth report raises the possibility that Sinomine Resource Group is poised for substantial financial growth.

- Navigate through the intricacies of Sinomine Resource Group with our comprehensive financial health report here.

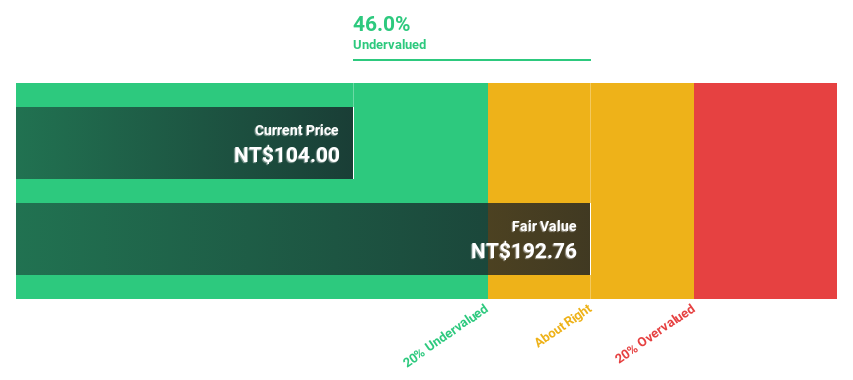

Kinsus Interconnect Technology (TWSE:3189)

Overview: Kinsus Interconnect Technology Corp., along with its subsidiaries, manufactures and sells electronic products both in Taiwan and internationally, with a market cap of NT$65.78 billion.

Operations: The company's revenue is primarily derived from its IC Substrate segment, which accounts for NT$29.68 billion, and its Optical Department, contributing NT$6.90 billion.

Estimated Discount To Fair Value: 24.4%

Kinsus Interconnect Technology is trading at NT$144, below its fair value estimate of NT$190.48, reflecting potential undervaluation based on cash flows. The company has demonstrated robust earnings growth, with net income for the third quarter rising to TWD 339.34 million from TWD 185.27 million year-on-year. Despite a highly volatile share price recently and a forecasted low return on equity of 10.1%, its earnings are expected to grow significantly above the Taiwan market average over the next three years.

- In light of our recent growth report, it seems possible that Kinsus Interconnect Technology's financial performance will exceed current levels.

- Get an in-depth perspective on Kinsus Interconnect Technology's balance sheet by reading our health report here.

Where To Now?

- Gain an insight into the universe of 272 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报