Top ASX Dividend Stocks To Consider In December 2025

As the Australian stock market wraps up the year with a slight dip, primarily due to pre-holiday profit-taking and influenced by Wall Street's record highs, investors are turning their attention to sectors like precious metals which have seen recent gains. In this environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.42% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 6.02% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.72% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.46% | ★★★★★☆ |

| Joyce (ASX:JYC) | 5.19% | ★★★★☆☆ |

| Fiducian Group (ASX:FID) | 4.29% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.73% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.33% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top ASX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Commonwealth Bank of Australia (ASX:CBA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Commonwealth Bank of Australia offers retail and commercial banking services across Australia, New Zealand, and internationally with a market cap of A$269.85 billion.

Operations: Commonwealth Bank of Australia's revenue segments include Retail Banking Services (Incl. Bankwest) at A$12.87 billion, Business Banking at A$8.75 billion, New Zealand operations at A$2.96 billion, and Institutional Banking and Markets at A$2.76 billion.

Dividend Yield: 3%

Commonwealth Bank of Australia's dividend payments have been volatile over the past decade, with a current payout ratio of 80% covered by earnings and forecasted to remain sustainable at 77.8% in three years. Despite the low dividend yield of 3.01%, recent strategic leadership changes, including the appointment of Ranil Boteju as Chief AI Officer, emphasize CBA's focus on technological advancement and innovation, potentially influencing future financial stability and growth prospects for investors seeking reliable dividends.

- Take a closer look at Commonwealth Bank of Australia's potential here in our dividend report.

- According our valuation report, there's an indication that Commonwealth Bank of Australia's share price might be on the expensive side.

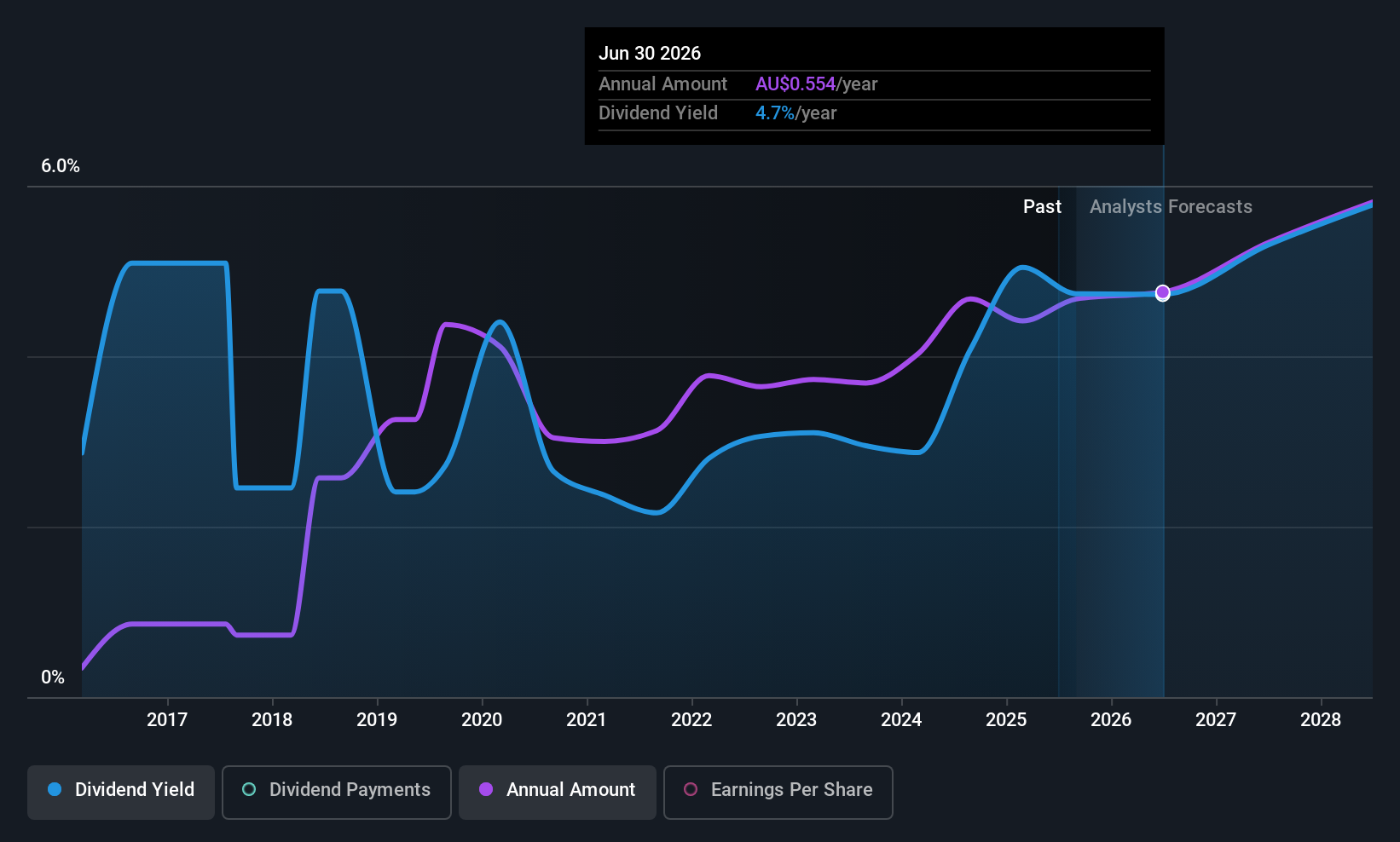

Jumbo Interactive (ASX:JIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jumbo Interactive Limited operates as an online and mobile retailer of lottery tickets across Australia, the United Kingdom, Canada, Fiji, and other international markets with a market cap of A$714.15 million.

Operations: Jumbo Interactive Limited generates revenue through its segments of Managed Services (A$26.72 million), Lottery Retailing (A$108.05 million), and Software-As-A-Service (SaaS) (A$44.25 million).

Dividend Yield: 4.8%

Jumbo Interactive's dividend payments have been volatile over the past decade, with an 85% payout ratio covered by earnings and an 83% cash payout ratio. While its dividend yield of 4.84% is below the top quartile in Australia, recent strategic moves such as acquiring Dream Car Giveaways and enhancing its A$120 million debt facility indicate a focus on growth. These efforts may offer potential for future stability despite past unpredictability in dividends.

- Get an in-depth perspective on Jumbo Interactive's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Jumbo Interactive's current price could be quite moderate.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a rice food company with operations across Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of A$1.19 billion.

Operations: Ricegrowers Limited generates revenue of A$1.82 billion from its operations across various regions, including Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America.

Dividend Yield: 4%

Ricegrowers' dividend payments, covered by a 64.1% payout ratio and an 84.1% cash payout ratio, have been volatile over the past decade despite recent increases. The dividend yield of 4.01% is below the top quartile in Australia. Recent earnings growth and strategic plans for acquisitions, supported by a strong balance sheet with core debt near zero, suggest potential for future stability in dividends as part of its growth strategy towards 2030.

- Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

- The analysis detailed in our Ricegrowers valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Embark on your investment journey to our 29 Top ASX Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报