Acusensus And 2 Other ASX Penny Stocks To Watch

As the Australian market approaches the holiday season, it seems to be slowing down with a slight dip of 0.2%, largely attributed to profit-taking before the break. Despite this lull, investors can still find intriguing opportunities in penny stocks, which are often smaller or newer companies that may offer growth potential beyond what larger firms provide. While the term "penny stocks" might seem outdated, these investments remain relevant for those seeking under-the-radar companies with strong financials and long-term promise.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.39 | A$65.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.14 | A$3.59B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.825 | A$118.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 429 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Acusensus (ASX:ACE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Acusensus Limited develops technology for detecting and providing prosecutable evidence of traffic violations such as distracted driving, seatbelt compliance, speeding, and railway crossing compliance, with a market cap of A$239.66 million.

Operations: The company generates revenue of A$59.35 million from its electronic security devices segment.

Market Cap: A$239.66M

Acusensus Limited, with a market cap of A$239.66 million, is navigating the penny stock landscape by leveraging its technology for traffic enforcement. Despite being unprofitable and having a negative return on equity, the company shows promise with revenue forecasted to grow 17.65% annually. Recent developments include an upgraded revenue guidance for 2026 due to successful contract mobilizations and new wins like Connecticut's Automated Work Zone Speed Control contract valued at approximately US$22.6 million (~A$34 million). Additionally, Acusensus completed a A$30 million follow-on equity offering to support its growth initiatives while maintaining sufficient cash runway for over a year.

- Jump into the full analysis health report here for a deeper understanding of Acusensus.

- Examine Acusensus' earnings growth report to understand how analysts expect it to perform.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, the United Kingdom, and other international markets with a market cap of A$655.69 million.

Operations: GWA Group's revenue is primarily generated from its Water Solutions segment, which accounts for A$418.48 million.

Market Cap: A$655.69M

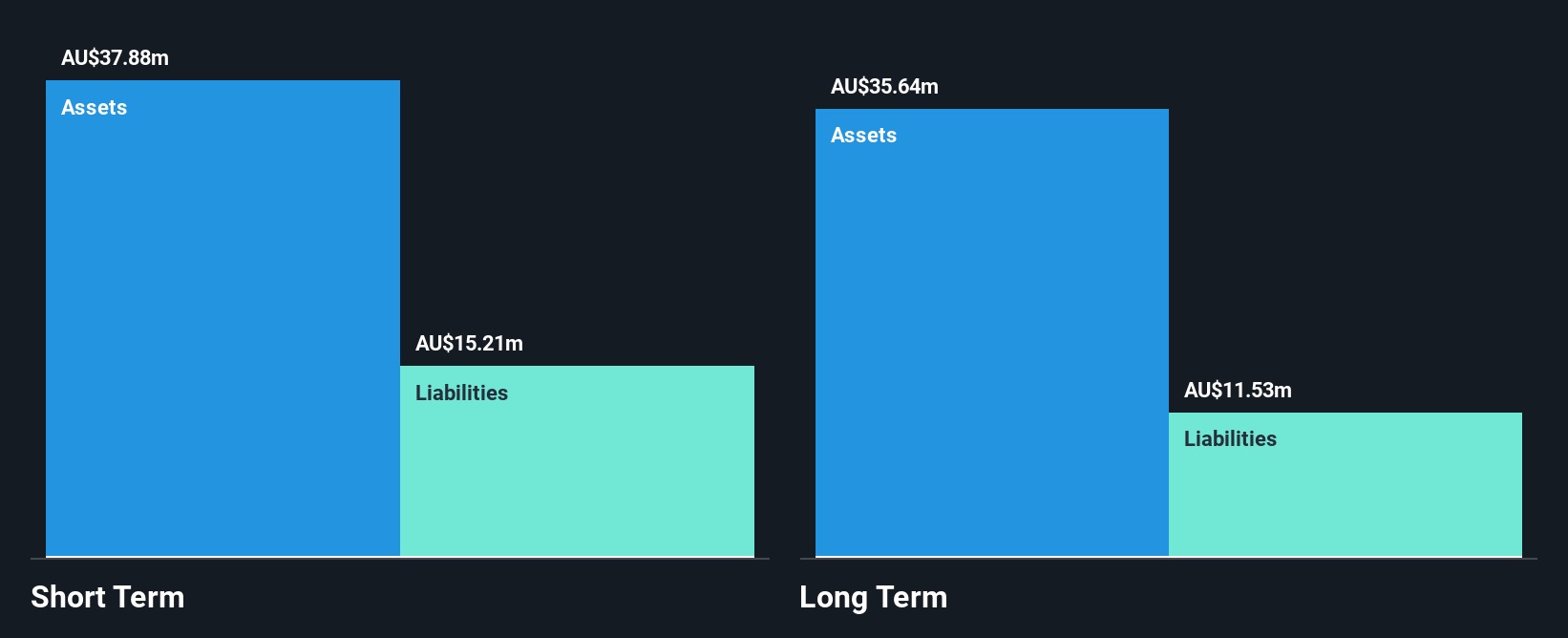

GWA Group, with a market cap of A$655.69 million, operates in the building fixtures sector and has shown steady financial performance. Its earnings have grown by 12.3% over the past year, surpassing its five-year average growth rate of 1.6%. The company's debt is well covered by operating cash flow at 51.9%, while its net debt to equity ratio stands at a satisfactory 27.7%. However, its dividend yield of 6.2% isn't fully supported by earnings, and short-term assets don't cover long-term liabilities entirely. Recent board changes include Nicola Page's appointment as an Independent non-Executive Director to enhance governance and strategic growth initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of GWA Group.

- Evaluate GWA Group's prospects by accessing our earnings growth report.

Starpharma Holdings (ASX:SPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Starpharma Holdings Limited is a biopharmaceutical company focused on the research, development, and commercialization of dendrimer technology for pharmaceutical and healthcare applications globally, with a market cap of A$161.02 million.

Operations: The company generates revenue of A$5.85 million from the discovery, development, and commercialization of dendrimers.

Market Cap: A$161.02M

Starpharma Holdings, with a market cap of A$161.02 million, is focused on dendrimer technology and has recently partnered with Radiopharm Theranostics to develop a radiopharmaceutical molecule using its DEP platform. This collaboration could lead to significant milestone payments up to A$89 million, plus royalties. Despite its limited revenue of A$5.85 million and current unprofitability, Starpharma holds more cash than debt and maintains stable short-term financial health with assets exceeding liabilities. However, the company's stock price remains highly volatile, reflecting broader challenges in achieving profitability within the biopharmaceutical sector.

- Get an in-depth perspective on Starpharma Holdings' performance by reading our balance sheet health report here.

- Gain insights into Starpharma Holdings' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Dive into all 429 of the ASX Penny Stocks we have identified here.

- Contemplating Other Strategies? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报