UK Penny Stocks Under £300M Market Cap: 3 Promising Picks

The UK stock market has faced recent challenges, with the FTSE 100 and FTSE 250 indices declining due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, there remain opportunities for investors willing to explore beyond the blue-chip stocks. Penny stocks, a term that may seem outdated but remains relevant, can offer potential growth at lower price points when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.22 | £484.13M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.28 | £330.38M | ✅ 5 ⚠️ 1 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.84 | £12.68M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.71 | $412.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.50 | £181.67M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.47 | £40.51M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Afentra (AIM:AET)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Afentra plc, with a market cap of £88.20 million, operates as an upstream oil and gas company primarily in Africa through its subsidiaries.

Operations: The company generates revenue of $157.22 million from its oil and gas exploration and production activities.

Market Cap: £88.2M

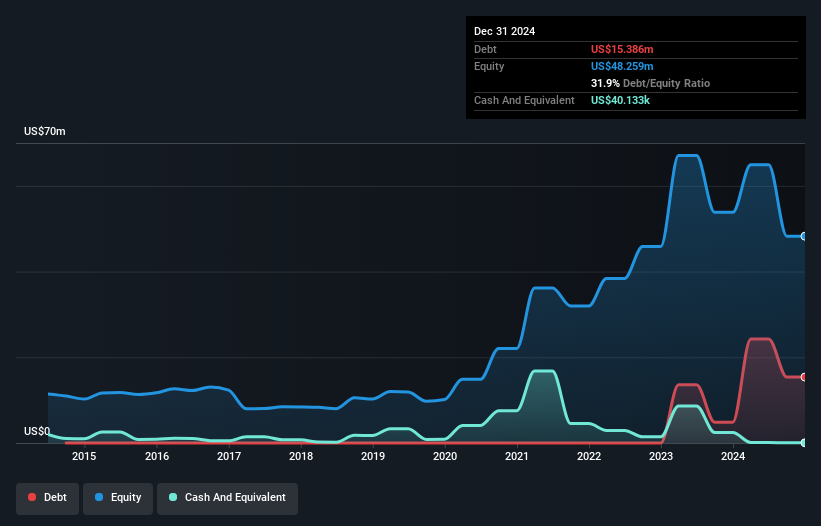

Afentra plc, with a market cap of £88.20 million, operates in the upstream oil and gas sector primarily in Africa. The company generates US$157.22 million in revenue from its exploration and production activities. Recent board changes include the appointment of Andrew Jon Osborne as Independent Non-Executive Director and Chair of the Audit Committee, enhancing governance with his extensive industry experience. Financially, Afentra's net debt to equity ratio is satisfactory at 21.2%, while its earnings growth rate has been robust at 53.2% over the past year, outperforming industry averages despite a slight decline from historical growth rates.

- Unlock comprehensive insights into our analysis of Afentra stock in this financial health report.

- Examine Afentra's earnings growth report to understand how analysts expect it to perform.

Alumasc Group (AIM:ALU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Alumasc Group plc, with a market cap of £86.30 million, manufactures and sells building products and solutions across the United Kingdom, Europe, North America, the Middle East, the Far East, and internationally.

Operations: The company generates revenue from three main segments: Water Management (£55.52 million), Building Envelope (£41.81 million), and Housebuilding Products (£16.08 million).

Market Cap: £86.3M

Alumasc Group plc, with a market cap of £86.30 million, operates in the building products sector and has shown steady financial health. Its earnings have grown 13.4% annually over five years, though recent growth of 6.8% lags behind this trend. The company is trading at a significant discount to estimated fair value and boasts high-quality earnings with a strong return on equity at 22.8%. Alumasc's debt management is commendable, with net debt to equity reduced significantly over five years and well-covered by operating cash flow. Recent events include an increased dividend declaration of 7.6 pence per share in October 2025.

- Dive into the specifics of Alumasc Group here with our thorough balance sheet health report.

- Learn about Alumasc Group's future growth trajectory here.

Pensana (LSE:PRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pensana Plc explores, mines, and processes mineral properties in the United Kingdom and Angola, with a market cap of £272.25 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £272.25M

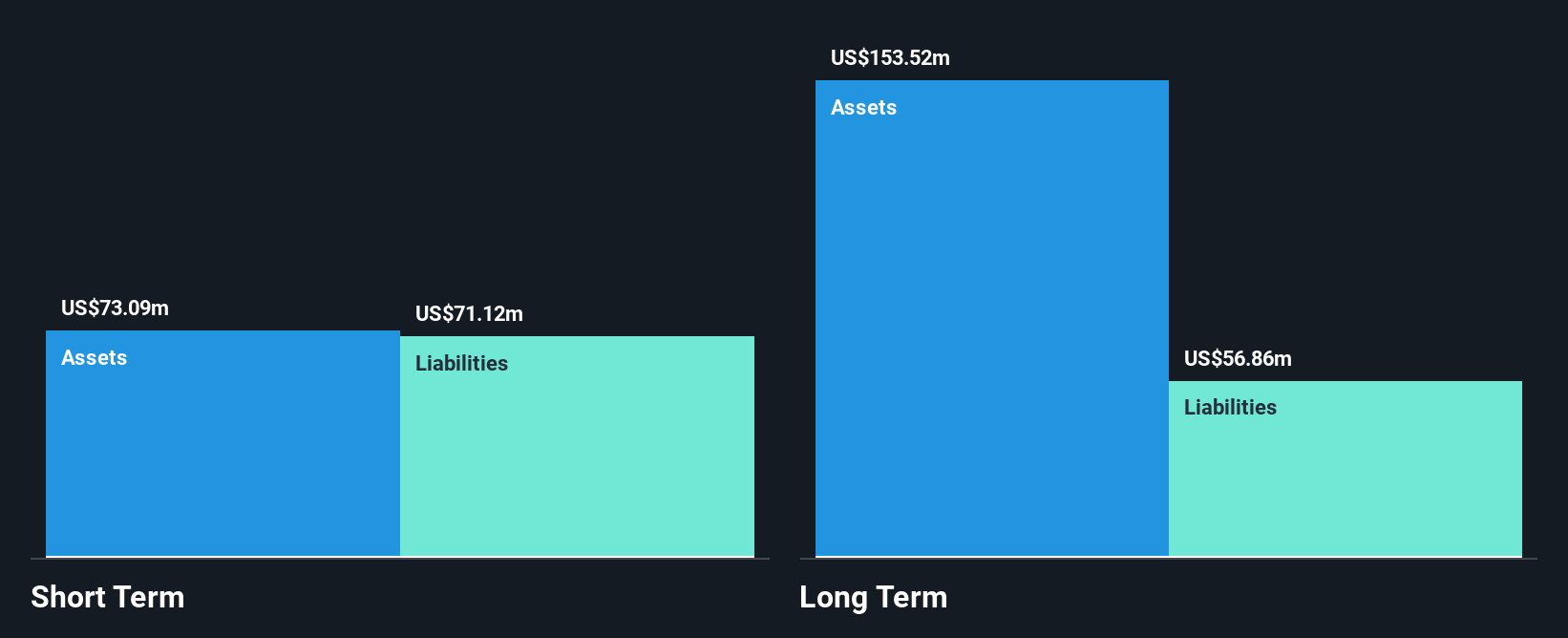

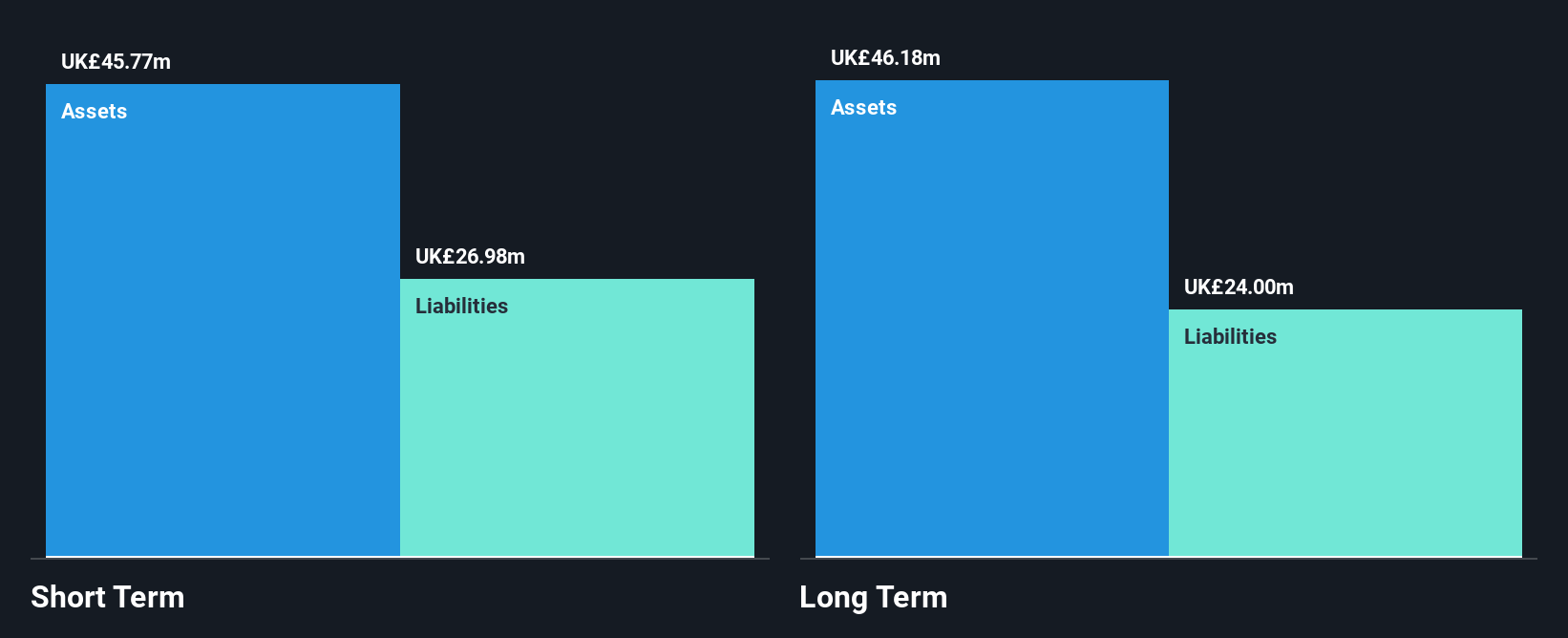

Pensana Plc, with a market cap of £272.25 million, operates as a pre-revenue entity primarily focused on mining activities in Angola and the UK. Recent developments include multiple follow-on equity offerings totaling £6.14 million to bolster its cash position amid concerns over its short-term liabilities of $31.4M against assets of $2.3M. The company is constructing one of the world's largest rare earth mines at Longonjo, benefiting from strategic partnerships aimed at establishing a mine-to-magnet supply chain in the U.S., potentially enhancing its future revenue prospects despite current unprofitability and high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Pensana.

- Review our growth performance report to gain insights into Pensana's future.

Make It Happen

- Get an in-depth perspective on all 305 UK Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报