The Market Lifts TRX Gold Corporation (TSE:TRX) Shares 51% But It Can Do More

TRX Gold Corporation (TSE:TRX) shareholders have had their patience rewarded with a 51% share price jump in the last month. The last month tops off a massive increase of 212% in the last year.

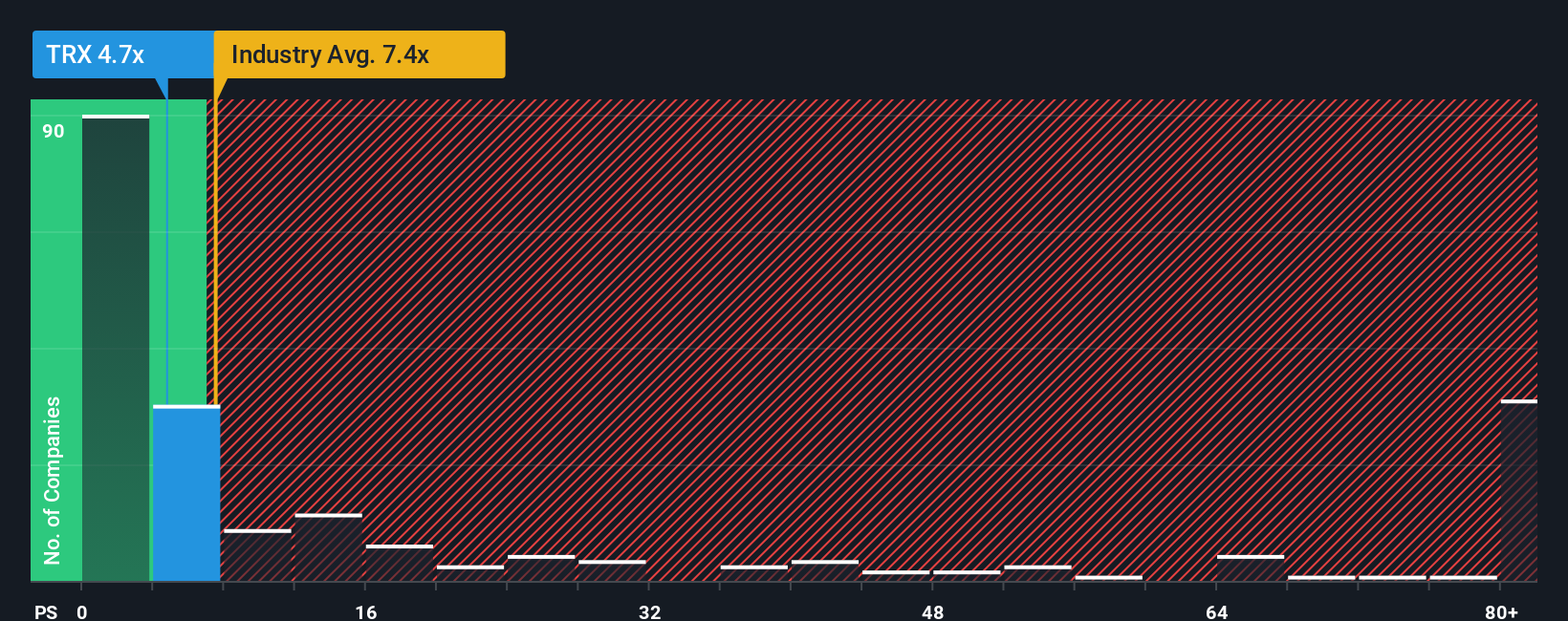

Although its price has surged higher, TRX Gold may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.7x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 7.4x and even P/S higher than 45x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for TRX Gold

What Does TRX Gold's Recent Performance Look Like?

Recent times haven't been great for TRX Gold as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TRX Gold.How Is TRX Gold's Revenue Growth Trending?

In order to justify its P/S ratio, TRX Gold would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 40% last year. The latest three year period has also seen an excellent 282% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 104% over the next year. That's shaping up to be materially higher than the 53% growth forecast for the broader industry.

With this in consideration, we find it intriguing that TRX Gold's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From TRX Gold's P/S?

Despite TRX Gold's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems TRX Gold currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for TRX Gold with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报