Global Stocks Estimated To Be Trading Below Intrinsic Values In December 2025

As we approach the end of 2025, global markets are navigating a complex landscape marked by mixed economic signals and shifting monetary policies. With interest rate adjustments in major economies like Japan and Europe, alongside fluctuating inflation rates in the U.S., investors are keenly observing these developments for potential opportunities. In such an environment, identifying stocks trading below their intrinsic values can be particularly appealing to investors seeking value amid market volatility and economic uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.40 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.30 | 49.8% |

| NEXON Games (KOSDAQ:A225570) | ₩12270.00 | ₩24519.40 | 50% |

| Mobvista (SEHK:1860) | HK$15.40 | HK$30.69 | 49.8% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.74 | 49.9% |

| Exail Technologies (ENXTPA:EXA) | €84.10 | €167.48 | 49.8% |

| cyan (XTRA:CYR) | €2.26 | €4.50 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.92 | HK$55.44 | 49.6% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.36 | 49.9% |

| Andes Technology (TWSE:6533) | NT$242.50 | NT$481.61 | 49.6% |

We'll examine a selection from our screener results.

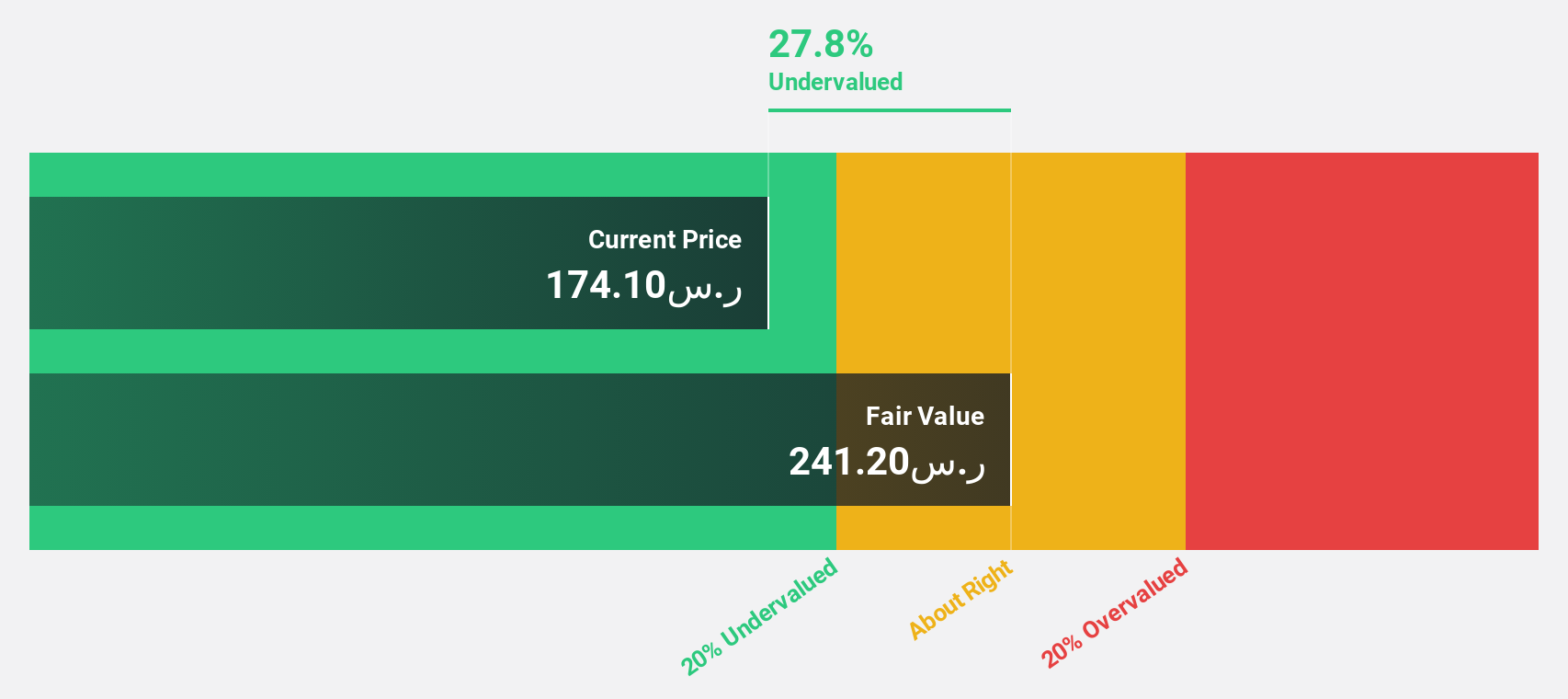

Almoosa Health (SASE:4018)

Overview: Almoosa Health Company operates as a private healthcare provider in the Kingdom of Saudi Arabia with a market cap of SAR7.93 billion.

Operations: The company's revenue is derived from three main segments: Rehabilitation (SAR162.41 million), Pharmaceuticals (SAR295.83 million), and Medical Services (SAR902.20 million).

Estimated Discount To Fair Value: 41.2%

Almoosa Health is trading at SAR179, significantly below its estimated fair value of SAR304.19, indicating potential undervaluation based on cash flows. Recent earnings growth and revenue increases bolster this view, with net income rising to SAR154.5 million for the first nine months of 2025. However, despite strong earnings forecasts and a new credit facility for hospital expansion, investors should note the forecasted low return on equity in three years (13.4%).

- The growth report we've compiled suggests that Almoosa Health's future prospects could be on the up.

- Navigate through the intricacies of Almoosa Health with our comprehensive financial health report here.

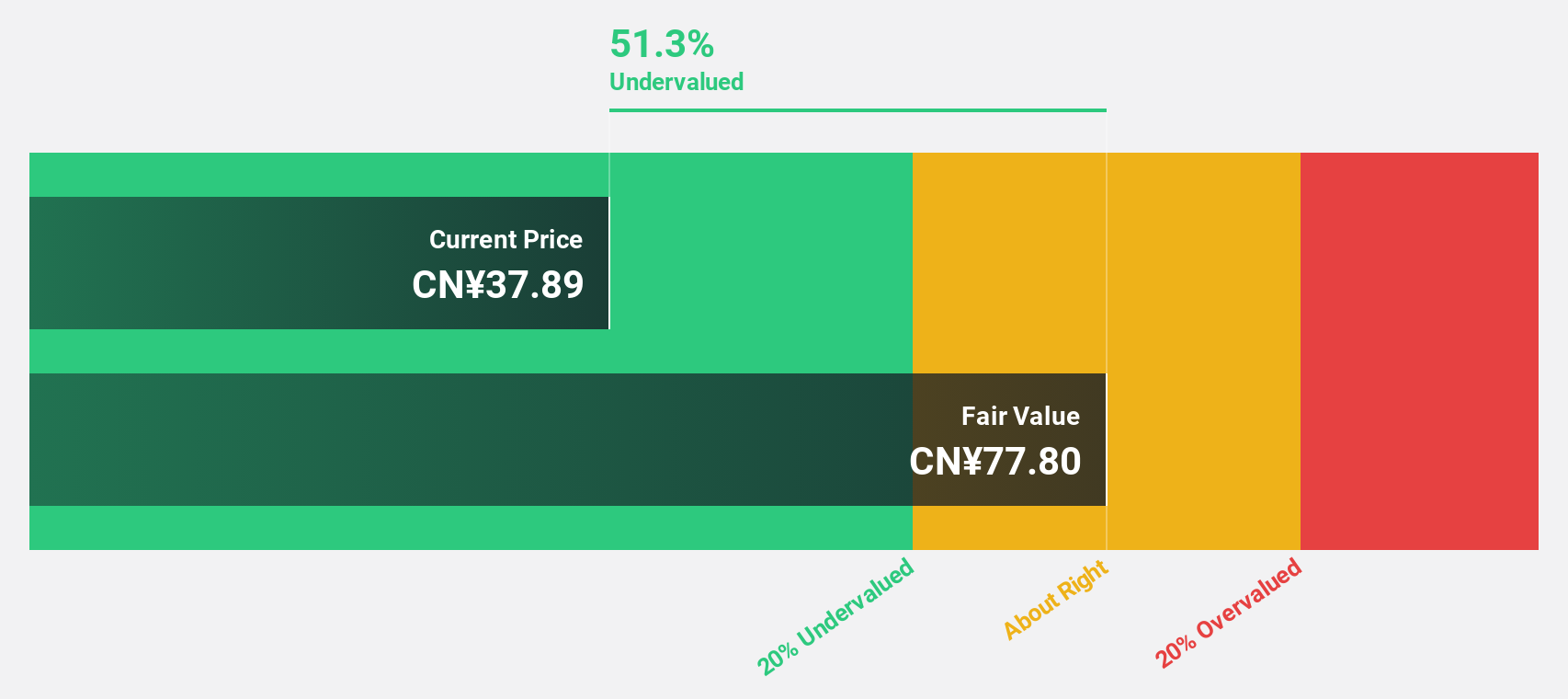

Xizang Gaozheng Civil Explosives (SZSE:002827)

Overview: Xizang Gaozheng Civil Explosives Co., Ltd. operates in the civil explosives industry and has a market cap of CN¥10.65 billion.

Operations: Xizang Gaozheng Civil Explosives Co., Ltd. generates its revenue primarily from the civil explosives sector.

Estimated Discount To Fair Value: 46.3%

Xizang Gaozheng Civil Explosives is trading at CN¥41.68, substantially below its estimated fair value of CN¥77.66, highlighting potential undervaluation based on cash flows. The company reported sales of CNY 1.26 billion for the first nine months of 2025, with net income rising to CNY 126.05 million. Analysts forecast significant earnings growth over the next three years and a high return on equity (25.8%), although recent bylaw changes may affect future operations.

- The analysis detailed in our Xizang Gaozheng Civil Explosives growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Xizang Gaozheng Civil Explosives.

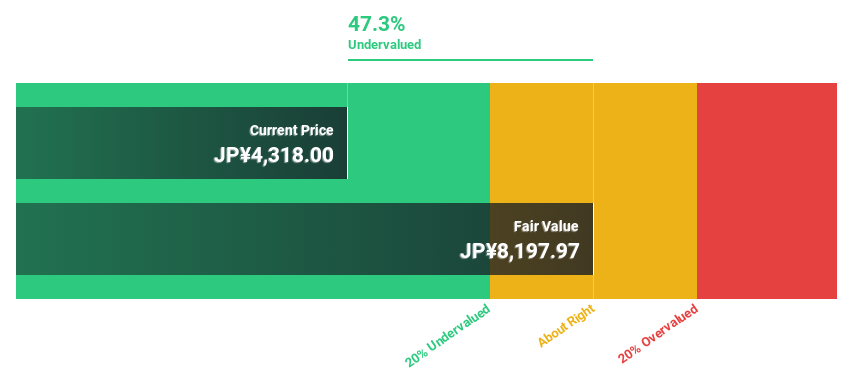

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥870.59 billion.

Operations: The company's revenue segments include the Japan Sushiro Business at ¥265.90 billion, Overseas Sushiro Business at ¥131.42 billion, Kyotaru Business at ¥23.53 billion, and Japan Sugidama Business at ¥8.28 billion.

Estimated Discount To Fair Value: 24.3%

Food & Life Companies is trading at ¥7,758, significantly below its estimated fair value of ¥10,246.58, suggesting undervaluation based on cash flows. Despite recent share price volatility, earnings grew by 56.7% over the past year and are forecast to grow at 12.24% annually, outpacing the JP market's 8.5%. The company projects a profit attributable to owners of ¥24 billion for fiscal 2026 and maintains a consistent dividend payout of ¥35 per share.

- In light of our recent growth report, it seems possible that Food & Life Companies' financial performance will exceed current levels.

- Dive into the specifics of Food & Life Companies here with our thorough financial health report.

Where To Now?

- Click through to start exploring the rest of the 487 Undervalued Global Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报