Exploring Three High Growth Tech Stocks in Europe

As the pan-European STOXX Europe 600 Index recently ended 1.60% higher, buoyed by signs of steady economic growth and looser monetary policy, the European tech sector has become an area of keen interest for investors seeking potential high-growth opportunities. In such a dynamic environment, identifying strong tech stocks often involves looking at companies with innovative technologies and robust business models that can adapt to changing market conditions and capitalize on emerging trends.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Paradox Interactive | 11.59% | 24.12% | ★★★★★☆ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.76% | 49.60% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Pharma Mar | 19.32% | 41.01% | ★★★★★☆ |

| Kitron | 21.22% | 32.49% | ★★★★★★ |

| Gapwaves | 32.48% | 72.52% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★★★

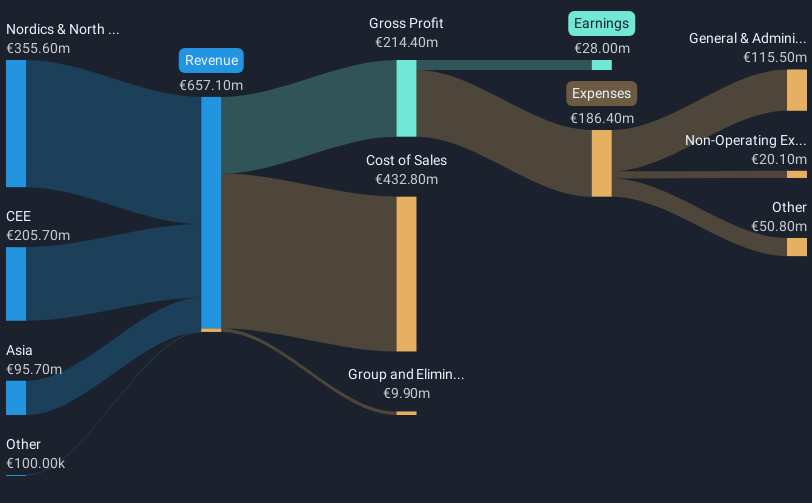

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries, including Norway, Sweden, and the United States, with a market cap of NOK15.58 billion.

Operations: Kitron ASA generates revenue primarily through its Electronics Manufacturing Services (EMS) segment, which reported €665.20 million. Operating across various countries, the company focuses on providing comprehensive manufacturing solutions in the electronics sector.

Kitron's recent strategic maneuvers, including securing contracts worth over EUR 91 million in the defense and aerospace sectors, underscore its robust positioning in high-demand markets. This aligns with their ambitious revenue target projections, aiming to surge from current levels to EUR 1.5 billion, reflecting a significant uptick in defense sector activity and internal capacity expansions. Financially, Kitron has demonstrated strong growth metrics with a reported annual revenue increase of 21.2% and an earnings growth forecast of 32.5%, substantially outpacing the broader Norwegian market's growth rates. These figures are bolstered by recent successful equity offerings and strategic acquisitions like DeltaNordic, which are expected to further enhance Kitron’s market footprint and operational capabilities in upcoming years.

- Dive into the specifics of Kitron here with our thorough health report.

Examine Kitron's past performance report to understand how it has performed in the past.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various global regions, with a market cap of NOK7.71 billion.

Operations: Pexip generates revenue primarily through the sale of collaboration services, amounting to NOK1.23 billion.

Pexip Holding has recently marked a notable uptick in its financial performance, with a 26.1% forecasted annual earnings growth outstripping the Norwegian market's 16%. This growth is complemented by an 11.2% increase in revenue per year, significantly ahead of the broader market's 2.3%, signaling robust sector-specific advancements despite broader market conditions. The firm's strategic pivot to profitability this year enhances its competitive stance within the software industry, where it has already achieved a high Return on Equity forecast at 22.5%. Moreover, recent quarterly results underscore this momentum, with net income escalating to NOK 25.64 million from NOK 5.8 million year-over-year and sales rising to NOK 265.63 million from NOK 228.48 million in the same period, affirming Pexip's operational efficacy and market adaptation strategies.

- Take a closer look at Pexip Holding's potential here in our health report.

Explore historical data to track Pexip Holding's performance over time in our Past section.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

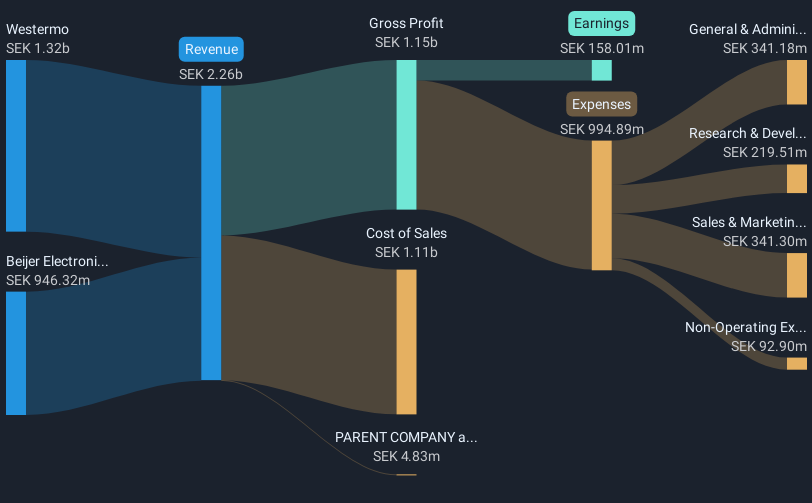

Overview: Ependion AB, with a market cap of approximately SEK3.61 billion, offers digital solutions for secure control, management, visualization, and data communication tailored for industrial applications through its subsidiaries.

Operations: With a market cap of approximately SEK3.61 billion, Ependion AB generates revenue through its subsidiaries Westermo and Beijer Electronics (including Korenix), contributing SEK1.36 billion and SEK875.54 million respectively, focusing on digital solutions for industrial applications.

Ependion AB's recent performance showcases a robust trajectory in the tech sector, with a 10.1% annual revenue growth outpacing the Swedish market's 3.9%. Despite facing challenges with a -11.9% earnings dip over the past year, forecasts are optimistic, projecting an earnings surge of 28.1% annually, significantly above Sweden's average of 13.6%. This growth is underpinned by substantial R&D investments and strategic initiatives like its presentation at Aktiespararnas Stora Aktiedagar, signaling strong future prospects amidst competitive pressures and evolving market demands.

- Click here and access our complete health analysis report to understand the dynamics of Ependion.

Evaluate Ependion's historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 50 European High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报