3 European Growth Stocks Insiders Are Betting On

As the pan-European STOXX Europe 600 Index recently climbed by 1.60%, buoyed by signs of steady economic growth and looser monetary policy, investor interest in growth stocks with high insider ownership is gaining momentum. In such an environment, companies where insiders hold significant stakes may offer unique insights into potential long-term value, as these stakeholders often align their interests closely with those of other shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 32.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's review some notable picks from our screened stocks.

DNO (OB:DNO)

Simply Wall St Growth Rating: ★★★★★★

Overview: DNO ASA is involved in the exploration, development, and production of oil and gas assets across the Middle East, the North Sea, and West Africa with a market capitalization of NOK 15.02 billion.

Operations: The company generates revenue primarily from its oil and gas activities, amounting to $1.17 billion.

Insider Ownership: 13.5%

Earnings Growth Forecast: 97.5% p.a.

DNO ASA is experiencing significant growth, with revenue forecasted to increase by 28.8% annually, outpacing the Norwegian market. The company is expected to become profitable within three years and has a high insider ownership structure. Recent strategic alliances with Aker BP enhance DNO's operational capabilities in key areas, while production guidance indicates increasing output in both the North Sea and Kurdistan regions. However, DNO carries a high level of debt and its dividend coverage remains weak.

- Delve into the full analysis future growth report here for a deeper understanding of DNO.

- The analysis detailed in our DNO valuation report hints at an deflated share price compared to its estimated value.

Beijer Alma (OM:BEIA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijer Alma AB (publ) operates in component manufacturing and industrial trading across Sweden, the Nordic Region, Europe, North America, Asia, and internationally with a market cap of SEK17.72 billion.

Operations: The company's revenue is derived from its Lesjöfors segment, contributing SEK5.08 billion, and its Beijer Tech segment, generating SEK2.62 billion.

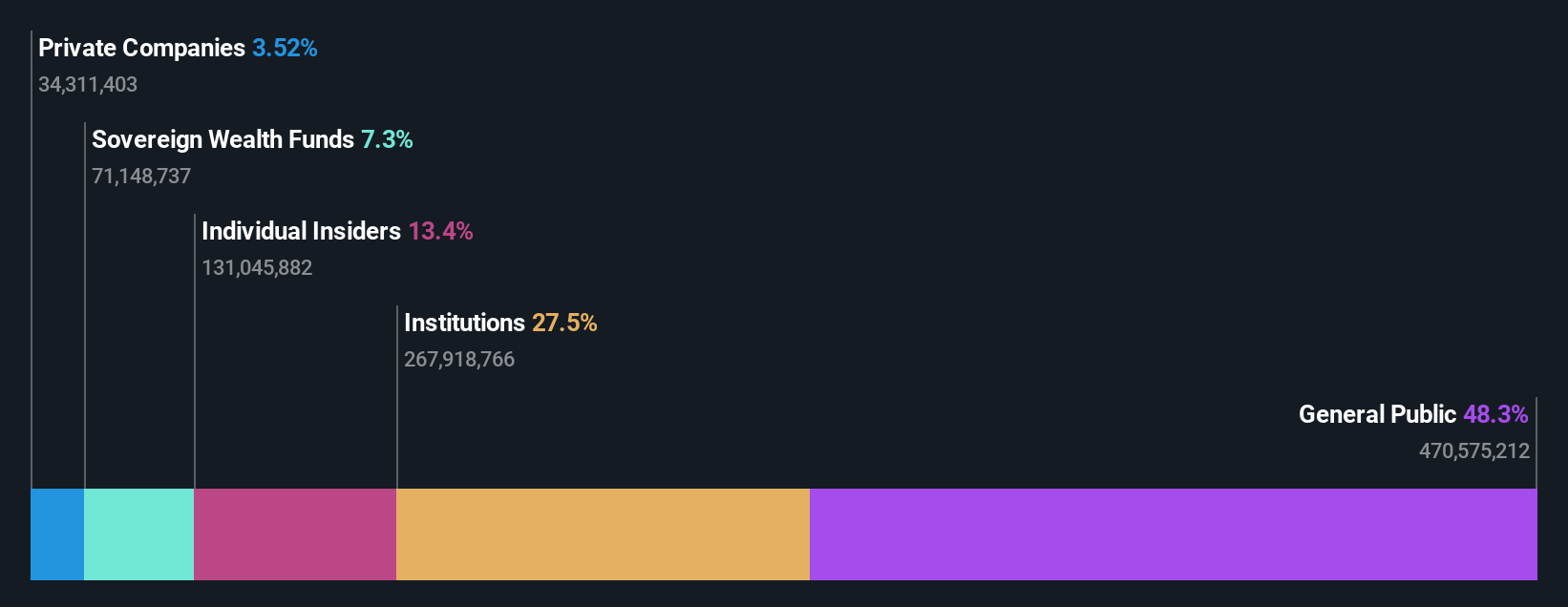

Insider Ownership: 14.2%

Earnings Growth Forecast: 23.1% p.a.

Beijer Alma is experiencing substantial insider buying, with no significant selling over the past three months. Its earnings are projected to grow significantly at 23.1% annually, surpassing the Swedish market's growth rate. Despite trading slightly below fair value and having a forecasted low return on equity of 16.4%, Beijer Alma faces challenges with high debt levels and declining profit margins, as evidenced by recent quarterly net income dropping from SEK 303 million to SEK 176 million year-on-year.

- Navigate through the intricacies of Beijer Alma with our comprehensive analyst estimates report here.

- The analysis detailed in our Beijer Alma valuation report hints at an inflated share price compared to its estimated value.

AlzChem Group (XTRA:ACT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AlzChem Group AG, with a market cap of €1.47 billion, develops, produces, and markets a variety of chemical specialties across Germany, the European Union, the rest of Europe, Asia, the NAFTA region, and internationally.

Operations: The company's revenue is primarily derived from its Specialty Chemicals segment, which generated €370.59 million, and its Basics & Intermediates segment, contributing €163.48 million.

Insider Ownership: 15.5%

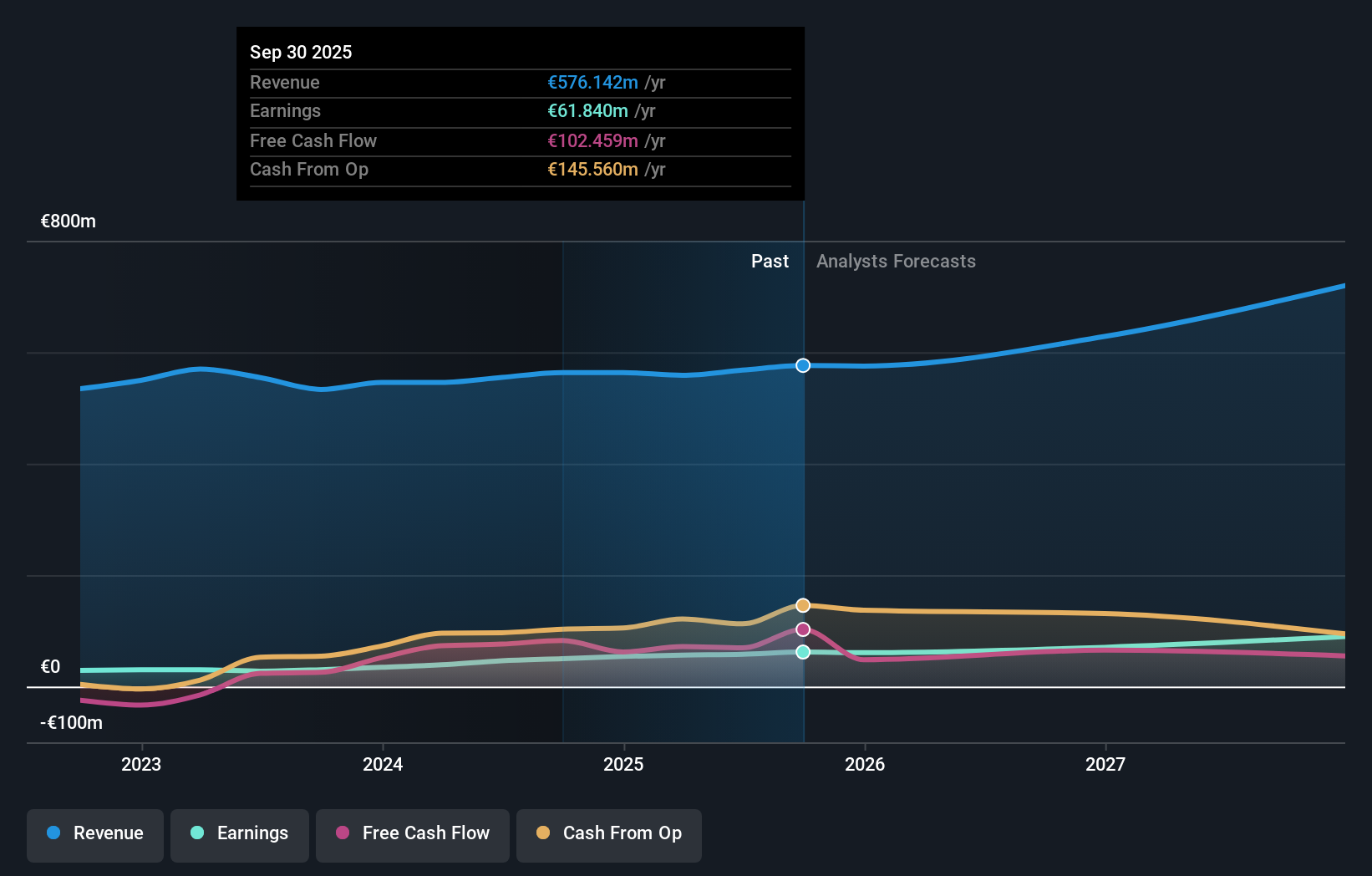

Earnings Growth Forecast: 18.5% p.a.

AlzChem Group is experiencing robust growth, with earnings projected to rise 18.5% annually, outpacing the German market. Despite high share price volatility, it trades at 33.6% below estimated fair value and maintains a strong return on equity forecast of 28.4%. Recent strategic investments of €120 million aim to enhance its production capacity in sports, food, and health sectors, promising substantial sales potential and reinforcing its market position with innovative products like Creavitalis®.

- Dive into the specifics of AlzChem Group here with our thorough growth forecast report.

- Our expertly prepared valuation report AlzChem Group implies its share price may be lower than expected.

Seize The Opportunity

- Investigate our full lineup of 211 Fast Growing European Companies With High Insider Ownership right here.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报