SergeFerrari Group SA (EPA:SEFER) Doing What It Can To Lift Shares

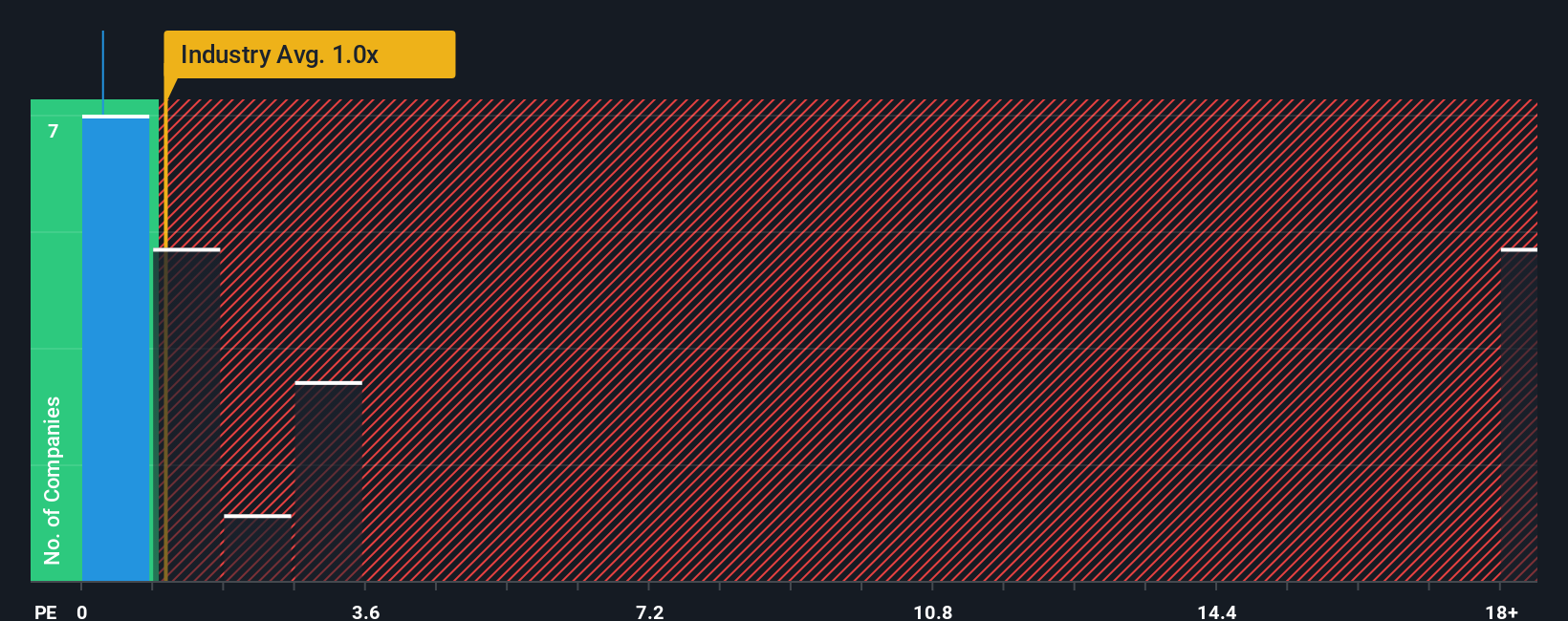

With a price-to-sales (or "P/S") ratio of 0.3x SergeFerrari Group SA (EPA:SEFER) may be sending bullish signals at the moment, given that almost half of all the Chemicals companies in France have P/S ratios greater than 1.9x and even P/S higher than 21x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for SergeFerrari Group

What Does SergeFerrari Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, SergeFerrari Group has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SergeFerrari Group will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SergeFerrari Group?

The only time you'd be truly comfortable seeing a P/S as low as SergeFerrari Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.4% last year. The latest three year period has also seen a 9.4% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.7% during the coming year according to the three analysts following the company. That's shaping up to be similar to the 2.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that SergeFerrari Group's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of SergeFerrari Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 1 warning sign for SergeFerrari Group that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报