Asian Dividend Stocks To Watch In December 2025

As December 2025 unfolds, Asian markets are navigating a complex landscape shaped by Japan's significant interest rate hike and China's mixed economic signals. In this environment, dividend stocks can offer investors potential stability and income, making them an attractive option for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.30% | ★★★★★★ |

Click here to see the full list of 1022 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

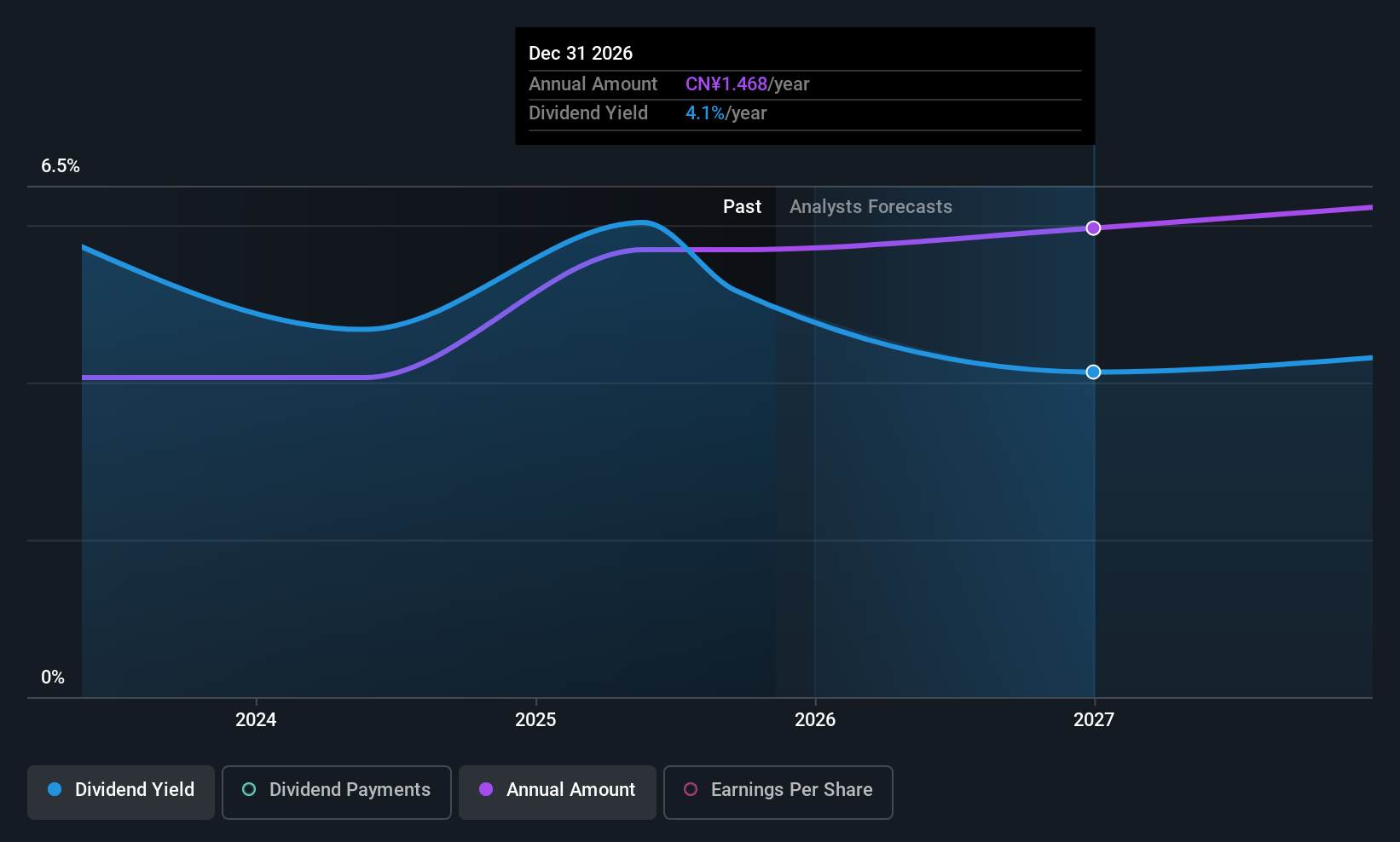

Yunnan Yuntianhua (SHSE:600096)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yunnan Yuntianhua Co., Ltd. is a Chinese company that manufactures and sells phosphate and nitrogen fertilizers as well as formaldehyde copolymers, with a market cap of CN¥56.17 billion.

Operations: Yunnan Yuntianhua Co., Ltd.'s revenue primarily comes from the production and sale of phosphate and nitrogen fertilizers, along with formaldehyde copolymers in China.

Dividend Yield: 4.5%

Yunnan Yuntianhua's dividend profile is promising due to its 4.54% yield, placing it among the top 25% in China's market. Despite a short history of just three years of payments, dividends are well-covered by earnings and cash flows with payout ratios at 52% and 30.1%, respectively. While recent earnings grew modestly to CNY 4.73 billion, revenue declined from the previous year, warranting cautious optimism for sustained dividend growth.

- Unlock comprehensive insights into our analysis of Yunnan Yuntianhua stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Yunnan Yuntianhua is priced lower than what may be justified by its financials.

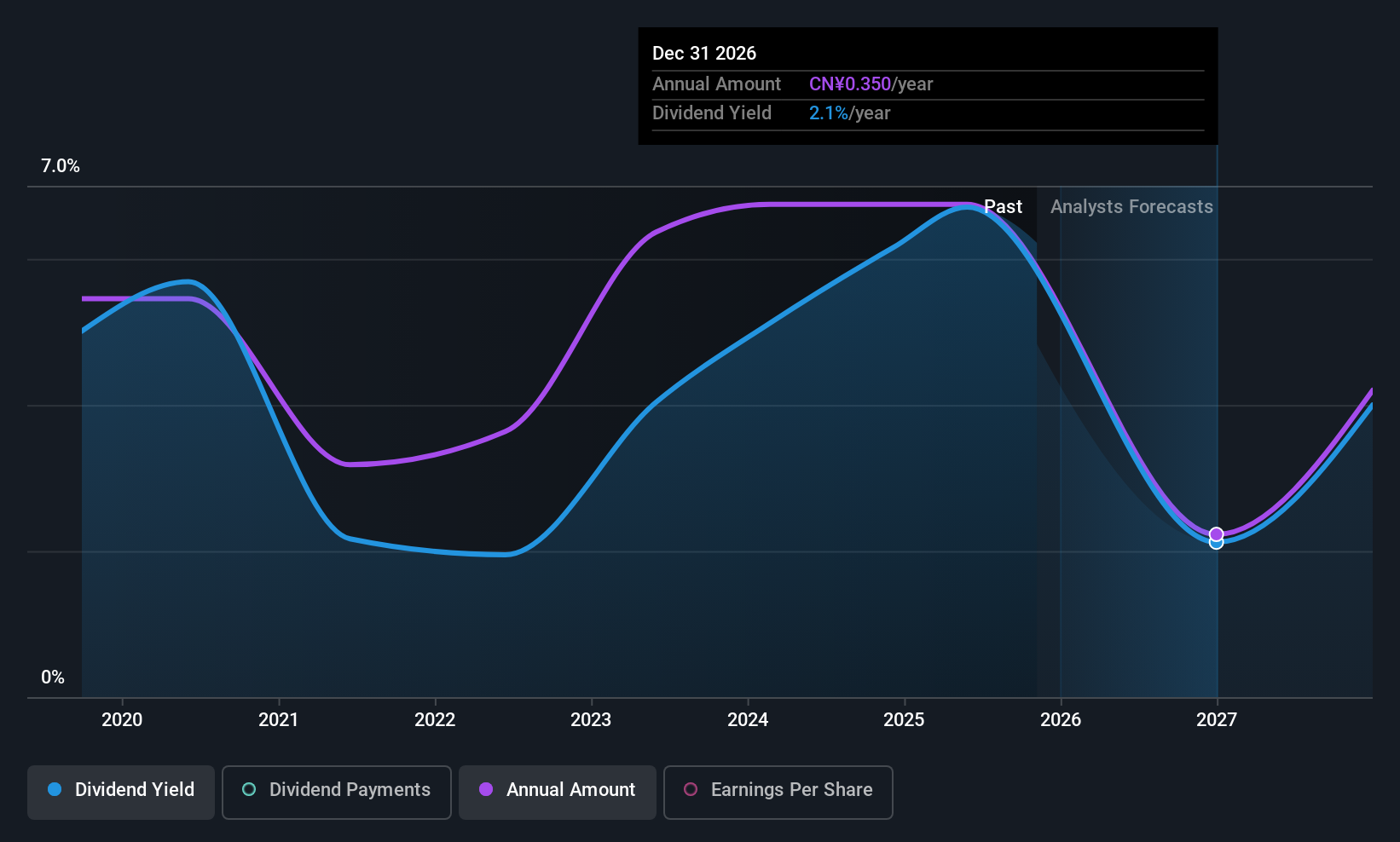

Jingjin Equipment (SHSE:603279)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jingjin Equipment Inc. provides environmental protection products and services both in China and internationally, with a market cap of CN¥9.07 billion.

Operations: Jingjin Equipment Inc. generates revenue from its General Equipment Manufacturing segment, amounting to CN¥5.63 billion.

Dividend Yield: 5.7%

Jingjin Equipment's dividend yield of 5.72% ranks it in the top 25% of China's market, yet its six-year payment history is marked by volatility. Despite this, dividends are covered by earnings and cash flows with payout ratios at 82.2% and 56.1%, respectively. The stock trades at a significant discount to estimated fair value, suggesting potential for capital appreciation; however, recent revenue and net income declines raise concerns about future stability in dividend payments.

- Get an in-depth perspective on Jingjin Equipment's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Jingjin Equipment's current price could be quite moderate.

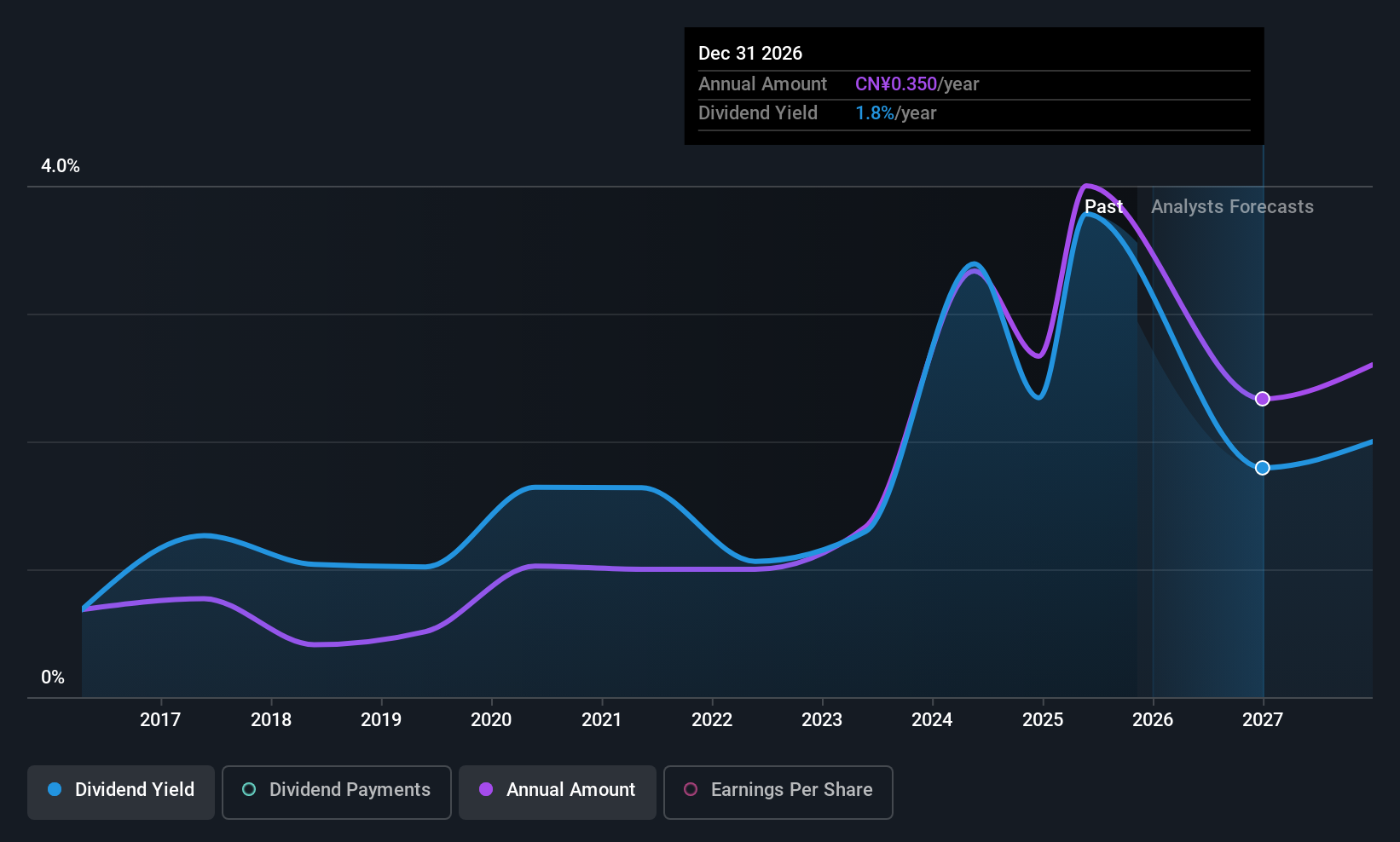

Hangzhou Sunrise TechnologyLtd (SZSE:300360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hangzhou Sunrise Technology Co., Ltd. operates in the electrical instrumentation industry both within China and internationally, with a market cap of CN¥9.03 billion.

Operations: Hangzhou Sunrise Technology Co., Ltd. generates revenue from its operations in the electrical instrumentation sector across domestic and international markets.

Dividend Yield: 4%

Hangzhou Sunrise Technology offers a dividend yield of 3.99%, placing it among the top 25% of dividend payers in China despite its volatile payment history over the past decade. While dividends are covered by earnings with a payout ratio of 60.3%, they are not well supported by free cash flows, indicated by a high cash payout ratio of 107.9%. The stock trades at a favorable price-to-earnings ratio compared to the broader CN market, yet recent revenue and net income declines may impact future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Hangzhou Sunrise TechnologyLtd.

- In light of our recent valuation report, it seems possible that Hangzhou Sunrise TechnologyLtd is trading behind its estimated value.

Next Steps

- Embark on your investment journey to our 1022 Top Asian Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报