3 Middle Eastern Dividend Stocks Yielding Up To 3.5%

As Gulf markets experience gains driven by stabilizing oil prices and anticipation of U.S. Federal Reserve rate cuts, investors are increasingly looking towards dividend stocks as a means to capitalize on these favorable conditions. In this environment, selecting stocks that offer reliable dividend yields can be an effective strategy for generating consistent income amidst the evolving market landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.55% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.13% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.53% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.49% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.54% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.99% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.30% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.02% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.55% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

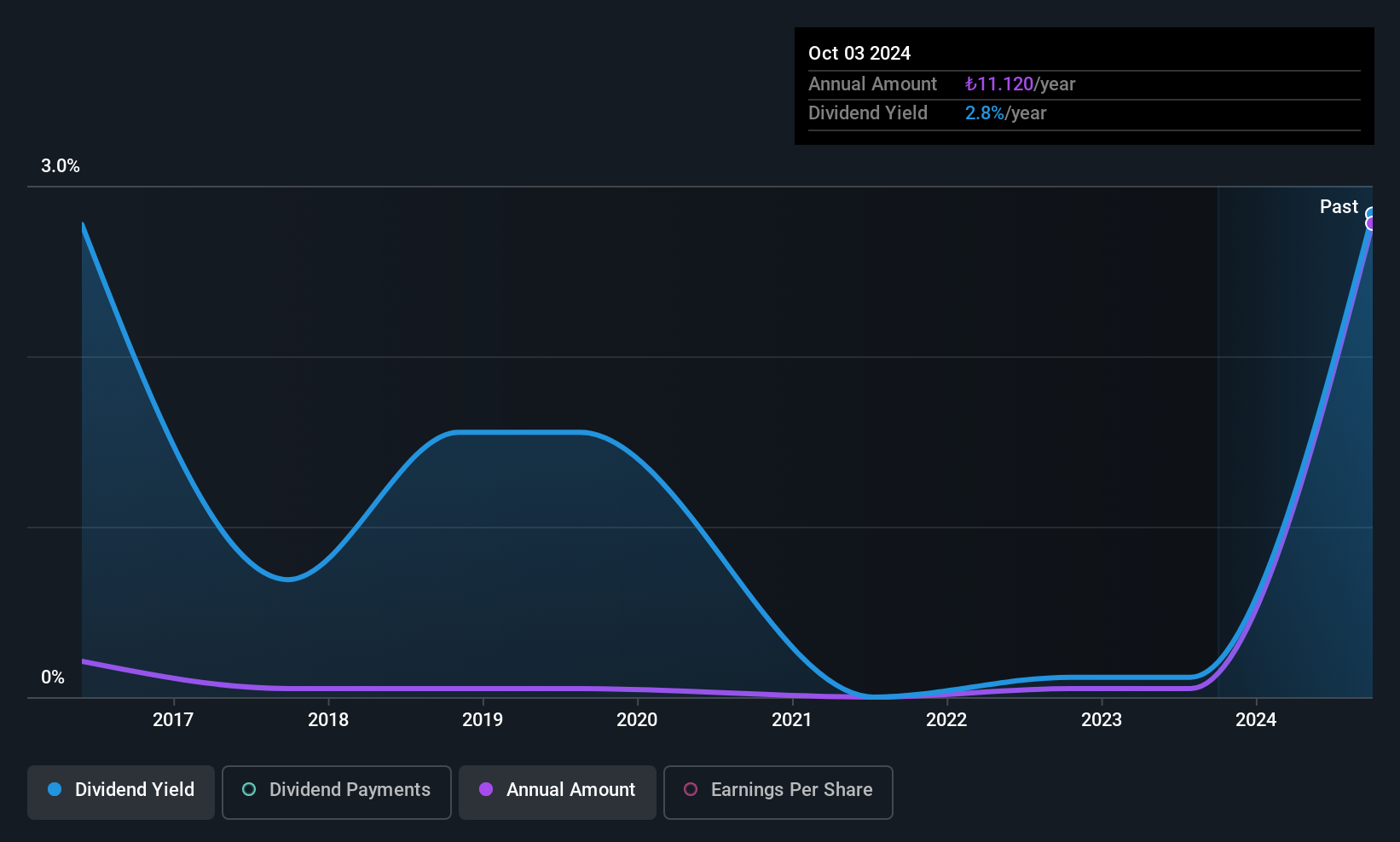

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. operates in the cement industry, producing and distributing various types of cement products, with a market cap of TRY5.66 billion.

Operations: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. generates revenue primarily from its Cement and Ready Mixed Concrete segment, contributing TRY4.87 billion, and its Energy segment, which adds TRY492.22 million.

Dividend Yield: 3.5%

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's dividend yield is in the top 25% of Turkish market payers, yet its track record remains volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows, with a low payout ratio of 7.9% and a reasonable cash payout ratio of 55.2%. Recent earnings show improved profitability with TRY 88.64 million net income in Q3 2025, indicating potential for continued dividend sustainability despite past fluctuations.

- Take a closer look at Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's potential here in our dividend report.

- Upon reviewing our latest valuation report, Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's share price might be too optimistic.

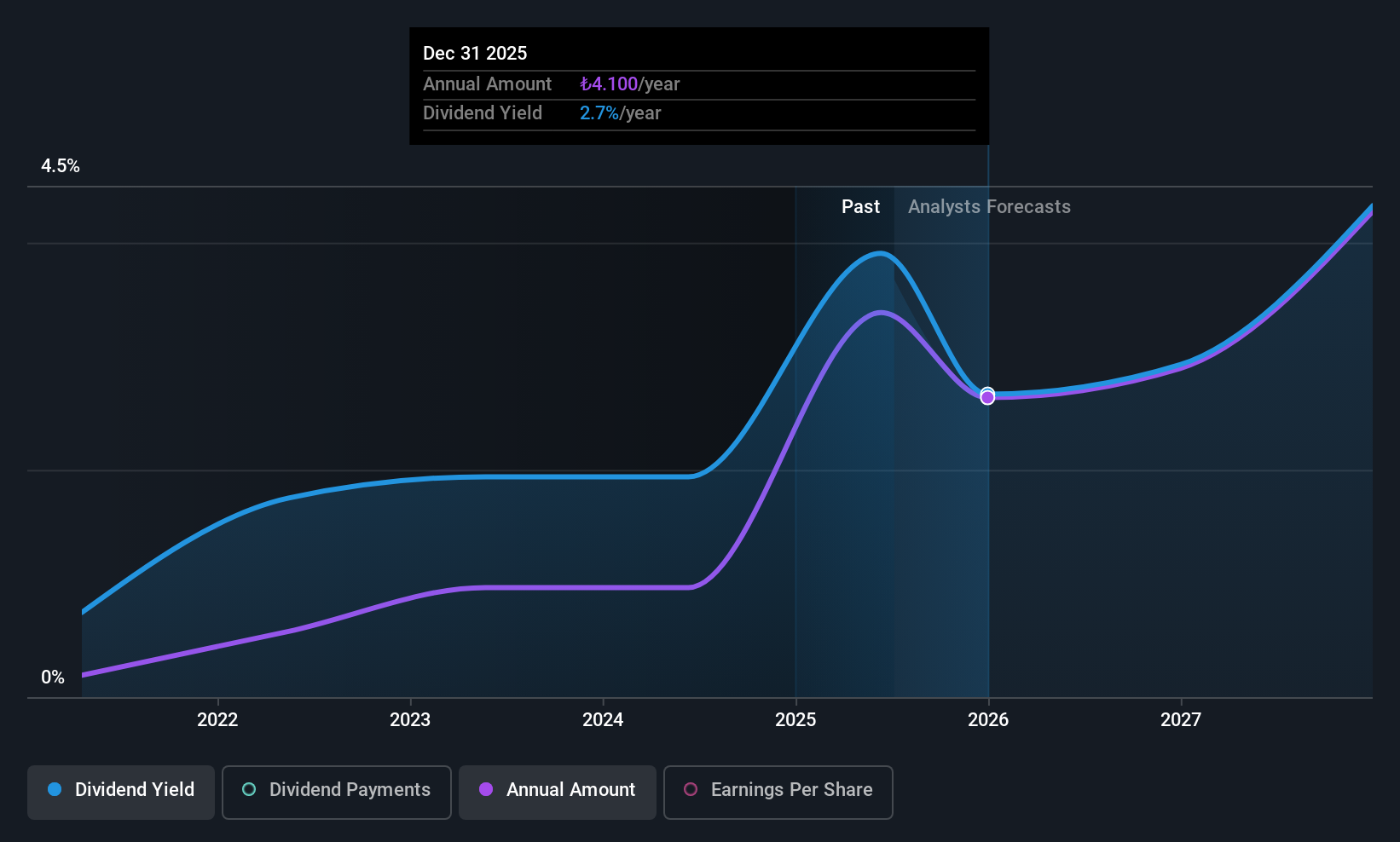

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions both in Turkey and internationally, with a market capitalization of TRY14.86 billion.

Operations: Logo Yazilim Sanayi ve Ticaret A.S. generates revenue primarily from the software industry, amounting to TRY4.48 billion.

Dividend Yield: 3.4%

Logo Yazilim Sanayi ve Ticaret's dividend yield ranks in the top 25% of the Turkish market, supported by a low payout ratio of 37.8% and a cash payout ratio of 56.5%, ensuring coverage by earnings and cash flows. Despite only five years of dividend history, payments have been stable. Recent earnings show strong growth, with Q3 net income at TRY 239.77 million, up from TRY 148.37 million last year, suggesting robust financial health to sustain dividends.

- Unlock comprehensive insights into our analysis of Logo Yazilim Sanayi ve Ticaret stock in this dividend report.

- Our valuation report here indicates Logo Yazilim Sanayi ve Ticaret may be undervalued.

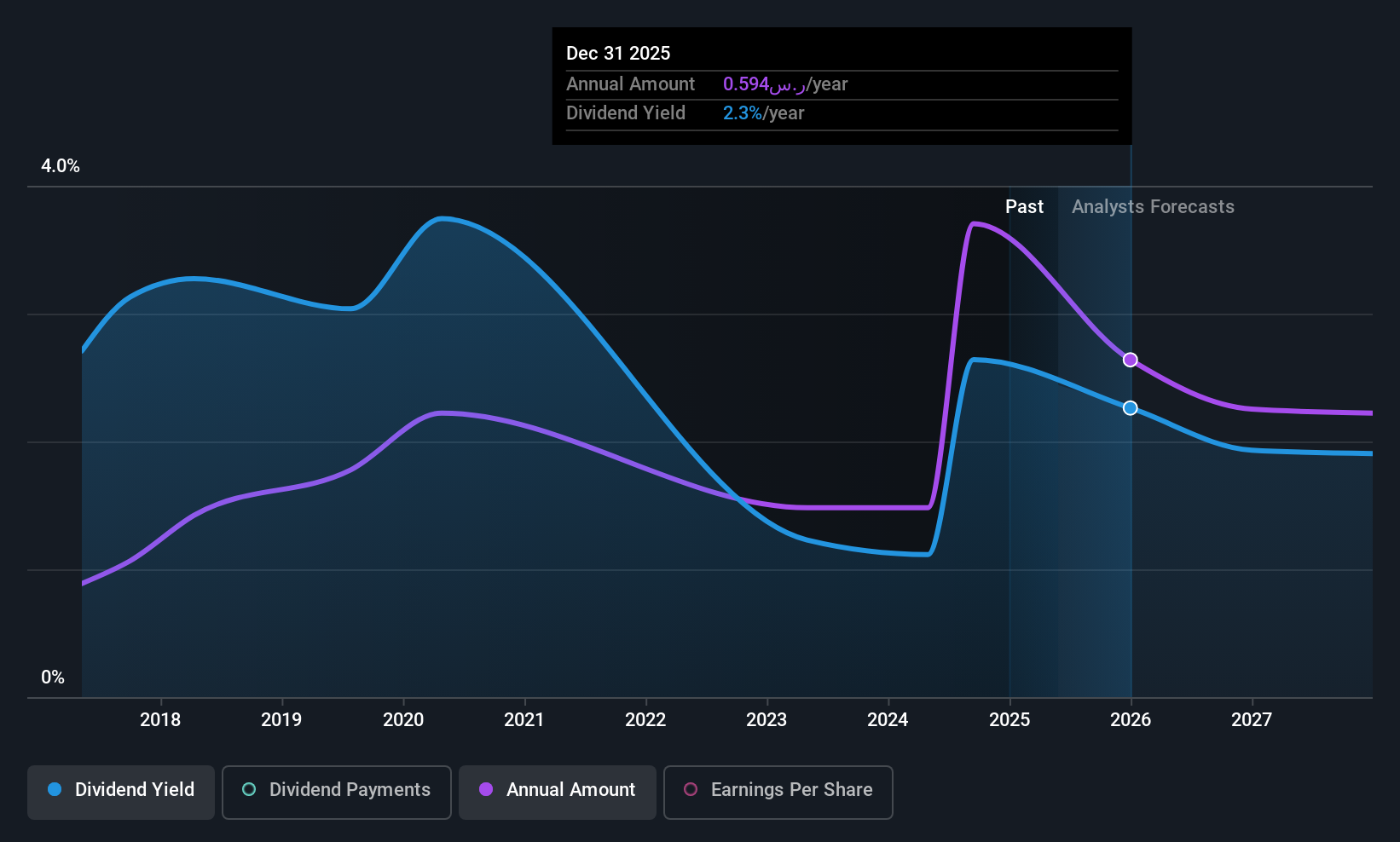

Bank Albilad (SASE:1140)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Albilad, with a market cap of SAR38.16 billion, operates in the Kingdom of Saudi Arabia offering a range of banking products and services through its subsidiaries.

Operations: Bank Albilad generates revenue through four main segments: Retail Banking (SAR2.11 billion), Treasury Sector (SAR1.38 billion), Corporate Banking (SAR2.01 billion), and Investment and Brokerage Services Sector (SAR442.87 million).

Dividend Yield: 3.3%

Bank Albilad's dividend yield is relatively low compared to the top 25% of Saudi Arabian dividend payers. Despite a volatile dividend history over the past decade, current and forecasted payout ratios of 42.6% and 34.3%, respectively, indicate dividends are well covered by earnings. Recent earnings growth, with Q3 net income rising to SAR 766.5 million from SAR 702.7 million last year, supports its capacity to maintain payouts amidst improving financial performance.

- Dive into the specifics of Bank Albilad here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Bank Albilad is trading beyond its estimated value.

Summing It All Up

- Embark on your investment journey to our 58 Top Middle Eastern Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报