Is Adobe’s AI Push Creating a Long Term Opportunity After a 20% Share Price Slide?

- Wondering whether Adobe's share price still reflects its long term potential, or if the market has already priced in the upside? This breakdown will help you decide if it deserves a spot on your watchlist right now.

- Adobe has had a choppy run, slipping about 0.6% over the last week but still climbing 10.6% in the past month. Even so, the stock is down 20.1% year to date and 21.3% over the last year, which hints at shifting sentiment and possible repricing of its growth story.

- Recent headlines have centered on Adobe's continued push deeper into AI powered creative tools and cloud based design workflows as it tries to lock in subscribers and expand its ecosystem against growing competition. At the same time, investors are weighing regulatory scrutiny in the broader tech space and the pace of innovation in generative AI, both of which help explain the volatility around the stock.

- On our checks, Adobe scores a solid 5/6 valuation score, suggesting it screens as undervalued on most metrics we track. However, the real story comes out when we compare different valuation approaches and, later on, look at an even more intuitive way to understand what the market is really willing to pay for this business.

Find out why Adobe's -21.3% return over the last year is lagging behind its peers.

Approach 1: Adobe Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting all the cash it is expected to generate in the future and then discounting those cash flows back to today in $ terms.

Adobe currently generates about $9.5 billion in free cash flow, and analysts, along with Simply Wall St extrapolations, see this rising steadily over the coming decade. Projections show free cash flow climbing to roughly $13.0 billion by 2030, with intermediate years like 2026 to 2029 also trending higher as Adobe expands its subscription and cloud based offerings.

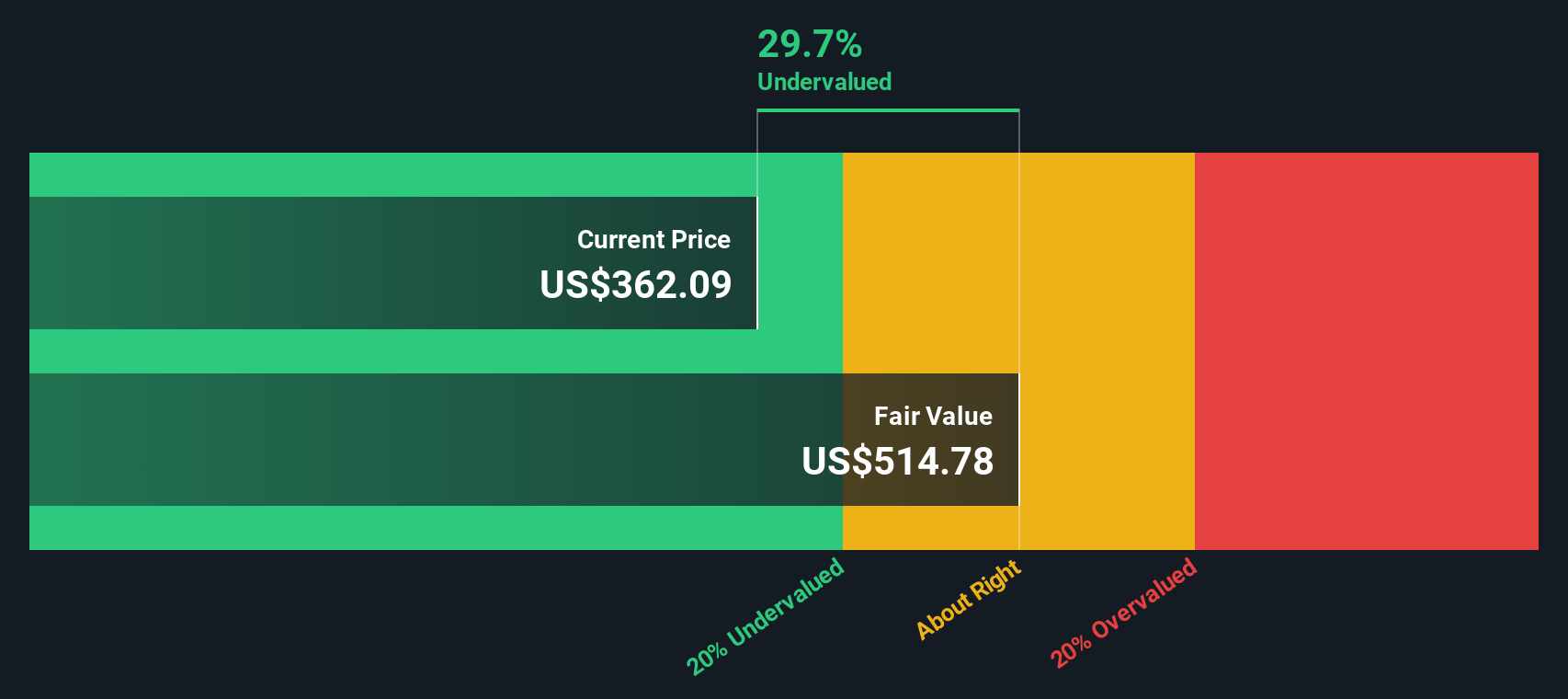

Using a 2 Stage Free Cash Flow to Equity model, these future cash flows are discounted to a present value that implies an intrinsic value of about $519.90 per share. Compared with the current share price, this points to a 32.2% discount, with the market pricing Adobe below its cash flow based fair value.

This DCF view presents Adobe as a strong cash generator that appears to be trading at a notable markdown based on this model.

Result: UNDERVALUED (according to this DCF model)

Our Discounted Cash Flow (DCF) analysis suggests Adobe is undervalued by 32.2%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Adobe Price vs Earnings

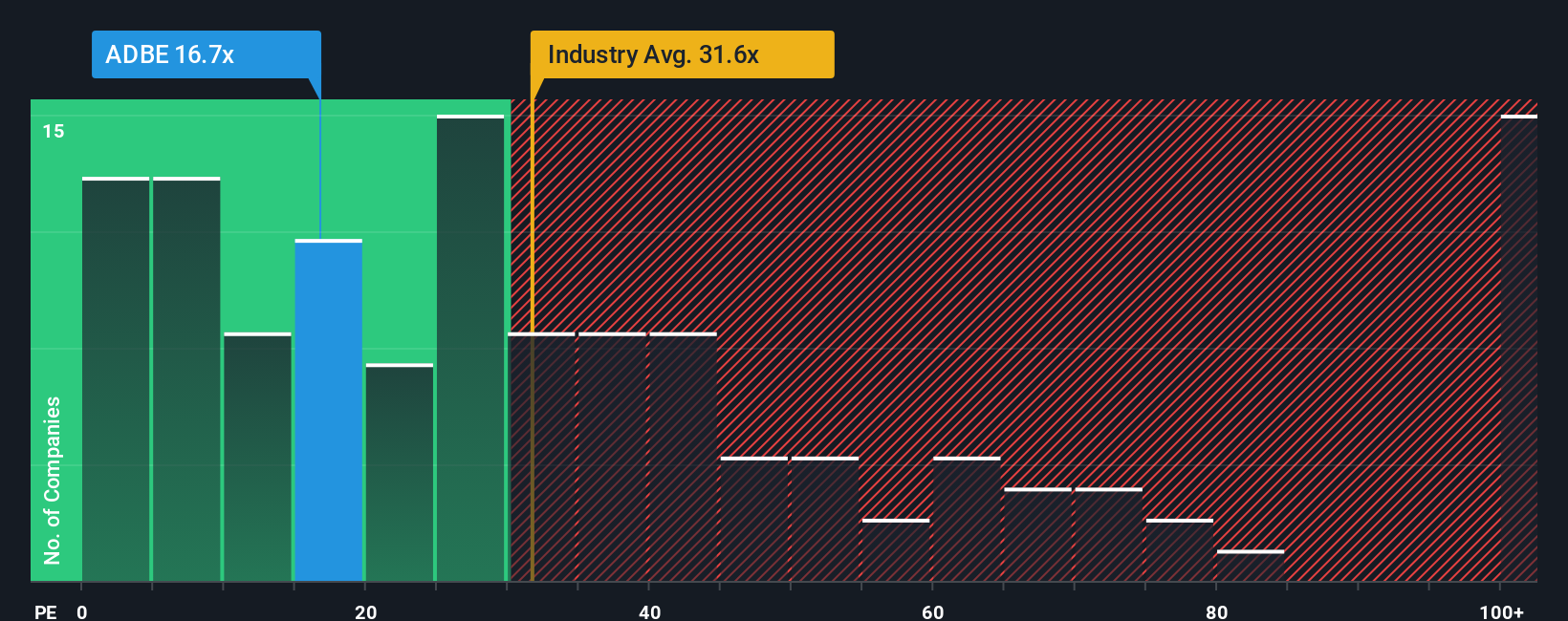

For profitable, mature software companies like Adobe, the price to earnings (PE) ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of current profit. A higher PE can be warranted when a business has strong growth prospects and relatively low risk, while slower or more uncertain growth usually justifies a lower, more conservative multiple.

Adobe currently trades on a PE of about 20.7x, which is below both the broader Software industry average of around 32.3x and the peer group average near 57.3x. On the surface, that discount suggests the market is more cautious on Adobe than on many of its software peers, despite its scale and profitability.

Simply Wall St also estimates a proprietary Fair Ratio for Adobe of roughly 35.6x, which reflects what investors might reasonably pay given its earnings growth outlook, margins, industry, market cap and risk profile. This Fair Ratio goes beyond simple peer or industry comparisons by baking in company specific fundamentals, rather than assuming all software names deserve the same multiple. Compared with Adobe’s actual 20.7x PE, the Fair Ratio indicates the shares are trading well below what these fundamentals would typically support.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Adobe Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Adobe’s story with a concrete financial forecast and a Fair Value you can compare to today’s share price.

On Simply Wall St’s Community page, Narratives let investors spell out their assumptions for future revenue, earnings and margins, and then translate that story into numbers so the platform can calculate what they believe Adobe is really worth.

Because Narratives stay linked to live market data, they update dynamically when new earnings, product news or guidance arrives, helping you quickly see whether your Fair Value still supports buying, holding or selling at the current price.

Looking at Adobe, for instance, one optimistic Narrative pegs Fair Value near 605 dollars a share, while a more cautious Narrative sits closer to about 272 dollars. That spread shows how different but well structured stories about AI driven growth, competition and margins can lead to very different, yet transparent, investment decisions.

For Adobe, here are previews of two leading Adobe Narratives to make comparison easier:

Fair Value: $383.06 per share

Implied Upside vs Current Price: 7.99% undervalued

Revenue Growth Assumption: 8.12%

- Frames Adobe as a wide moat, highly profitable franchise facing rising AI competition and focused rivals like Figma, but still fundamentally strong on ROIC, margins, and balance sheet strength.

- Builds a probability-weighted Bear, Base, and Bull valuation map that converges on a Fair Value above today’s price, assuming revenue growth normalizes around 8 to 10% with net margins near 28 to 29% and a mid to high teens future PE.

- Argues that, even with potential moat erosion and higher AI R&D spend, Adobe’s enterprise relationships and copyright-safe Firefly positioning can support durable cash generation that the market may be discounting too heavily.

Fair Value: $271.93 per share

Implied Downside vs Current Price: 29.64% overvalued

Revenue Growth Assumption: 6.66%

- Presents a cautious view that rising AI infrastructure and development costs, plus heavier competition and regulatory scrutiny, could pressure Adobe’s long-term margins and limit its ability to re-accelerate growth.

- Draws on the lowest analyst price targets, assuming revenue growth in the mid single to high single digits, modest margin compression, and a lower future PE multiple that results in a Fair Value below the current share price.

- Warns that if AI monetization, new subscription tiers, and large deals do not execute smoothly, investors could experience both slower earnings growth and multiple compression from today’s levels.

Do you think there's more to the story for Adobe? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报