Undiscovered Gems In Asia Three Promising Stocks With Strong Fundamentals

As global markets face mixed performances and economic uncertainties, the Asian market continues to present unique opportunities for investors seeking growth. In this environment, identifying stocks with strong fundamentals becomes crucial, as they can offer stability and potential upside amid fluctuating market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ohashi Technica | NA | 6.82% | -2.11% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | 0.06% | -13.76% | -28.84% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| Grade Upon Technology | NA | 21.73% | 65.67% | ★★★★★★ |

| Wholetech System Hitech | 14.93% | 13.36% | 18.63% | ★★★★★☆ |

| Xinya Electronic | 51.57% | 28.63% | 3.77% | ★★★★★☆ |

| Champion Building MaterialsLtd | 35.20% | -0.61% | -2.99% | ★★★★★☆ |

| Kung Sing Engineering | 15.19% | 10.12% | -35.75% | ★★★★★☆ |

| Iljin DiamondLtd | 2.08% | -4.09% | 13.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Quick Intelligent EquipmentLtd (SHSE:603203)

Simply Wall St Value Rating: ★★★★★★

Overview: Quick Intelligent Equipment Co., Ltd. is involved in the research, development, manufacturing, and sale of precision assembly technology for electronics both in China and internationally, with a market cap of CN¥9.03 billion.

Operations: Quick Intelligent Equipment Co., Ltd. generates revenue primarily from the Special Equipment Manufacturing Industry, amounting to CN¥1.07 billion. The company focuses on precision assembly technology for electronics, serving both domestic and international markets.

Quick Intelligent Equipment Co.,Ltd. showcases robust growth with earnings up by 25.3% over the past year, outpacing the Machinery industry's 6.1%. The company is debt-free, which enhances its financial stability and flexibility in operations. Its price-to-earnings ratio of 36.4x indicates good value compared to the CN market's 44x benchmark. Recent results reveal sales of CNY 808 million for nine months ending September 2025, a rise from CNY 683 million last year, with net income climbing to CNY 198 million from CNY 163 million previously. Earnings per share also increased from CNY 0.65 to CNY 0.79, reflecting strong performance momentum.

FSPG Hi-Tech (SZSE:000973)

Simply Wall St Value Rating: ★★★★★★

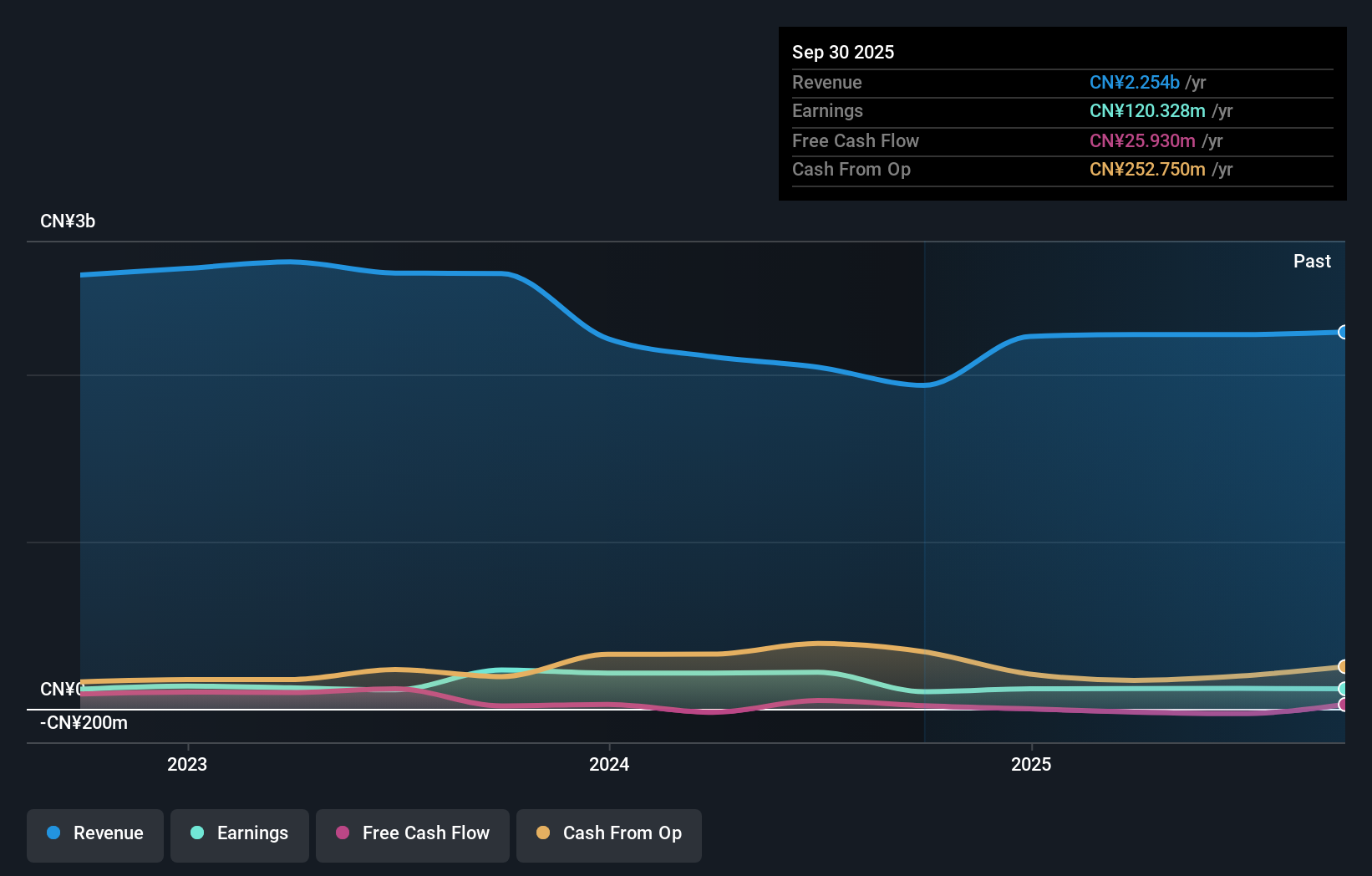

Overview: FSPG Hi-Tech Co., Ltd. is a Chinese company that specializes in the manufacturing and sale of plastic materials, with a market cap of CN¥12.51 billion.

Operations: FSPG Hi-Tech generates revenue primarily from the manufacturing and sale of plastic materials. The company's financial performance includes a net profit margin that has shown variability over recent periods.

FSPG Hi-Tech, a nimble player in the chemicals sector, has shown robust performance with earnings growth of 17.4% over the past year, outpacing the industry's 6.8%. The debt to equity ratio has improved from 33.1% to 24.2% over five years, indicating better financial health. With more cash than total debt and positive free cash flow, financial stability seems assured. Recent earnings for nine months ending September 2025 reported sales of CNY 1.66 billion and net income of CNY 83.92 million, reflecting slight improvements from last year’s figures despite a volatile share price recently observed in the market.

- Dive into the specifics of FSPG Hi-Tech here with our thorough health report.

Evaluate FSPG Hi-Tech's historical performance by accessing our past performance report.

ShenZhen QiangRui Precision Technology (SZSE:301128)

Simply Wall St Value Rating: ★★★★☆☆

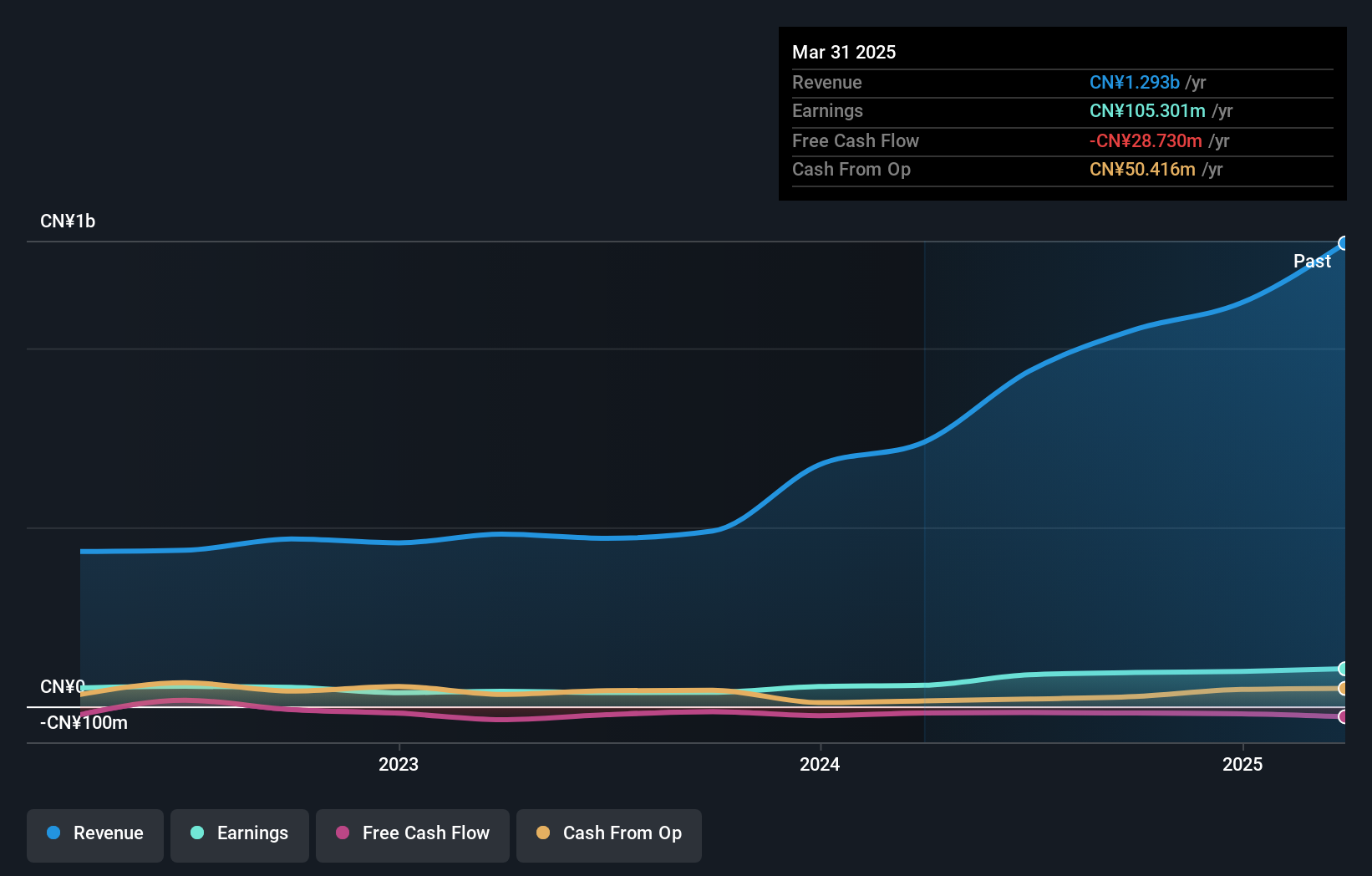

Overview: ShenZhen QiangRui Precision Technology Co., Ltd. specializes in precision manufacturing and operates with a market capitalization of CN¥9.74 billion.

Operations: QiangRui Precision Technology generates its revenue primarily from manufacturing, amounting to CN¥1.71 billion. The company operates with a market capitalization of approximately CN¥9.74 billion, reflecting its significant presence in the precision manufacturing sector.

ShenZhen QiangRui Precision Technology, a small player in the machinery sector, has shown impressive growth with earnings up 41.6% over the past year, outpacing the industry's 6.1%. The company's net debt to equity ratio stands at a satisfactory 7.2%, and its interest payments are well covered by EBIT at 42.2 times coverage. Recent financials reveal sales of CNY 1.37 billion for nine months ending September 2025, compared to CNY 785 million previously, while net income rose to CNY 116 million from CNY 79 million last year. Despite volatility in share price, these figures suggest robust operational performance and potential for future growth within its niche market segment.

Taking Advantage

- Get an in-depth perspective on all 2492 Asian Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报