Oneview Healthcare PLC (ASX:ONE) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Oneview Healthcare PLC (ASX:ONE) shares have continued their recent momentum with a 29% gain in the last month alone. Looking further back, the 25% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

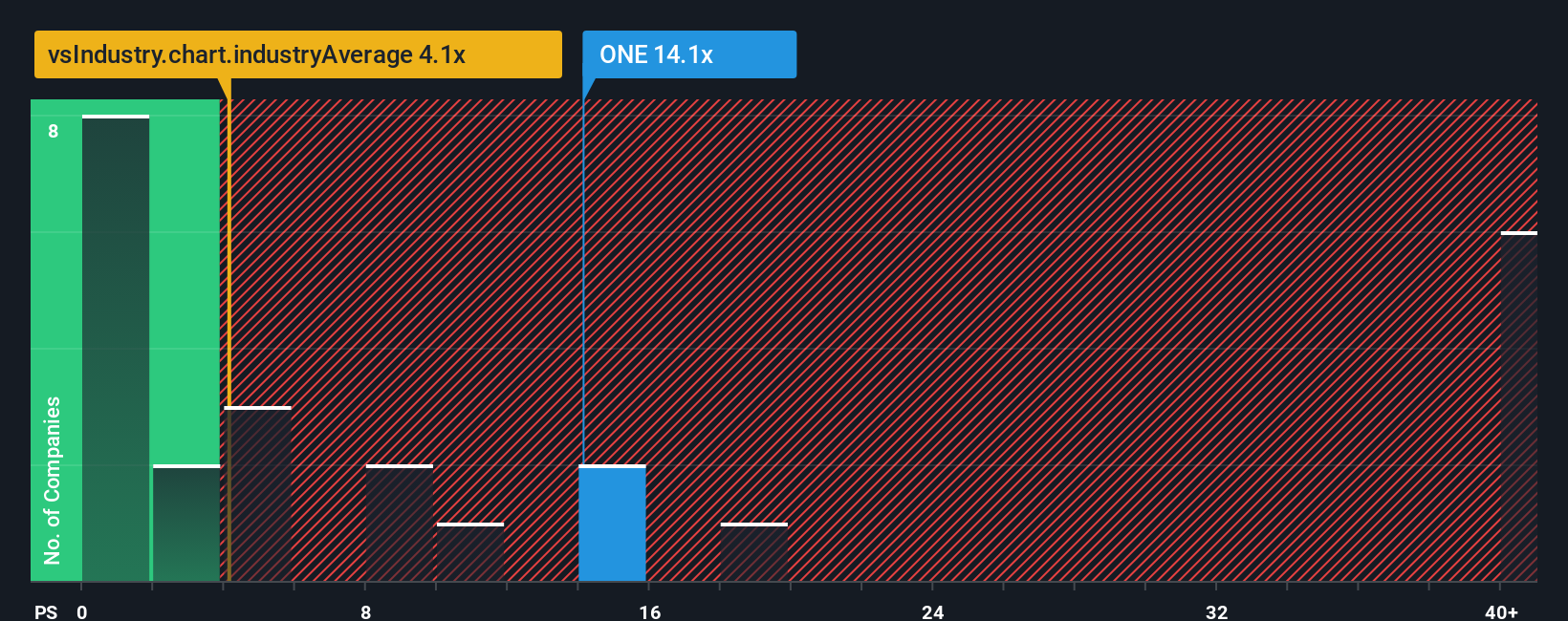

Although its price has surged higher, it's still not a stretch to say that Oneview Healthcare's price-to-sales (or "P/S") ratio of 14.1x right now seems quite "middle-of-the-road" compared to the Healthcare Services industry in Australia, where the median P/S ratio is around 12.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Oneview Healthcare

What Does Oneview Healthcare's P/S Mean For Shareholders?

Oneview Healthcare could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oneview Healthcare.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Oneview Healthcare's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. As a result, it also grew revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 31% per year over the next three years. With the industry predicted to deliver 312% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Oneview Healthcare's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Oneview Healthcare's P/S Mean For Investors?

Its shares have lifted substantially and now Oneview Healthcare's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Oneview Healthcare's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Oneview Healthcare that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报