SHIFT (TSE:3697): Valuation Check After Subsidiary Mergers and Digital Transformation Push

SHIFT (TSE:3697) just set a clear course for its next growth chapter by approving a series of absorption type mergers that pull key regional and consulting subsidiaries directly under its wing.

See our latest analysis for SHIFT.

The restructuring news lands at an interesting moment, with a 1 day share price return of 3.82 percent and a 7 day share price return of 12.32 percent offering a short term rebound against a much weaker 90 day share price return of 21.83 percent and a 3 year total shareholder return of 36.10 percent. This suggests momentum is tentatively rebuilding as investors reassess SHIFT’s long term growth story and valuation.

If SHIFT’s latest moves have you rethinking the software quality space, it could be worth scanning other high growth tech names via high growth tech and AI stocks to spot similar opportunities.

With the shares still trading at a steep discount to analyst targets despite double digit revenue and profit growth, investors now face a key question: is this a mispriced turnaround, or is the market already baking in the next leg of growth?

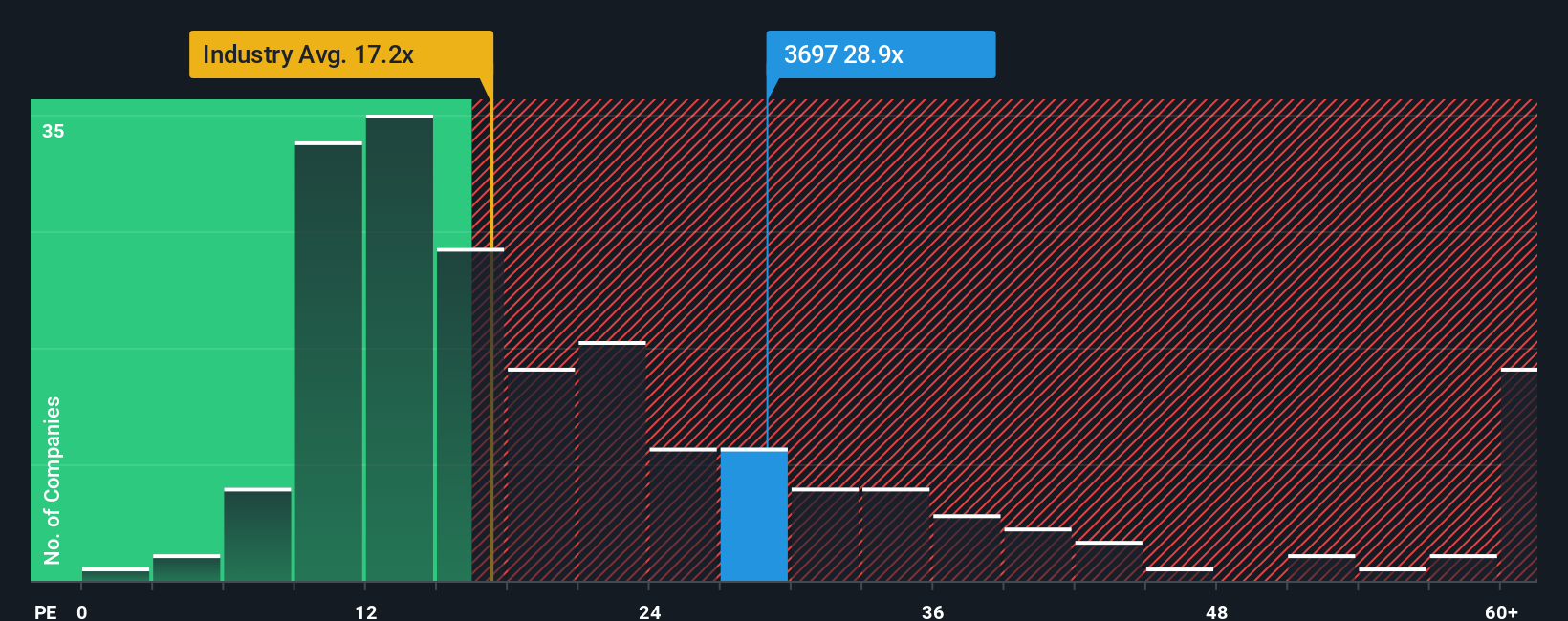

Price-to-Earnings of 29.6x: Is it justified?

Our SWS DCF model points to a fair value of ¥1326.02 per share, with SHIFT’s last close of ¥1004.5 trading at a material discount.

The DCF framework projects SHIFT’s future cash flows, then discounts them back to today using a rate that reflects risk and the time value of money. This produces an intrinsic value estimate rather than relying purely on current market sentiment.

For a software quality and consulting business with strong historic earnings growth and high quality profits, this cash flow centric view matters. SHIFT’s earnings have expanded in recent years and are expected to continue growing faster than the broader Japanese market, which can support a higher intrinsic value than what the share price currently implies.

Look into how the SWS DCF model arrives at its fair value.

Result: DCF Fair value of ¥1326.02 (UNDERVALUED)

However, sustained share price underperformance and any slowdown in SHIFT’s double digit revenue and profit growth could quickly undermine the undervaluation narrative.

Find out about the key risks to this SHIFT narrative.

Another angle on valuation

Against that DCF upside, SHIFT’s 29.6x price to earnings multiple paints a tougher picture. It sits well above both IT industry peers at 17.2x and the 19.9x peer average, even though it is close to our 30.9x fair ratio. Is the market overpaying for growth here, or just pricing in execution risk more cautiously?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SHIFT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SHIFT Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your SHIFT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when you can quickly scan fresh, data driven ideas with the Simply Wall St screener and stay ahead of the crowd.

- Capture potential bargains early by using these 907 undervalued stocks based on cash flows to spot companies where cash flow strength is not yet reflected in the share price.

- Ride structural growth trends by scanning these 24 AI penny stocks that could benefit as artificial intelligence reshapes entire industries and earnings power.

- Boost your income potential by targeting these 10 dividend stocks with yields > 3% that may add yield on top of long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报