Should Insider Buying, Special Dividend and Leadership Changes Require Action From W. R. Berkley (WRB) Investors?

- Earlier this month, W. R. Berkley Corporation presented at the Goldman Sachs 2025 U.S. Financial Services Conference in New York, while insiders and Mitsui Sumitomo Insurance Co. increased their holdings and the company declared a US$1.00 per share special dividend for payment on December 29, 2025.

- Taken together, the insider and institutional buying, special dividend, and leadership change at Berkley Net point to rising internal and external confidence in W. R. Berkley’s direction.

- We’ll now consider how this wave of insider and institutional buying could influence W. R. Berkley’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

W. R. Berkley Investment Narrative Recap

To own W. R. Berkley, you need to be comfortable with a property and casualty insurer that leans heavily on underwriting discipline in competitive, catastrophe exposed markets. The latest insider and institutional buying, plus the US$1.00 per share special dividend, supports the near term capital return story, but does not materially change the key catalyst of sustaining underwriting profitability or the main risk of pricing pressure and loss cost inflation.

The special cash dividend, on top of the earlier US$0.50 special payment in June, is the clearest recent signal about how Berkley is choosing to return excess capital. For investors watching catalysts, it sharpens the focus on whether the company can keep generating sufficient earnings and surplus to fund both these distributions and future growth, without increasing vulnerability to the competitive and catastrophe related risks already on the radar.

Yet against this backdrop of confidence, investors should still be alert to how prolonged social inflation could...

Read the full narrative on W. R. Berkley (it's free!)

W. R. Berkley's narrative projects $14.3 billion revenue and $2.0 billion earnings by 2028. This requires 0.0% yearly revenue growth and about a $0.2 billion earnings increase from $1.8 billion today.

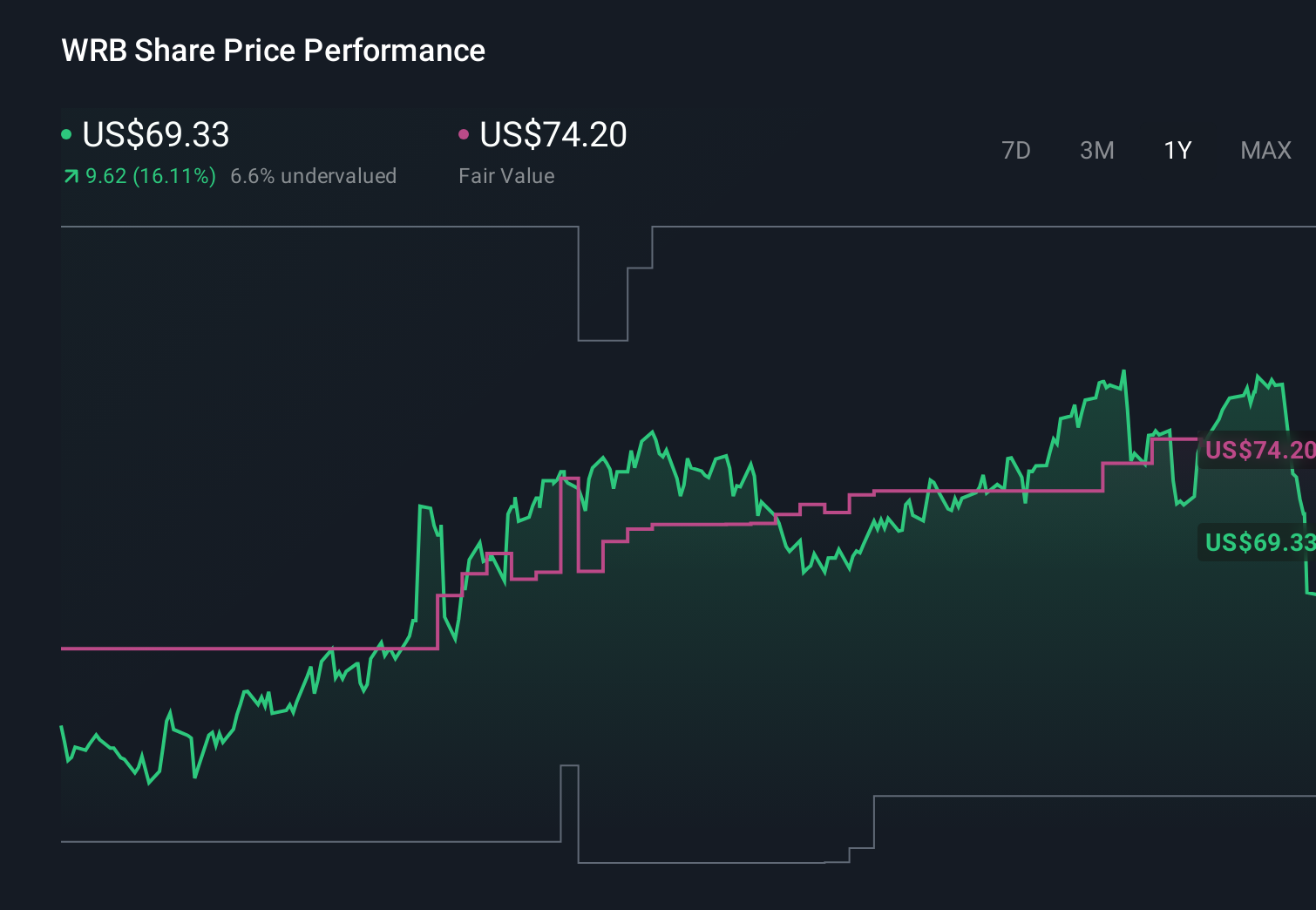

Uncover how W. R. Berkley's forecasts yield a $74.20 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from US$26.69 to US$117.81, underlining how far apart individual views can be. Set against concerns about rising competition and pricing discipline in property and reinsurance markets, this spread of opinions encourages you to weigh several different expectations for W. R. Berkley’s future performance.

Explore 4 other fair value estimates on W. R. Berkley - why the stock might be worth as much as 68% more than the current price!

Build Your Own W. R. Berkley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W. R. Berkley research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W. R. Berkley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W. R. Berkley's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报