Cyclopharm Limited's (ASX:CYC) Price Is Right But Growth Is Lacking After Shares Rocket 28%

Cyclopharm Limited (ASX:CYC) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

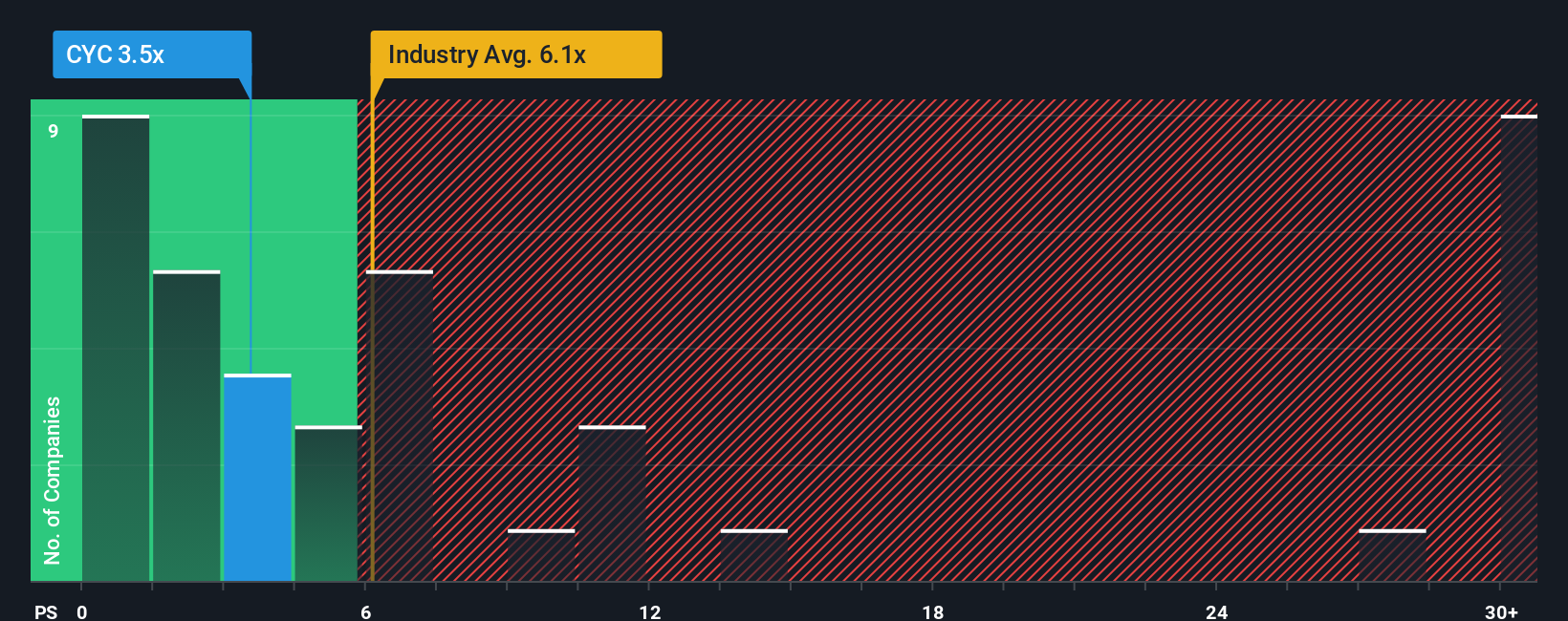

In spite of the firm bounce in price, Cyclopharm may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.5x, since almost half of all companies in the Medical Equipment industry in Australia have P/S ratios greater than 6.1x and even P/S higher than 26x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Cyclopharm

What Does Cyclopharm's P/S Mean For Shareholders?

Cyclopharm certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cyclopharm.How Is Cyclopharm's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Cyclopharm's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. The latest three year period has also seen an excellent 34% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 29% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 44% growth forecast for the broader industry.

In light of this, it's understandable that Cyclopharm's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Cyclopharm's P/S Mean For Investors?

Despite Cyclopharm's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Cyclopharm maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Cyclopharm that you should be aware of.

If these risks are making you reconsider your opinion on Cyclopharm, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报