Evaluating Modine Manufacturing (MOD) Stock Valuation as Earnings Momentum and Growth Expectations Draw Investor Focus

Modine Manufacturing (MOD) just added a new wrinkle to its stock story with a formal retirement plan for Climate Solutions president Eric McGinnis, even as investors focus on the companys earnings momentum.

See our latest analysis for Modine Manufacturing.

The planned transition for McGinnis lands as Modine’s 1 year to date share price return of 17.96 percent and 3 year total shareholder return of 597.71 percent signal momentum that is moderating, not stalling, near the 137.03 dollar mark.

If this kind of execution story has your attention, it is also worth exploring fast growing stocks with high insider ownership as a way to uncover other fast moving opportunities with aligned management incentives.

With earnings still beating expectations and analysts seeing roughly 35 percent upside to their 183 dollar target, the real question is whether Modine remains undervalued or if markets are already pricing in its future growth.

Most Popular Narrative Narrative: 25.1% Undervalued

With the narrative fair value set around 183 dollars versus Modine’s 137.03 dollar close, the spotlight shifts to how aggressively future growth is being priced in.

The accelerating build out of data centers and the need for next generation cooling solutions are driving extraordinary demand for Modine's products, with management forecasting the potential to double data center revenues from approximately 1 billion dollars in fiscal 2026 to 2 billion dollars by fiscal 2028, this structural demand from digital infrastructure is set to materially boost revenue growth and deliver significant operating leverage over time.

Want to see the math behind that confidence gap, between today’s price and that higher fair value, driven by rapid top line growth, rising margins and a richer future earnings multiple that rivals fast growing industrial tech names, all baked into one bold earnings trajectory.

Result: Fair Value of $183 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated North American data center exposure and execution risks around acquisitions and restructuring could quickly compress margins if demand or integration timelines slip.

Find out about the key risks to this Modine Manufacturing narrative.

Another Lens on Value

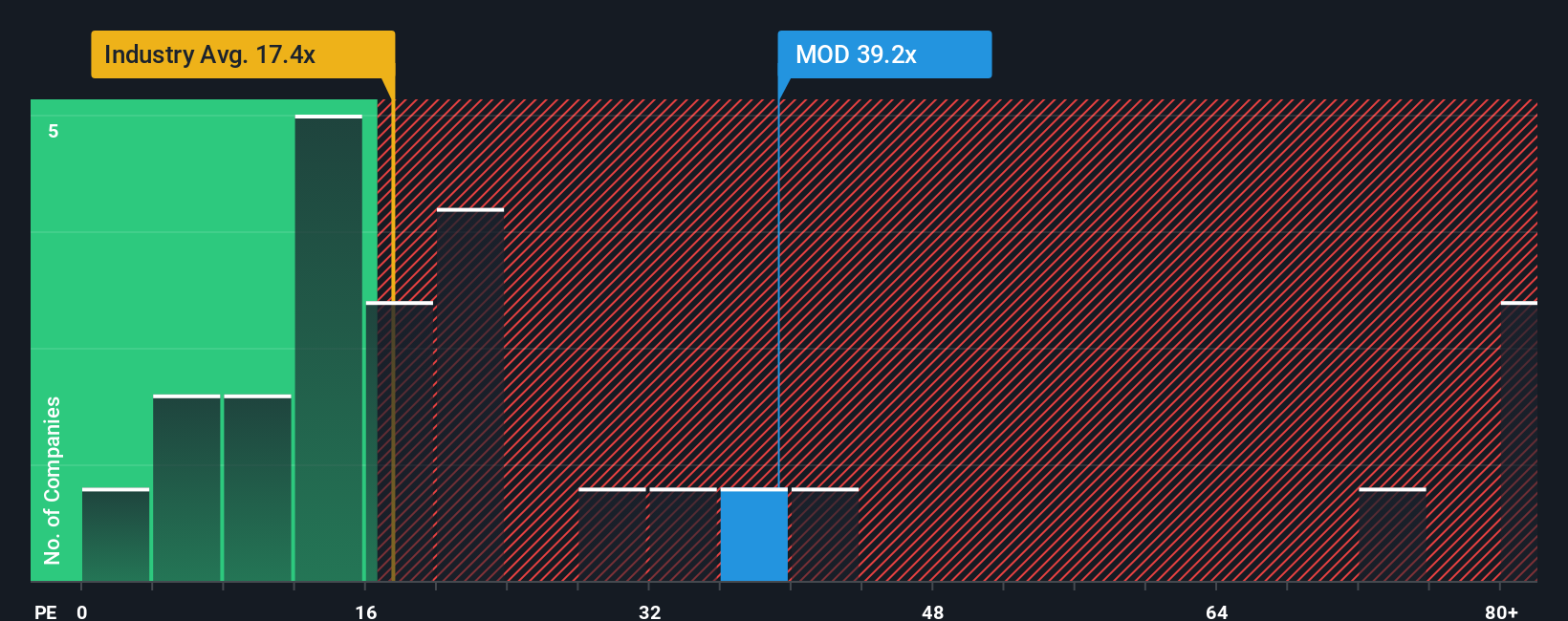

Step away from the narrative fair value and Modine suddenly looks far less forgiving. Its price to earnings ratio of 38.7 times towers over both the US Building industry at 19.4 times and peer average at 27.2 times, even if our fair ratio points higher at 53.8 times. Is this a quality premium or valuation risk building up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If this view does not quite match your own and you would rather dig into the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your Modine Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one compelling story when you can quickly spot other potential winners using focused stock screens built to surface clear, data backed opportunities.

- Target powerful price dislocations by running through these 907 undervalued stocks based on cash flows that may offer solid businesses at meaningful discounts to their intrinsic worth.

- Ride structural growth in automation and data by scanning these 24 AI penny stocks to identify candidates that may benefit from accelerating adoption across industries.

- Secure potential income and stability by reviewing these 10 dividend stocks with yields > 3% that combine shareholder payouts with resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报