Entergy (ETR) Valuation Check as New Meta Power Plants Break Ground Under 15‑Year Deal

Entergy (ETR) just took a concrete step into the data center energy race by starting construction on two combined cycle plants in Louisiana under a 15 year deal to power Meta’s new facility.

See our latest analysis for Entergy.

The Meta deal caps a run of constructive updates for Entergy, from breaking ground on the new Louisiana plants to securing equipment for incoming clients. The stock’s roughly 22 percent year to date share price return, alongside a 25 percent one year total shareholder return, suggests momentum is gradually building as investors reassess its growth profile and risk balance.

If this kind of data center driven story has your attention, it is a good moment to explore other potential winners across high growth tech and AI stocks for more ideas beyond utilities.

With Entergy trading about 13 percent below the average analyst target yet at a premium to some regulated peers, the real question now is whether data center upside leaves room for further gains or if markets already see the future growth.

Most Popular Narrative: 11.2% Undervalued

With the narrative fair value sitting meaningfully above Entergy’s last close, the story being told leans toward upside from here rather than exhaustion.

Capital investment of $40 billion over four years (with an expanded pipeline for renewables, grid modernization, and resilience upgrades) is expected to grow the company's rate base and support above average EPS and earnings growth for several years.

Want to see what underpins that bold spending plan? The narrative quietly bakes in faster growth, fatter margins, and a richer earnings multiple. Curious how those levers combine into today’s fair value call?

Result: Fair Value of $103.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital needs and extreme weather risks could pressure returns, especially if regulators push back on cost recovery or if financing proves more expensive.

Find out about the key risks to this Entergy narrative.

Another Take on Value

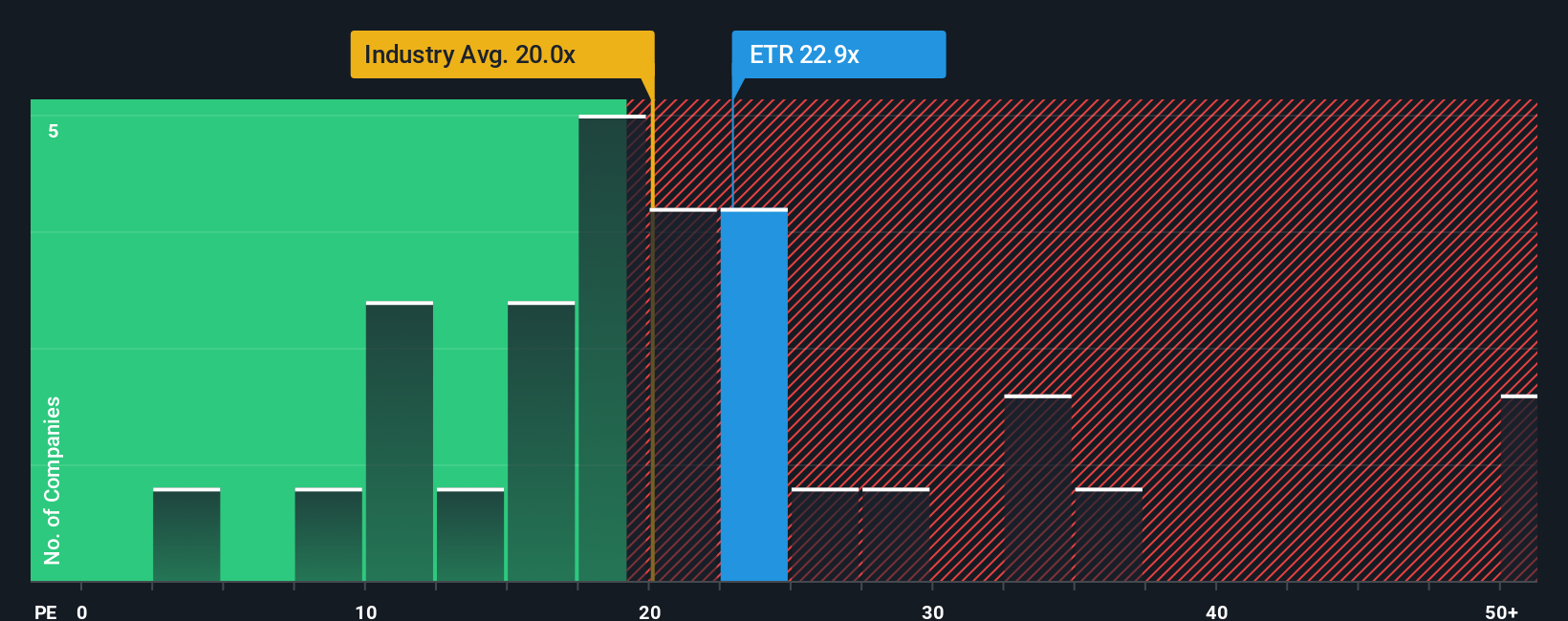

There is a catch to the upside story. Entergy trades on about 23 times earnings versus 19.4 times for US electric utilities and around 18.5 times for close peers, even though our fair ratio suggests about 25.2 times is where the market could drift toward.

That premium means there is less room for error. If growth or regulation disappoint, could the share price drift back toward peer-like valuations before moving higher again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entergy Narrative

If you see Entergy’s story differently or simply want to stress test the assumptions yourself, you can build a full view in minutes: Do it your way.

A great starting point for your Entergy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge

Before you move on, consider your next idea with targeted stock lists that highlight opportunities many investors may not notice right away.

- Explore income potential by scanning these 10 dividend stocks with yields > 3% with a history of consistent payouts that may help steady a portfolio in volatile markets.

- Focus your growth search on these 24 AI penny stocks that are aligned with the increasing use of artificial intelligence in different industries.

- Look for possible market mispricing with these 907 undervalued stocks based on cash flows that appear inexpensive relative to their cash flow characteristics and business outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报