Warner Music Group (WMG): Revisiting Valuation After Morgan Stanley Upgrade and Insider Buying Boost

Morgan Stanley’s move to upgrade Warner Music Group (WMG) to overweight, paired with executives buying more shares, has put the stock back on traders’ screens as they reassess its recent pullback.

See our latest analysis for Warner Music Group.

The upgrade and insider buying come after a choppy spell, with the share price at $29.93 and a 90 day share price return of minus 10.15 percent contrasting with a milder 1 year total shareholder return of minus 1.34 percent. This suggests recent pessimism may be overshooting longer term fundamentals.

If this kind of sentiment shift has you looking beyond just one name, it could be a smart moment to scan other media and entertainment players and discover fast growing stocks with high insider ownership.

With Warner Music Group trading at a double digit discount to analyst targets despite solid revenue and profit growth, the key question now is whether this weakness signals a genuine buying opportunity or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 21.2% Undervalued

With Warner Music Group last closing at $29.93 versus a narrative fair value of $38, the valuation story leans firmly toward upside potential.

Ongoing cost reduction initiatives (strategic reorganization, automation, and tech investments) are projected to unlock $300 million in annualized savings by 2027, improving operational efficiency and contributing to margin expansion of 150 to 200 basis points in fiscal 2026. Aggressive catalog acquisitions fueled by the Bain Capital joint venture provide Warner with additional revenue and market share via enhanced M&A capacity while also leveraging its existing global distribution infrastructure for higher catalog monetization, thus supporting sustained earnings growth.

Curious how steady revenue growth, sharply rising profits, and a lower future earnings multiple can still justify a higher price than today? Unlock the full valuation playbook behind this narrative and see which assumptions really move the fair value dial.

Result: Fair Value of $38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker cash generation, alongside execution risk around the Bain joint venture, could quickly challenge confidence in Warner’s margin and growth trajectory.

Find out about the key risks to this Warner Music Group narrative.

Another View on Valuation

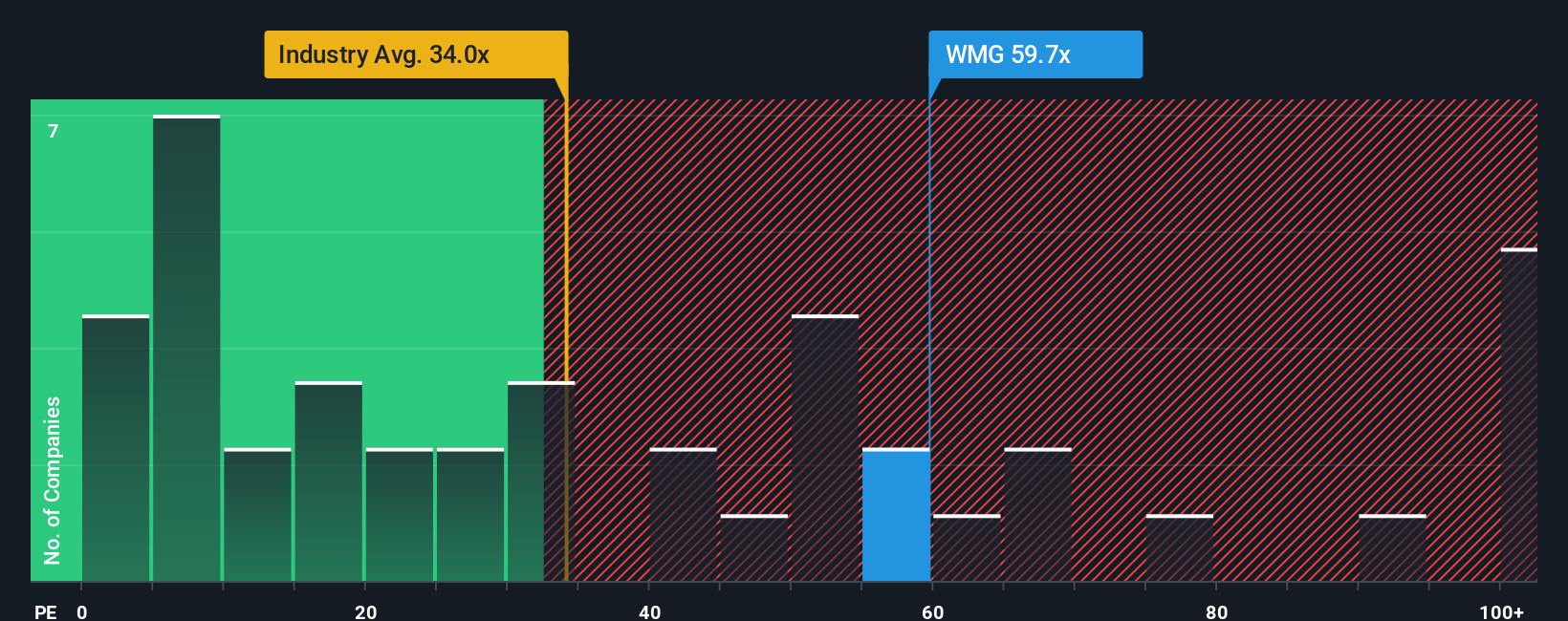

While our fair value points to upside, the price to earnings lens looks less forgiving. WMG trades on 43.3 times earnings versus 20.5 times for the US Entertainment industry and a fair ratio of 27.3 times, suggesting investors may be paying up for growth. Is that premium really justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Warner Music Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Warner Music Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, seize this chance to scan fresh opportunities across the market using the Simply Wall Street Screener so you are not leaving potential upside untouched.

- Capitalize on potential mispricings by targeting companies trading below intrinsic value through these 902 undervalued stocks based on cash flows that could offer stronger risk reward profiles.

- Position yourself at the forefront of automation and machine learning by focusing on innovators powering healthcare transformations with these 29 healthcare AI stocks.

- Ride powerful long term income trends by prioritizing reliable cash returns from businesses identified in these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报