Ameris Bancorp (ABCB): Revisiting Valuation After a Steady Share Price Climb

Ameris Bancorp (ABCB) shares have quietly climbed over the past month, drawing attention to how this regional bank is balancing steady loan growth, credit quality, and profitability in a still uncertain interest rate environment.

See our latest analysis for Ameris Bancorp.

That gradual climb sits on top of a much stronger backdrop, with a year to date share price return of 27.28 percent and a five year total shareholder return of 118.19 percent, suggesting momentum has been building rather than fading.

If this kind of steady compounding appeals to you, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar opportunities with aligned management incentives.

Yet with Ameris trading just below analyst targets but at a sizeable discount to some intrinsic value estimates, the real question is whether today’s price still underestimates its growth runway or whether it already reflects tomorrow’s gains.

Most Popular Narrative Narrative: 5.5% Undervalued

With Ameris Bancorp last closing at $77.63 against a narrative fair value near $82.14, the current setup assumes steady but not spectacular progress ahead.

The analysts have a consensus price target of $77.667 for Ameris Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $438.2 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 6.8%.

Curious what kind of revenue runway, profit margins, and richer earnings multiple have to line up to justify that valuation path? The full narrative spells out the entire blueprint.

Result: Fair Value of $82.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if intense competition forces higher deposit costs or if a regional downturn hits Ameris Bancorp’s Southeastern loan book.

Find out about the key risks to this Ameris Bancorp narrative.

Another Angle on Valuation

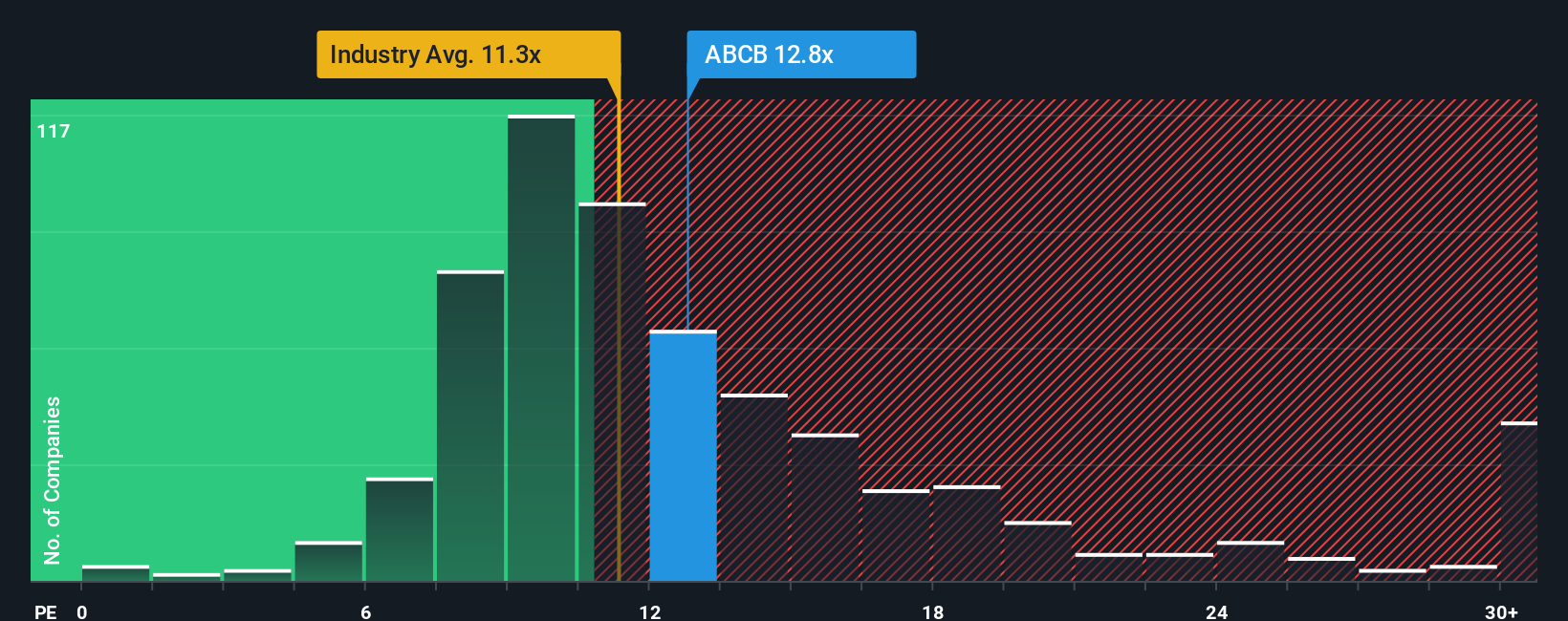

While the narrative fair value paints Ameris as modestly undervalued, its 13.3x price to earnings ratio is actually higher than both the US banks average of 11.9x and its own 11.8x fair ratio estimate. This suggests less obvious upside and greater sensitivity if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameris Bancorp Narrative

If you view the story differently or want to test your own assumptions against the numbers, you can build a full narrative in minutes: Do it your way.

A great starting point for your Ameris Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next moves with focused stock ideas built from real fundamentals, not hype, so tomorrow’s winners do not pass you by.

- Capture potential market mispricings by targeting companies trading below their cash flow potential using these 902 undervalued stocks based on cash flows as your hunting ground for bargains.

- Position yourself at the forefront of technological disruption by zeroing in on these 24 AI penny stocks shaping everything from automation to intelligent decision making.

- Strengthen your passive income strategy by pinpointing reliable payers through these 10 dividend stocks with yields > 3% and turn steady cash distributions into a long term advantage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报