Adaptive Biotechnologies (ADPT): Valuation Check After New Pfizer T-Cell Discovery and AI Drug Collaboration Deals

Adaptive Biotechnologies (ADPT) just signed two non exclusive deals with Pfizer that put its T cell receptor discovery platform and massive antigen mapping dataset at the center of Pfizer’s rheumatoid arthritis and AI driven drug discovery work.

See our latest analysis for Adaptive Biotechnologies.

The Pfizer collaborations come on top of an already sharp re rating, with a roughly 181 percent year to date share price return and a 175 percent one year total shareholder return suggesting investors see momentum building around Adaptive’s platform, even after a bruising five year total shareholder return.

If this kind of deal making has you rethinking your healthcare exposure, it could be a good moment to explore healthcare stocks as potential next candidates for your watchlist.

After such a dramatic rerating and a stock now trading only modestly below consensus targets, is Adaptive still flying under the radar, or are investors already paying upfront for years of future growth?

Most Popular Narrative Narrative: 11% Undervalued

With the most followed fair value at $19.57 versus a last close of $17.41, the narrative argues Adaptive’s cancer testing engine still has room to run.

Marked improvement in profitability, with the MRD segment now EBITDA positive and company wide cash burn improving 36% year over year, signals the business reaching scale and positions Adaptive for operating leverage and expanding net margins as revenue continues to rise.

Want to see how this shift to scale backs that higher price tag? The narrative leans on accelerating revenues, rising margins and an aggressive future earnings multiple. Curious how those moving parts fit together?

Result: Fair Value of $19.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and any stumble in key partnerships or reimbursement could quickly challenge expectations for durable, high margin growth.

Find out about the key risks to this Adaptive Biotechnologies narrative.

Another Lens on Valuation

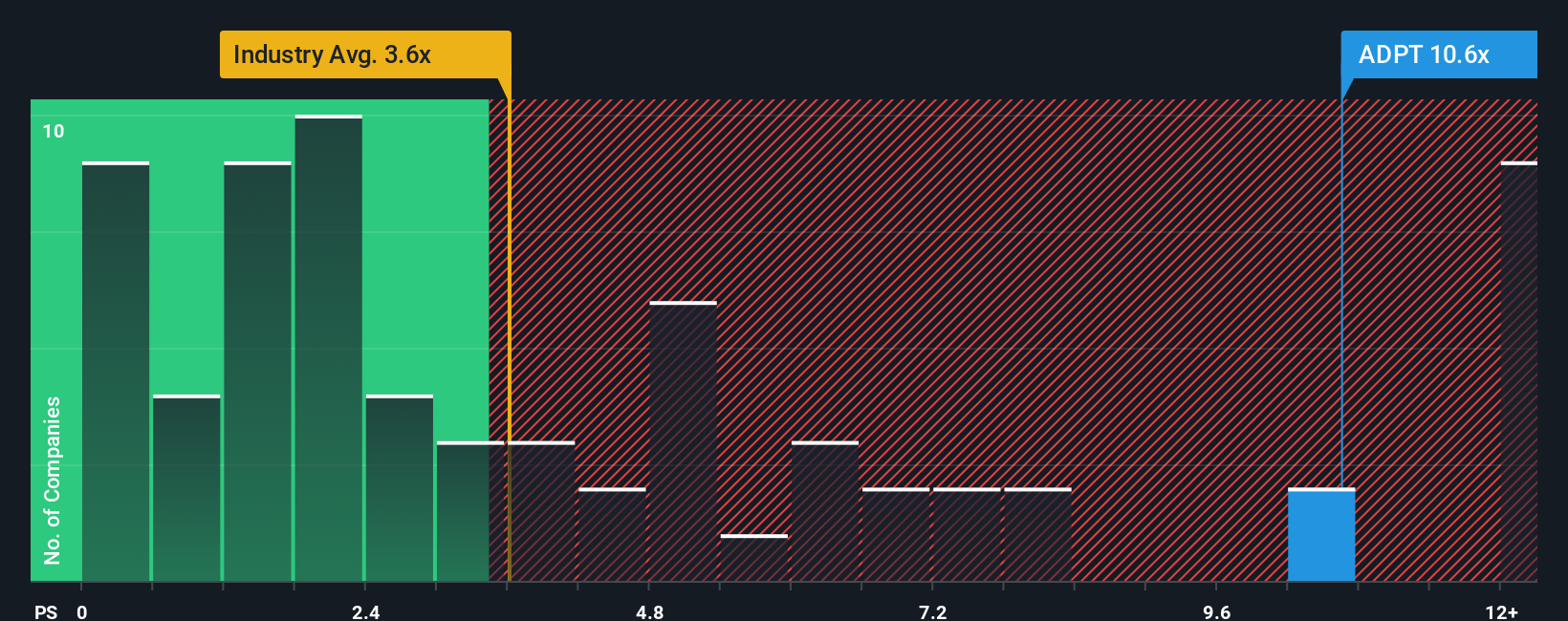

On revenue multiples, the picture looks very different. Adaptive trades at a price to sales ratio of 10.5 times, versus 3.5 times for the US Life Sciences industry and 2.7 times for peers. A fair ratio of 4.9 times suggests the market could eventually lean toward a lower, less forgiving multiple.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adaptive Biotechnologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall St to work uncovering fresh opportunities that match your strategy and could sharpen your next investing decision.

- Capture potential multi baggers early by scanning these 3635 penny stocks with strong financials that pair tiny market caps with improving fundamentals and room for major upside.

- Position ahead of the next tech wave by tracking these 24 AI penny stocks building real businesses around artificial intelligence instead of hype alone.

- Lock in value focused opportunities through these 902 undervalued stocks based on cash flows where strong cash flows meet prices that have not yet caught up to the fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报