Has Indivior’s 192% Surge in 2025 Already Priced In Its Growth Story?

- If you are wondering whether Indivior is still worth buying after a huge run up, you are not alone. This article will walk through what the current price really implies.

- The stock has climbed about 3.0% over the last week, 11.3% over the past month, and an eye catching 191.6% year to date, with a 204.0% gain over the last year underscoring how quickly sentiment has shifted.

- Investors have been reacting to a stream of updates around Indivior's positioning in treatments for opioid use disorder and its strategic push to defend and grow market share in key markets. Ongoing developments around product uptake, patent protection, and broader policy attention on addiction treatment have all helped frame the recent move in the share price as more than just short term noise.

- On our checks, Indivior scores a 3 out of 6 on valuation. This suggests the stock looks undervalued in some areas but not across the board. Next we will break that down using a few standard valuation approaches, before finishing with a way to think about what the market might really be pricing in.

Approach 1: Indivior Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back to today to estimate what the entire business is worth right now.

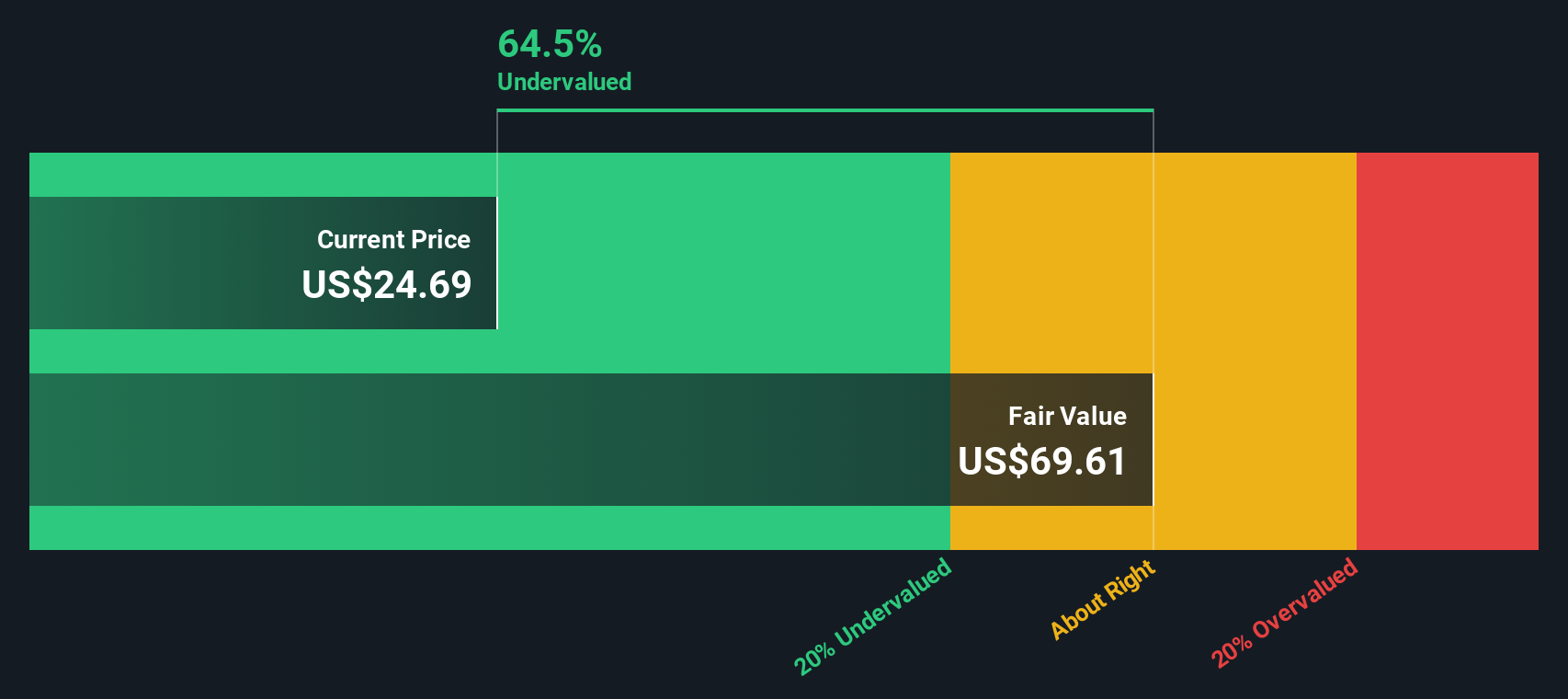

For Indivior, the model uses current Free Cash Flow of about $132.3 Million and analyst forecasts for the next few years, then extends those trends further out. By 2029, annual Free Cash Flow is projected to reach roughly $532.3 Million, with additional growth continuing into the early 2030s based on Simply Wall St extrapolations rather than explicit analyst estimates.

Aggregating and discounting these projected cash flows using a 2 Stage Free Cash Flow to Equity approach yields an estimated intrinsic value of $106.15 per share. Compared with the current market price, this implies the stock is trading at about a 65.7% discount. This indicates investors are still pricing in a much more cautious future than the cash flow outlook assumes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Indivior is undervalued by 65.7%. Track this in your watchlist or portfolio, or discover 902 more undervalued stocks based on cash flows.

Approach 2: Indivior Price vs Earnings

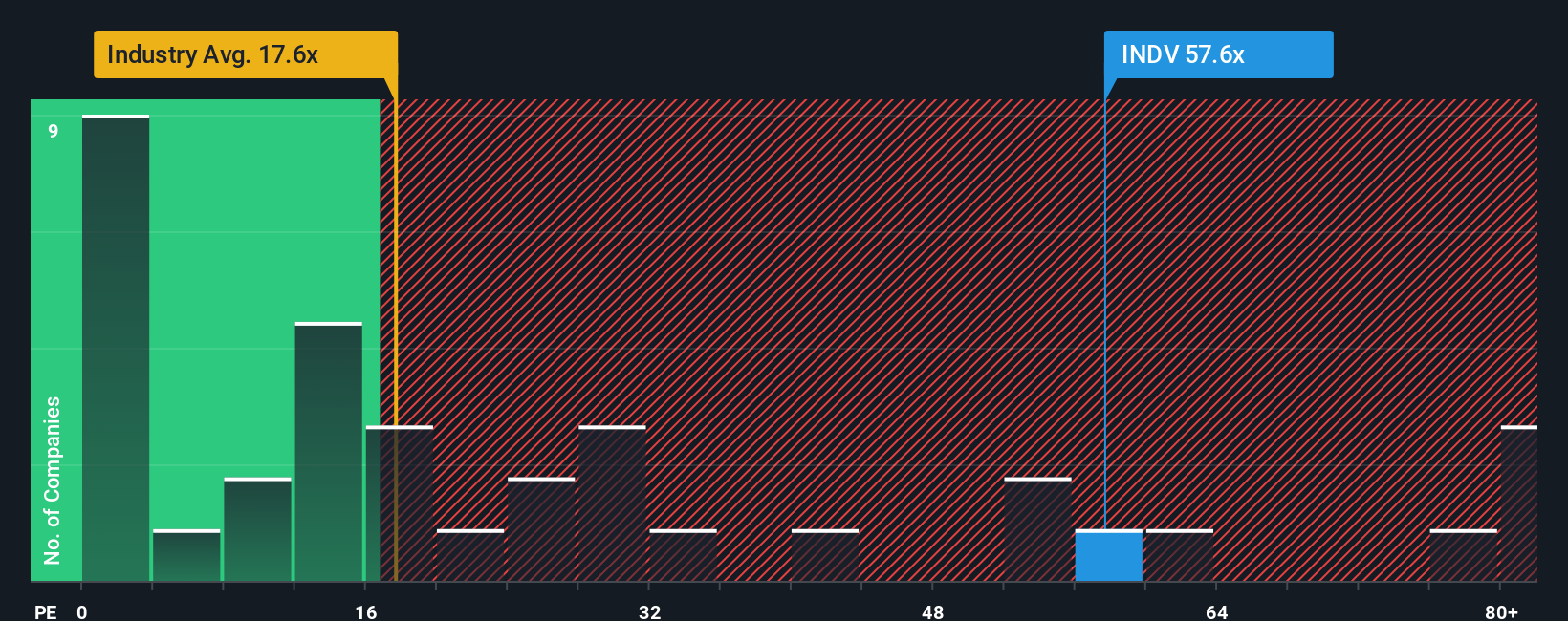

For profitable businesses like Indivior, the Price to Earnings ratio is a useful valuation lens because it links what investors pay per share directly to the profits the company is generating today. A higher PE can be justified when markets expect stronger, more durable growth and see fewer risks, while slower growth or higher uncertainty usually calls for a lower, more conservative PE.

Indivior currently trades on a PE of about 36.7x, which is well above the broader Pharmaceuticals industry average of roughly 19.9x and still below the peer group average of around 47.0x. To move beyond simple comparisons, Simply Wall St calculates a Fair Ratio, which is the PE you might reasonably expect once factors like earnings growth, profitability, size, industry characteristics, and risk profile are all taken into account.

This Fair Ratio for Indivior is 27.9x, making it a more tailored benchmark than generic industry or peer averages. Since the actual PE of 36.7x sits meaningfully higher than this Fair Ratio, the market appears to be pricing in more optimistic expectations than our fundamentals based model suggests.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Indivior Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind it. A Narrative is your own structured perspective on Indivior, where you set assumptions for future revenue, earnings and margins, and these are turned into a financial forecast and a clear fair value estimate. Narratives on Simply Wall St, available to millions of investors via the Community page, make this process accessible so you can quickly see whether your Fair Value suggests Indivior is a buy, a hold, or a sell at the current Price. Because Narratives update dynamically as new information like earnings, product news or regulatory changes comes in, your view stays aligned with reality without needing to rebuild a model from scratch. For example, one Indivior Narrative might assume rapid adoption of new treatments and assign a much higher fair value, while another Narrative could price in slower growth and tighter margins, resulting in a far lower fair value for the same stock.

Do you think there's more to the story for Indivior? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报