Undiscovered Gems in Canada to Explore This December 2025

As 2025 comes to a close, the Canadian market is navigating through a complex landscape marked by easing inflation pressures and stabilizing labor markets, setting an optimistic tone for 2026. In this environment, investors might find value in exploring small-cap stocks that demonstrate resilience and potential growth amid broader market rotations and improving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Orogen Royalties | NA | 50.65% | 42.51% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Kiwetinohk Energy | 23.09% | 21.68% | 30.98% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cipher Pharmaceuticals (TSX:CPH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cipher Pharmaceuticals Inc. is a specialty pharmaceutical company based in Canada with a market capitalization of CA$372.25 million.

Operations: Cipher Pharmaceuticals generates revenue primarily from its Specialty Pharmaceuticals segment, which reported CA$50.06 million.

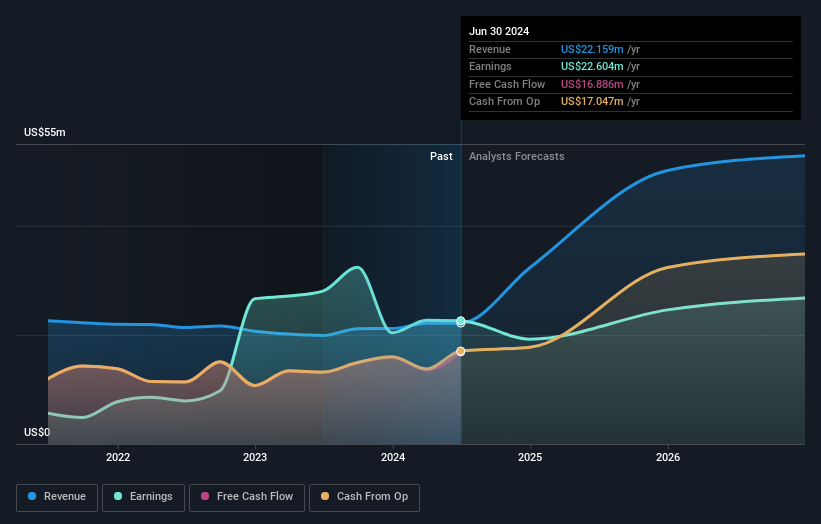

Cipher Pharmaceuticals, a nimble player in the Canadian market, has shown promising growth with earnings rising 9.5% over the past year, outpacing the industry average of 9.3%. The company reported a significant net income increase to US$5.5 million for Q3 2025 from US$0.283 million a year ago, reflecting strong operational performance. Despite an increased debt to equity ratio from 5.1% to 11.4% over five years, its net debt to equity remains satisfactory at 4%, and interest payments are well-covered by EBIT at an impressive eight times coverage, suggesting solid financial health moving forward.

- Dive into the specifics of Cipher Pharmaceuticals here with our thorough health report.

Evaluate Cipher Pharmaceuticals' historical performance by accessing our past performance report.

Dundee (TSX:DC.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dundee Corporation, with a market cap of CA$357.27 million, operates through its subsidiaries in various sectors including investment advisory, corporate finance, energy, resources, agriculture, real estate and infrastructure.

Operations: Dundee Corporation generates revenue primarily from its mining services, mining investments, and corporate activities, totaling CA$4.92 million. The company's net profit margin is a key indicator of financial performance.

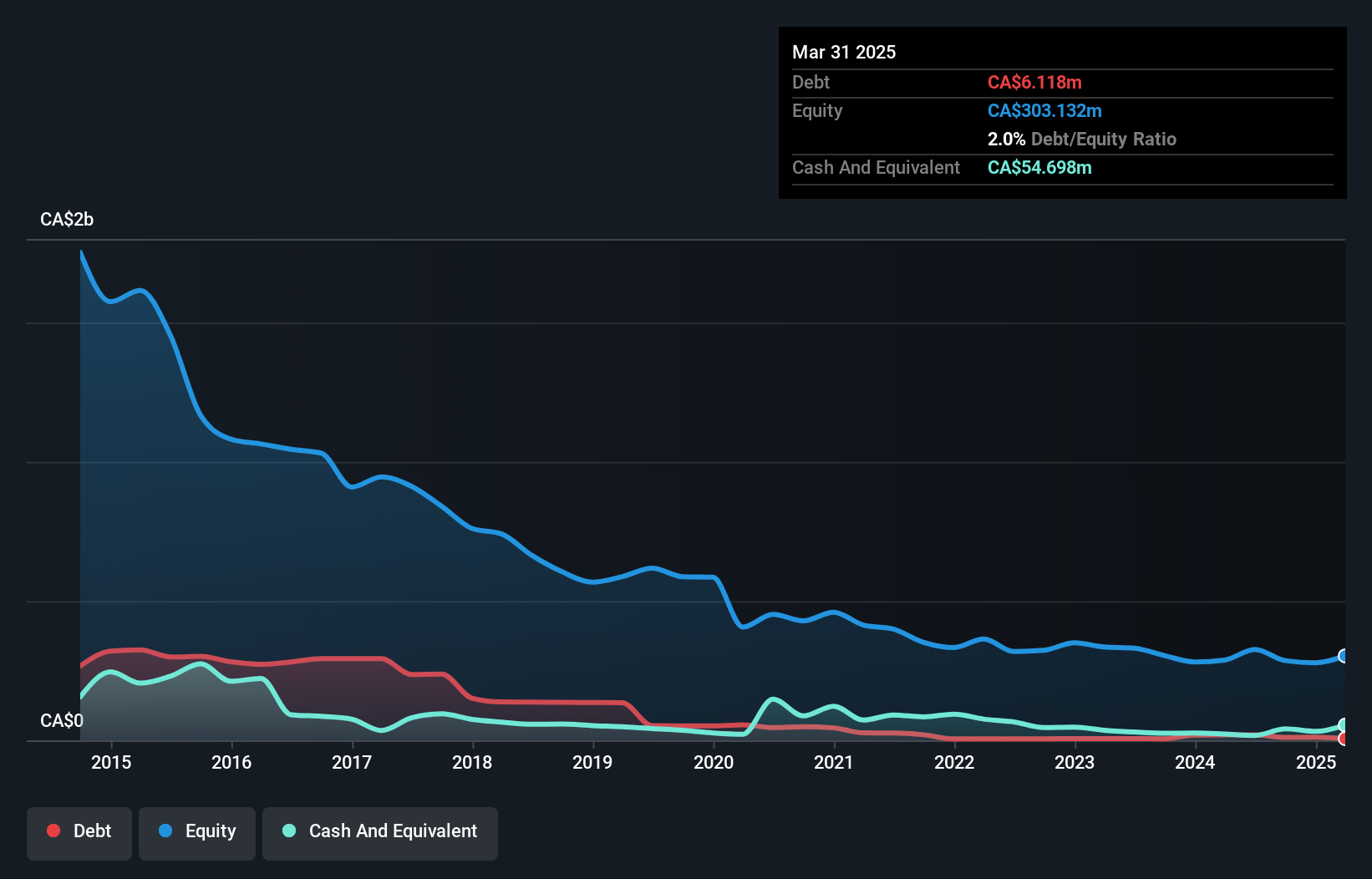

Dundee Corporation, a smaller player in the Canadian market, has demonstrated significant earnings growth of 95.2% over the past year, outpacing the Metals and Mining industry average of 63.4%. Despite not having meaningful revenue at CA$4 million, Dundee's profitability means cash runway isn't a concern. The company boasts a robust financial position with more cash than total debt and has impressively reduced its debt-to-equity ratio from 11.4 to 1.5 over five years. Recent legal victories against the CRA could further bolster its financial standing by potentially recovering CA$12.2 million plus interest, although liabilities may offset some gains.

- Navigate through the intricacies of Dundee with our comprehensive health report here.

Examine Dundee's past performance report to understand how it has performed in the past.

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Queen's Road Capital Investment Ltd. is a resource-focused investment company that invests in privately held and publicly traded resource companies, with a market capitalization of CA$477.13 million.

Operations: Queen's Road Capital generates revenue primarily through the selection, acquisition, and management of investments, amounting to $120.16 million. The focus on resource companies shapes its investment strategy and revenue model.

Queen's Road Capital Investment, a nimble player in the financial landscape, showcases a robust net debt to equity ratio of 6.9%, deemed satisfactory. Its interest payments are comfortably covered by EBIT at 74 times, indicating solid financial health. The company's earnings skyrocketed by 538% over the past year, significantly outpacing the Capital Markets industry's growth of 6%. Despite an increase in its debt to equity from 0% to 7.7% over five years, it remains well-positioned with a price-to-earnings ratio of just 3.1 times compared to the Canadian market average of 16.4 times.

Turning Ideas Into Actions

- Unlock our comprehensive list of 46 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报