MGIC Investment (MTG): Reassessing Valuation After Earnings Beat and Upward Analyst Revisions

MGIC Investment (MTG) has been getting fresh attention after its latest earnings beat on earnings per share, even though revenue landed just shy of forecasts, and that combination is reshaping how investors view the stock.

See our latest analysis for MGIC Investment.

That upbeat earnings reaction has fed into a steady uptrend, with the share price at $29.66 and a roughly 25 percent year to date share price return. The three year total shareholder return of about 146 percent shows that momentum has been building over time rather than fading.

If MGIC’s run has you rethinking where the next leg of returns might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With the shares trading above most analyst targets yet still at a steep discount to some intrinsic value estimates, investors now face a tougher question: is MGIC undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 7.2% Overvalued

MGIC Investment last closed at $29.66, a premium to the most popular narrative fair value of about $27.67, which frames an intriguing valuation gap.

Conservative capital management including ongoing share buybacks and dividend increases reduces outstanding share count and enhances EPS, directly benefitting shareholder returns and long term earnings per share growth. Strong investment in operational efficiency and technology driven cost controls, coupled with stable operating expenses, signal potential for margin expansion and greater bottom line profitability in future periods.

Want to see what powers this premium price view? The narrative leans on steady revenue, reshaped margins, and a future earnings multiple that challenges today’s market skepticism.

Result: Fair Value of $27.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could falter if elevated interest rates further suppress new originations, or if rising delinquencies push loss ratios and claims materially higher.

Find out about the key risks to this MGIC Investment narrative.

Another Lens on Valuation

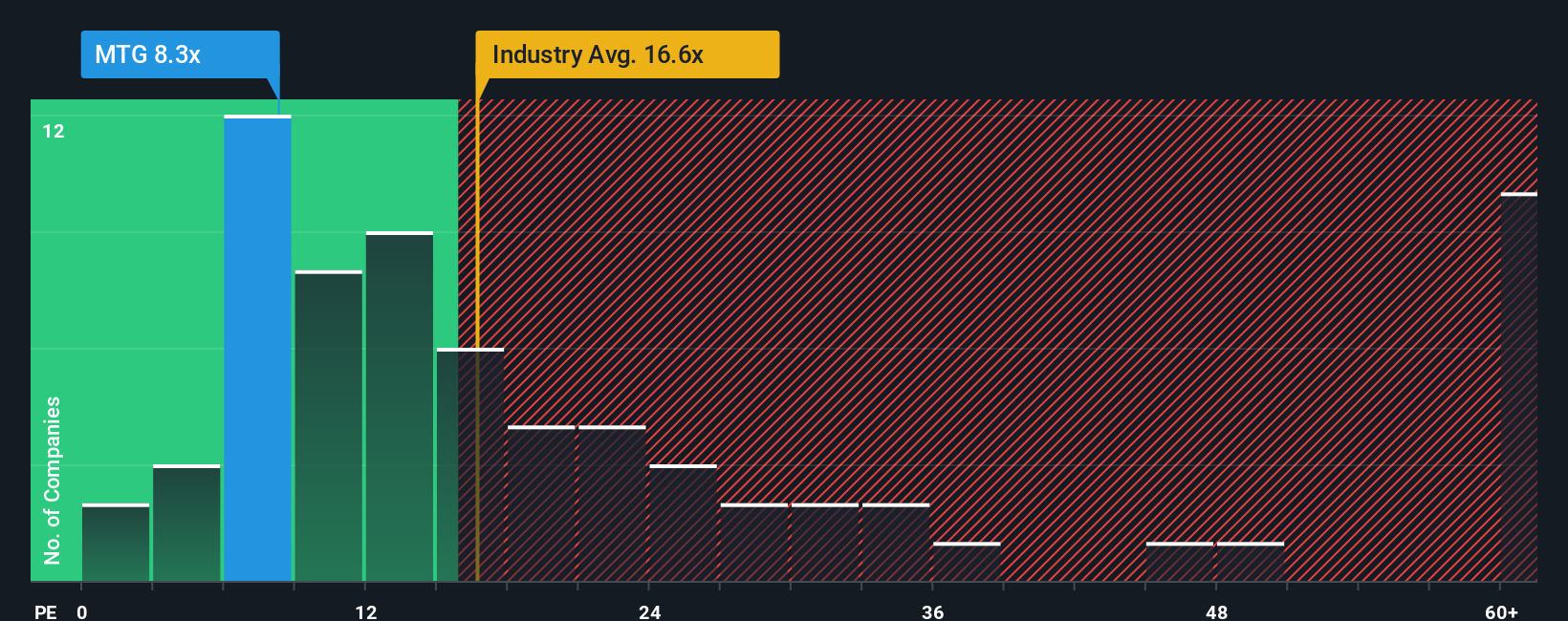

Looking at MGIC Investment through its earnings ratio paints a different picture. At about 8.8 times earnings versus a fair ratio closer to 11.7 times, and above peer and industry discounts, the stock screens as good value. Is the multiple quietly signalling more upside than the narrative allows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MGIC Investment Narrative

If you see the story differently or rely on your own research and assumptions, you can craft a fresh perspective in just minutes: Do it your way.

A great starting point for your MGIC Investment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If MGIC has sharpened your appetite for opportunity, do not stop here. Your next market winning move could be hiding in another corner of the market.

- Capture income potential by targeting reliable payers through these 10 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Capitalize on structural growth by focusing on innovators powering algorithms and automation with these 24 AI penny stocks.

- Position ahead of the next wave in decentralized finance by scanning these 79 cryptocurrency and blockchain stocks leading blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报