3 Stocks Estimated To Be Trading Below Fair Value By Up To 46%

As the U.S. stock market continues its upward trajectory, with major indices like the S&P 500 and Dow Jones Industrial Average nearing record highs, investors are increasingly on the lookout for opportunities that may be flying under the radar. In such a climate, identifying stocks that are estimated to be trading below their fair value can offer potential pathways to capitalize on market movements, especially when tech shares lead the charge and precious metals hit fresh records.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $27.62 | $52.64 | 47.5% |

| UMB Financial (UMBF) | $119.91 | $233.99 | 48.8% |

| Sportradar Group (SRAD) | $23.35 | $45.49 | 48.7% |

| SmartStop Self Storage REIT (SMA) | $31.70 | $61.01 | 48% |

| QXO (QXO) | $21.96 | $43.29 | 49.3% |

| Perfect (PERF) | $1.74 | $3.43 | 49.2% |

| GeneDx Holdings (WGS) | $140.17 | $273.43 | 48.7% |

| Community West Bancshares (CWBC) | $22.80 | $44.11 | 48.3% |

| Columbia Banking System (COLB) | $29.02 | $57.13 | 49.2% |

| BioLife Solutions (BLFS) | $25.47 | $49.99 | 49.1% |

Here's a peek at a few of the choices from the screener.

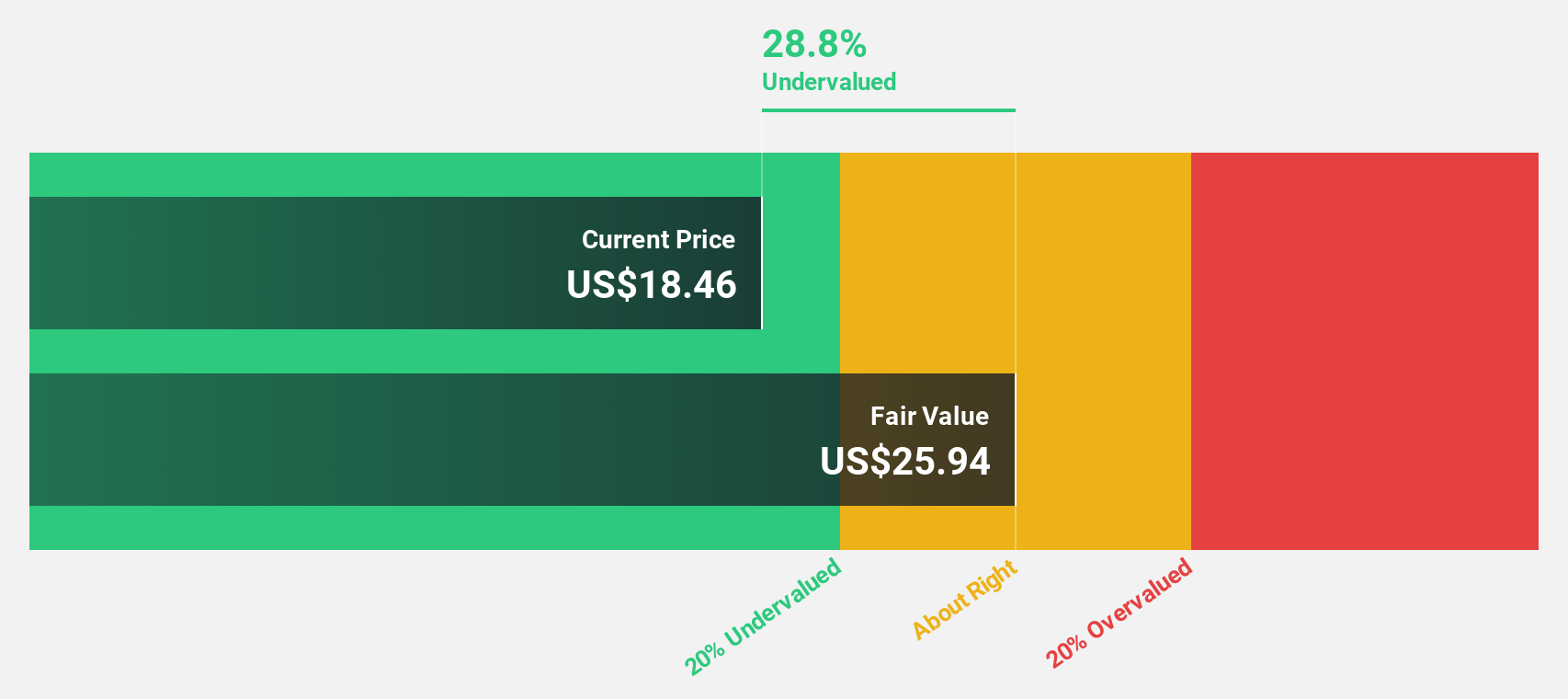

Firefly Aerospace (FLY)

Overview: Firefly Aerospace Inc. is a space and defense technology company offering mission solutions for national security, government, and commercial clients, with a market cap of $3.93 billion.

Operations: The company generates $111.22 million in revenue from its Aerospace & Defense segment, serving national security, government, and commercial sectors.

Estimated Discount To Fair Value: 44.7%

Firefly Aerospace, trading at US$28.60, is significantly undervalued based on discounted cash flow analysis with an estimated fair value of US$51.76. Despite a volatile share price, the company shows strong revenue growth of 87.2% over the past year and forecasts suggest continued robust revenue expansion at 46.4% annually, outpacing market averages. Recent index inclusion and increased credit facilities highlight strategic positioning, though legal challenges and operational setbacks present ongoing risks to investor confidence.

- The analysis detailed in our Firefly Aerospace growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Firefly Aerospace.

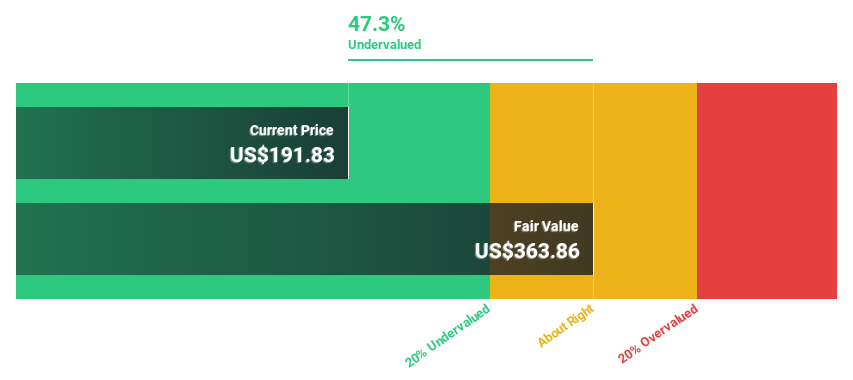

AbbVie (ABBV)

Overview: AbbVie Inc. is a research-based biopharmaceutical company involved in the development, manufacturing, commercialization, and sale of medicines and therapies globally, with a market cap of approximately $400.88 billion.

Operations: The company's revenue is primarily derived from its Innovative Medicines and Therapies segment, which generated $59.64 billion.

Estimated Discount To Fair Value: 46%

AbbVie, trading at US$227.91, appears highly undervalued with a fair value estimate of US$422.33 based on discounted cash flow analysis. Despite a decline in profit margins and high debt levels, AbbVie's strategic developments in immunology and oncology underscore its growth potential. Recent partnerships and product advancements support future revenue streams, although earnings growth forecasts outpace the market at 32% annually, reflecting optimism about its cash flow generation capabilities amidst financial challenges.

- Our growth report here indicates AbbVie may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in AbbVie's balance sheet health report.

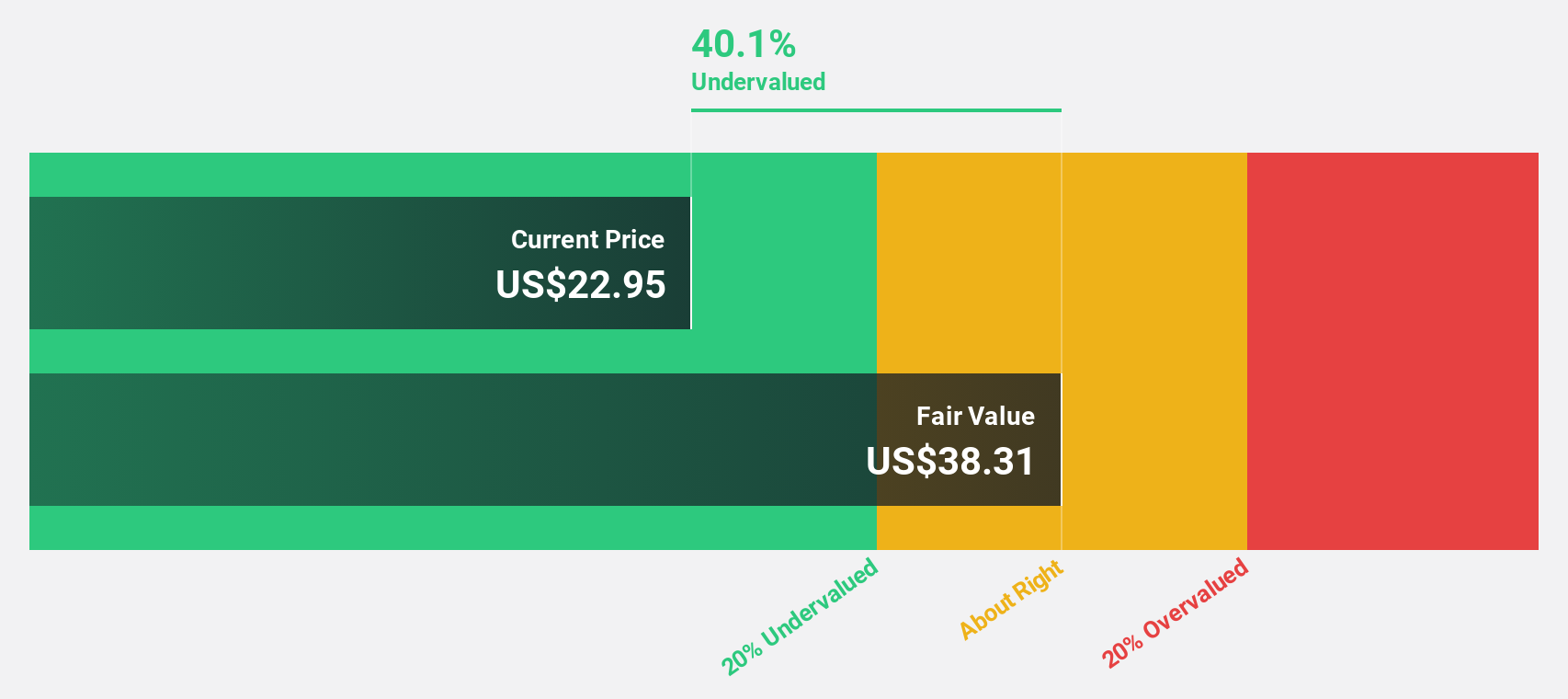

KeyCorp (KEY)

Overview: KeyCorp, with a market cap of approximately $22.93 billion, operates as the holding company for KeyBank National Association, offering a range of retail and commercial banking products and services across the United States.

Operations: KeyBank National Association generates revenue through two main segments: the Consumer Bank, which contributes $3.45 billion, and the Commercial Bank, which accounts for $3.71 billion.

Estimated Discount To Fair Value: 32.6%

KeyCorp, priced at US$21.21, is significantly undervalued with a fair value of US$31.49 according to discounted cash flow analysis. Despite activist pressures regarding past acquisitions and leadership decisions, KeyCorp's earnings are projected to grow 28.1% annually over the next three years, surpassing market expectations. However, its dividend sustainability remains questionable due to insufficient earnings coverage and low return on equity forecasts could pose challenges in maximizing cash flow potential for investors.

- Upon reviewing our latest growth report, KeyCorp's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of KeyCorp stock in this financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 211 Undervalued US Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报